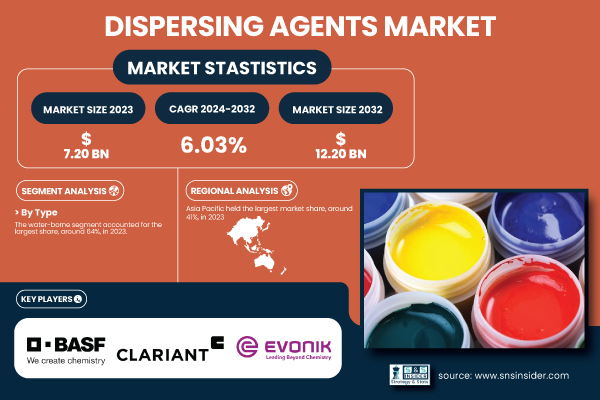

Austin, May 20, 2025 (GLOBE NEWSWIRE) -- The Dispersing Agents Market Size was valued at USD 7.20 Billion in 2023 and is expected to reach USD 12.20 Billion by 2032, growing at a CAGR of 6.03% over the forecast period of 2024-2032.

Download PDF Sample of Dispersing Agents Market @ https://www.snsinsider.com/sample-request/6695

Growing Demand for Eco-Friendly Dispersing Agents: Key Drivers and Market Expansion Across Industries

The Dispersing Agents market is experiencing significant growth due to their role in stabilizing particles in formulations across various sectors, including paints, coatings, personal care, and agriculture. Environmental regulations, particularly in the U.S. and Europe, are driving the shift toward water-based formulations. The U.S. EPA reports a 20% increase in demand for water-borne dispersing agents between 2022-2023. Industry leaders like BASF and Evonik are expanding their product lines to meet this demand, with BASF introducing a new eco-friendly dispersing agent. The FDA’s approval of certain dispersing agents for food applications is broadening their use in dietary supplements and beverages. As sustainable practices gain traction, the market is expected to grow steadily.

The US Dispersing Agents Market Size was valued at USD 1.20 Billion in 2023 and is projected to reach USD 2.14 Billion by 2032, growing at a CAGR of 6.64% from 2024 to 2032.

The U.S. Dispersing Agents Market is witnessing strong growth driven by rising demand for low-VOC, water-based paints and coatings. With stringent EPA regulations and the U.S. Green Building Council promoting sustainable construction practices, demand for eco-friendly dispersants has increased. For example, Sherwin-Williams launched a new line of zero-VOC paints in 2023, increasing its use of water-borne dispersing agents. Additionally, the personal care sector is adopting dispersants in gel-based skincare formulations.

Key Players:

- BASF SE (Dispex Ultra PX 4290, Efka PX 4310)

- Clariant AG (Genapol PF 40, Hostaperm Pink E)

- Arkema S.A. (Rheotech 2000, Ethacryl 783)

- Ashland Global Holdings Inc. (Drewplus L-475, Advantage 4910)

- Dow Inc. (Acumer 3100, Primal AC-261)

- Elementis plc (Nuosperse FX 908, Bentone EW)

- Evonik Industries AG (TEGO Dispers 656, TEGO Wet 280)

- Lubrizol Corporation (Solthix T10, Carboset 525)

- Croda International Plc (Coltide Radiance, Synperonic A7)

- Stepan Company (Stepwet DOS 70, Makon NF-12)

- Altana AG (BYK-9076, BYK-110)

- Lanxess AG (Baypure DS 100, Naphtolite S)

- Huntsman Corporation (Surfonic N-60, T-Mulz 734)

- Solvay S.A. (Rhodoline DF 642, Soprophor FLK)

- Wacker Chemie AG (GENIOSIL GF 960, VINNAPAS 5518 H)

- Kao Corporation (Emal AD-25, Levenol H&B)

- King Industries Inc. (Disparlon DA-325, K-Stay 501)

- Air Products and Chemicals, Inc. (Surfynol 104, ZetaSperse 3800)

- Synthron (Syntran 2802, Synadd 8411)

- Venator Materials PLC (Tioxide TR28, Dispex CX 4320)

Dispersing Agents Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 7.20 Billion |

| Market Size by 2032 | USD 12.20 Billion |

| CAGR | CAGR of 6.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Water-borne, Others) • By Structure (Anionic, Non-ionic, Hydrophilic, Amphoteric, Other), • By End-Use (Paints, Coatings & Inks, Adhesives & Sealants, Personal Care & Cosmetics, Agriculture, Construction, Household and Industrial/Institutional Cleaning, Other) |

| Key Drivers | • Surging demand for high-performance dispersing agents in paints and coatings sector fuels the market growth. |

Buy Full Research Report on Dispersing Agents Market 2024-2032 @ https://www.snsinsider.com/checkout/6695

Sustainability Trends Driving Innovation in the Dispersing Agents Market

- Companies are adopting eco-friendly formulations to meet consumer and regulatory sustainability demands.

- Water-based and bio-based dispersing agents are replacing harmful chemicals due to stricter environmental regulations.

- BASF and Evonik are investing in sustainable technologies and green product lines to reduce environmental impact.

- The demand for low-VOC formulations is driving the growth of eco-friendly dispersing agents in coatings.

- FDA approvals are expanding the use of dispersing agents in food-grade applications, promoting non-toxic solutions.

By Type, Water-borne Segment Dominated the Dispersing Agents Market in 2023 with a 64% Market Share

Water-borne dispersants are in high demand due to their low toxicity and compliance with environmental regulations. In the U.S., the EPA's pressure on reducing solvent emissions has spurred adoption. For instance, the automotive refinishing sector is increasingly shifting to water-based coatings Axalta and PPG Industries launched such products in 2023. Similarly, in architectural coatings, firms like Benjamin Moore have introduced low-VOC paints utilizing water-borne dispersing agents. Their widespread adoption in adhesives, sealants, and concrete additives further underscores their importance. Asia-Pacific is also embracing water-borne solutions, especially in countries like Japan and South Korea, due to strict air quality norms. Continuous R&D is resulting in water-borne agents with improved wetting and stabilization properties, making them an industry standard.

By Structure, Anionic Segment Dominated the Dispersing Agents Market in 2023 with a 38% Market Share

This segment’s dominance is attributed to their cost-effectiveness and high compatibility with diverse applications. These dispersants carry a negative charge, enabling strong electrostatic repulsion, which helps in stabilizing pigments and particles in paints, inks, and agricultural sprays. For example, in 2023, Evonik developed an anionic dispersant for pigment-based inks used in textile printing, improving color consistency. In the construction industry, they’re widely used to enhance cement and concrete flowability. Additionally, anionic types are dominant in the detergent and cleaner segments due to their excellent foaming and emulsifying properties. The agricultural sector uses them in herbicide formulations for uniform spray delivery. Due to their wide compatibility and lower environmental impact, anionic dispersants continue to be the preferred structure, particularly in formulations requiring long-term stability and dispersion.

By End-Use, Paints, Coatings & Inks Segment Dominated the Dispersing Agents Market in 2023 with a 28% Market Share

This dominance is propelled by rising infrastructure projects, automotive refinishing, and eco-friendly decorative paints. In the U.S., demand for dispersing agents in low-VOC and water-borne paints surged by over 15% between 2022 and 2023, as per the American Coatings Association. Asia-Pacific, led by China and India, is witnessing an uptick in demand due to growing urbanization. Leading companies like AkzoNobel and Nippon Paint Holdings have launched dispersant-integrated paints that improve color strength and reduce energy consumption during manufacturing. Similarly, inkjet printing is booming in packaging and textiles, fueling further demand for specialty dispersing agents. Continuous innovations, such as solvent-free and hybrid dispersant technologies, are sustaining segment growth.

Asia Pacific Dominated the Dispersing Agents Market In 2023, Holding a 41% Market Share.

Asia-Pacific led the Dispersing Agents Market in 2023, fueled by industrialization, urbanization, and government-backed infrastructure projects like China’s Belt and Road Initiative and India’s Smart Cities Mission. Rising demand in construction, packaging, automotive, and textiles boosted dispersing agent usage. Japan’s METI reported a 12% YoY increase in production driven by electronics and coatings. Competitive manufacturing costs, growing production capacities, and policy support further reinforced the region's dominance in both demand and supply.

North America Emerged as the Fastest Growing Region in Dispersing Agents Market with A Significant Growth Rate in The Forecast Period

North America was the fastest-growing market in 2023, propelled by sustainability mandates and technological innovation. The U.S. EPA's VOC restrictions and LEED building certifications encouraged adoption of eco-friendly dispersing agents. DuPont introduced bio-based dispersants for agriculture, while Sherwin-Williams launched low-VOC paints with new dispersants. Cosmetic giants like Estée Lauder embraced dispersants in skincare lines. With strong R&D, corporate initiatives, and regulatory alignment, the region experienced significant growth across coatings, agrochemicals, and personal care applications.

If You Need Any Customization on Dispersing Agents Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6695

Recent Developments

- August 2024: Environmental groups petitioned the EPA to ban two oil dispersants due to their harmful effects on marine life, urging the adoption of safer alternatives for oil spill response.

- July 2024: Arclin acquired RG Dispersants, expanding its presence in the chemical distribution market and enhancing its production capabilities in North America, particularly in agriculture and water treatment sectors.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Dispersing Agents Market Segmentation, By Type

8. Dispersing Agents Market Segmentation, By Structure

9. Dispersing Agents Market Segmentation, By End-Use

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practice

13. Conclusion

Read Our Trending Reports:

Surfactants Market Report Size 2024-2032

Hydrophilic Coating Market Share & Forecast to 2032

Industrial Cleaning Chemical Market - Global Research by 2032

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.