Austin, May 20, 2025 (GLOBE NEWSWIRE) -- Construction Drone Market Size & Growth Insights:

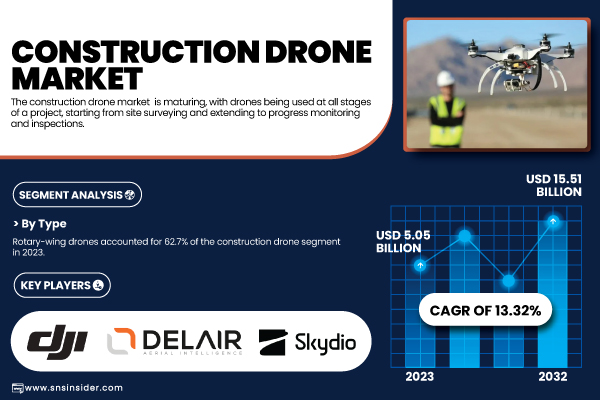

According to the SNS Insider,“The Construction Drone Market was valued at USD 5.05 billion in 2023 and is expected to reach USD 15.51 billion by 2032, growing at a CAGR of 13.32% over the forecast period 2024-2032.”

Advancements in drone technology significantly enhance construction efficiency, safety, and real-time monitoring across all project phases.

The market for construction drones is reaching maturity with use cases deployed throughout the full lifecycle of projects including site surveying, and progress monitoring and inspecting suitable use cases. Advanced new tools like LiDAR and thermal imaging have made mapping and structural analysis more accurate, while upgraded 5G connections allow for faster and more secure real-time data sharing and remote control. By using AI and machine learning technology, drones are able to find patterns, spot problems, and streamline workflows, thus making construction safer, more efficient, and allowing for faster decision-making. The U.S. Construction Survey 2024 reports 45% of civil contractors and 67% of key organizations are using drones on all their projects, and more than 1.7 million drones have been registered for commercial purposes. These drones have raised measurement accuracy by 61% and reduced data collection time by 53% and saving construction time. The U.S. market for construction drone is estimated to be USD 1.44 billion in 2023 and is expected to register a CAGR of 12.73%. Increased demand in new safety applications, regulatory incentives and higher technological advancement and adoption across the residential, commercial, industrial segment will continue to drive the demand.

Get a Sample Report of Construction Drone Market Forecast @ https://www.snsinsider.com/sample-request/6776

Leading Market Players with their Product Listed in this Report are:

- DJI (Phantom 4 RTK)

- Parrot (Anafi USA)

- Delair (Delair UX11)

- senseFly (eBee X)

- Skydio (Skydio 2)

- Quantum Systems (Quantum Trinity F90+)

- Autel Robotics (Autel EVO II RTK)

- Aerovironment (Quantix Mapper)

- Yuneec (H520 RTK)

- Flyability (Elios 2)

- 3DR (Site Scan)

- Kespry (Kespry 2S)

- Vantage Robotics (Vantage V2)

- Altitude Angel (Angel UAV)

- DroneDeploy (DroneDeploy Software)

Construction Drone Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 5.05 Billion |

| Market Size by 2032 | USD 15.51 Billion |

| CAGR | CAGR of 13.32% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type (Fixed-wing drone, Rotary-wing drone) • By Application (Surveying, Inspection & monitoring, Aerial imaging & photography, Safety, Logistics) • By End-Use (Residential, Commercial, Industrial) |

| Key Drivers | • Advancing Drone Technology Boosts Construction Efficiency, Safety, and Real-Time Monitoring Across All Project Types. • Drone Integration Drives Smart Construction Logistics, Sustainability, and Advanced Monitoring with AI and Digital Solutions. |

Purchase Single User PDF of Construction Drone Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6776

Construction Drone Market Overview by Type, Application, and End-Use: Key Trends and Growth Drivers

By Type

Rotary-wing drones, commonly known as quadcopters or multi-rotors, accounted for 62.7% of the construction drone market in 2023 as they are versatile, stable, and can hover. These qualities render them suitable options for surveying, for insurance adjustment, for site inspection, and for aerial imaging, particularly in mountainous, rocky terrain and small construction sites, which is why they are used in a vast number of residential, commercial and industrial projects.

Fixed-wing drones are projected to experience the highest CAGR between 2024 and 2032. Prolonged endurance, high-speed flight, and high area coverage render them suitable for large-scale tasks including infrastructure monitoring and environmental assessment, which has facilitated wider acceptance of UAVs, with substantial advancements in technology driving their expansion.

By Application

In 2023, the surveying segment led the construction drone market with a 36.7% revenue share, owing to its applications including topographic and land survey, as well as volumetric survey in a construction drone market. Drones provide precise, high-resolution data, cut down on human labor, and improve operational efficiency. The fact that they are easy to pilot into difficult and dangerous locations also makes them attractive for surveying construction sites, or investigating the aftermath of a disaster.

From 2024 to 2032, the safety segment is expected to grow the fastest, as drones continue to assist in safety protocols that check conditions, look out for hazards and help ensure compliance with rules and regulations with real-time aerial monitoring on construction sites, thus reducing accidents.

By End-Use

In 2023, the residential sector held the largest share of 38.5% in the construction drone market, as drones are increasingly used for land surveying, site inspections, and aerial imaging. Their expertise in optimizing processes and accuracy are invaluable in the residential construction industry, where efficiency, cost and accuracy matter. The increased popularity of smart homes and sustainable building methods has also accelerated drone usage.

From 2024 to 2032, the industrial sector is expected to see the highest CAGR, with drones playing a key role in overseeing large projects, marine logistics and safety inspections to satisfy the needs of challenging industrial construction industry.

North America and Asia Pacific: Regional Growth Dynamics and Key Drivers in the Construction Drone Market

North America held a 38.9% share of the construction drone market in 2023, driven by major construction firms like Skanska and Bechtel that use drones for surveying, site monitoring, and progress tracking. These technologies help reduce fieldwork costs, especially for large infrastructure projects. Additionally, clear regulatory frameworks such as the FAA’s Part 107 have fostered drone adoption in the U.S.

The Asia Pacific region is expected to witness the highest CAGR from 2024 to 2032, due to increase in construction activities in China and India. Companies such as China State Construction Engineering Corporation and major Indian builders use drones for large-scale site surveys, better safety, and faster project delivery. According to the local government as well as demand for quicker construction processes being pushed from abroad, the market potential in the region is increased, which is why the Asia Pacific region is a major growth driver for the construction drone industry.

Do you have any specific queries or need any customized research on Construction Drone Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6776

Recent Developments:

- On September 2024, Quantum Systems, the leading European innovator in drone technology, has successfully extended its Series B financing to well over 100 million Euros, by securing investment by new lead investors Notion Capital and Porsche SE, alongside existing backers to drive Quantum Systems’ growth and innovation.

- On February 2025 – Flyability and WinCan have combined efforts to place their product at the core of a new integrated solution for foul air and confined space monitoring.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Drone Usage by Construction Stage

5.2 Growth of LiDAR and Thermal Imaging Integration

5.3 Impact of 5G and Remote Operations

5.4 Impact of AI and Machine Learning

6. Competitive Landscape

7. Construction Drone Market Segmentation, by Type

8. Construction Drone Market Segmentation, by Application

9. Construction Drone Market Segmentation, by End-Use

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.