Austin, May 26, 2025 (GLOBE NEWSWIRE) -- Panel Level Packaging Market Size & Growth Insights:

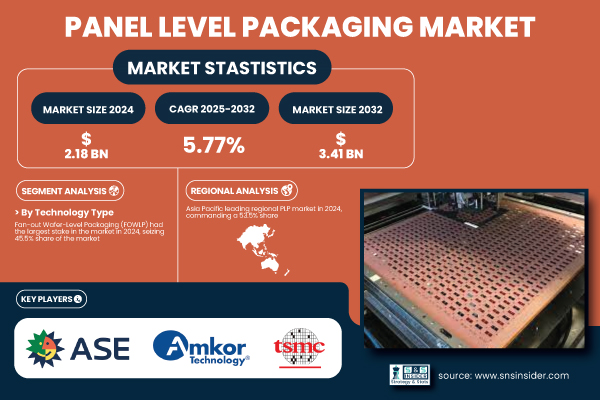

According to the SNS Insider,“The Panel Level Packaging Market Size was valued at USD 2.18 billion in 2024 and is expected to reach USD 3.41 billion by 2032, growing at a CAGR of 5.77% over the forecast period 2025-2032.”

Driving Growth in the Panel Level Packaging Market with Cost-Efficient and High-Performance Solutions

Panel Level Packaging (PLP) market is growing fast owing to the high demand for high performance, small size semiconductor devices for applications- AI and 5G, automotive electronics and others. PLP provides a cost-effective, power efficient, high-density package solution that enables multiple dies and chips to be embedded in a single panel to increase device capabilities and reduce costs. PLP generally recognized as the best candidate for 5G RF modules and AI accelerators; it is very good at handling high frequency process and thermal power dissipation problems.

The PLP market in the U.S. is projected to reach USD 0.33 billion by 2024, at a CAGR of 6.41% during the forecast period driven by high performance computing, IoT, and increasing use in medical electronics.

Get a Sample Report of Panel Level Packaging Market Forecast @ https://www.snsinsider.com/sample-request/6903

Leading Market Players with their Product Listed in this Report are:

- ASE Group

- Amkor Technology

- TSMC

- Samsung Electronics

- JCET Group

- Nepes Corporation

- PTI

- Deca Technologies

- Intel

- SPIL

Panel Level Packaging Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.18 Billion |

| Market Size by 2032 | USD 3.41 Billion |

| CAGR | CAGR of 5.77% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Technology Type (Fan-out Wafer-Level Packaging (FOWLP), Wafer-Level Packaging (WLP), Panel-Level Packaging (PLP)) • By Carrier Type (Rigid Carrier, Flexible Carrier, Organic Substrate Carrier, Glass Carrier, Metal Carrier, Composite Carrier) • By End User (Consumer Electronics, Automotive Electronics, Telecommunications, Industrial Electronics, Healthcare Devices, Others) |

| Key Drivers | • Driving Growth in Panel Level Packaging with Cost-Effective High-Performance Solutions. • Unlocking Panel Level Packaging Potential in Automotive HPC and Advanced Technology Applications. |

Purchase Single User PDF of Panel Level Packaging Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6903

"Panel-Level Packaging Market Analysis by Technology, Carrier, and End-User Segments”

By Technology Type

Fan-out Wafer-Level Packaging (FOWLP) dominated the market in 2024 with a 45.5% share, due to its wide adoption in mobile and consumer applications. An efficient, in-situ design that delivers high performance and eliminates the substrate combines in the power module to provide superior thermal performance, current density and overall performance desired in advanced power devices.

Panel-Level Packaging (PLP) is expected to be the fastest-growing technology from 2025 to 2032 s it can support larger formats, reducing cost per unit significantly. PLP is being developed in AI, automotive and HPC, and in combination with 2.5D and 3D integrations, will transform the advanced packaging scene.

By Carrier Type

In 2024, Rigid Carriers held the largest market share at 37.5%, largely due to their widespread use in mainstream semiconductor packaging. Known for excellent mechanical stability and compatibility with established manufacturing processes, rigid carriers mainly made from silicon or ceramics are favored in high-volume applications across consumer electronics, telecommunications, and industrial devices.

Composite Carriers are expected to grow the fastest from 2025 to 2032, offering superior mechanical, thermal, and electrical properties by combining different materials. Particularly suited for AI, automotive, and 5G applications, composite carriers are gaining traction as demand for customizable, high-performance packaging substrates rises globally.

By End User

In 2024, the panel-level packaging market was led by consumer electronics, capturing 41.4% of the share, due to the increase in usage of the panel-level packaging in the smartphones, tablets, laptops, and wearable devices. PLP serves its high volume products and products that need high density, performance and efficiency like It’s going to be offered to IoT, with ease, especially after the arrival of 5G.

Automotive electronics is expected to grow the fastest from 2025 to 2032, driven by the transition to EVs, autonomous driving and ADAS. Characterized by its high density, PLP’s thermally efficient capabilities and robust package design are a requirement for high performance and reliability in automotive applications operating in harsh environments, anchoring it for use in future mobility solutions.

"Global Dynamics of the Panel-Level Packaging Market: Regional Leaders, Growth Drivers, and Future Trends"

In 2024 the Asia Pacific held a significant market share of the Panel-Level Packaging (PLP) market, with a market share of over 53.5%, which was attributed to the presence of the manufacturing hub of semiconductor and high volume production. Key players such as TSMC, ASE, JCET have driven the PLP growth in consumer electronics and mobile devices with large government incentives. Advanced packaging technology is still in the hands of Taiwan, in great part because of the innovation support that TSMC provides.

North America is poised for the fastest growth from 2025 to 2032, with considerable investments from players such as Intel and Amkor in artificial intelligence, automotive electronics and HPC, but also further bolstered by the CHIPS Act and its ambition to drive semiconductor independence.

Europe is growing steadily, supported by the German automotive industry and key players (Infineon, Bosch), targeting rugged PLP solutions in EVs and ADAS.

Latin America and the Middle East & Africa maintain a minimal share, limited by underdeveloped semiconductor infrastructure and premature stages of adoption, but offers a promising future growth.

Do you have any specific queries or need any customized research on Panel Level Packaging Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6903

Recent Developments:

- In Feb 2025, ASE Technology Holdings and Powertech Technology (PTI) are gearing up their investment in fan-out panel-level packaging (FOPLP) to meet growing demand arising from AI and high-performance computing applications, with volume production to start in the second half of 2025.

- In Dec 2024, Samsung continues to focus more on plastic panels for next-generation fan-out panel-level packaging (FOPLP) using mobile chip experience, while TSMC is promoting a glass panel design that is a better match for performance and reliability.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Yield Improvement Metrics

5.2 PLP Adoption in 5G and AI Applications

5.3 Capacity Expansion and Industry Investments

5.4 Growth in Semiconductor Packaging Solutions

6. Competitive Landscape

7. Panel Level Packaging Market Segmentation, by Technology Type

8. Panel Level Packaging Market Segmentation, by Carrier Type

8. Panel Level Packaging Market Segmentation, by End User

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Other Related Reports:

U.S. Hermetic Packaging Market Set to More Than Double by 2032, Reaching USD 1.36 Billion