Austin, May 20, 2025 (GLOBE NEWSWIRE) -- Thin Film Photovoltaics Market Size & Growth Insights:

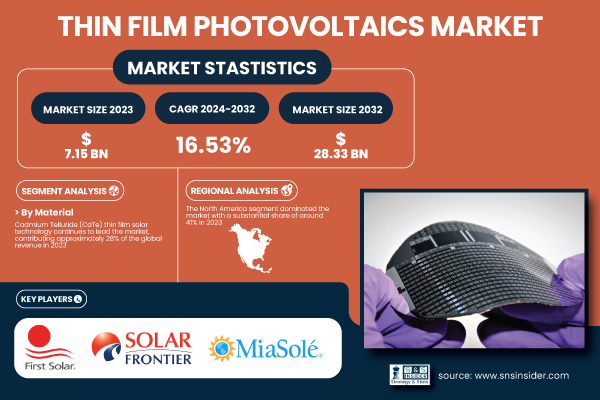

According to the SNS Insider,“The Thin Film Photovoltaics Market was valued at 7.15 Billion in 2023 and is projected to reach USD 28.33 Billion by 2032, growing at a CAGR of 16.53 % from 2024 to 2032.”

Policy Incentives and Trade Measures Accelerate Thin Film Photovoltaics Growth

The Thin Film Photovoltaics (TFPV) market is experiencing rapid growth, fueled by strategic policy incentives and shifting global trade dynamics. The expansion of investment tax credit to solar ingot and wafer manufacturing has attracted money into TFPV manufacturing, with technologies such as CdTe and CIGS benefitting the most. The shift equalizes solar manufacturing in those countries with the same favorable tax benefits extended in the past only to the semiconductor industry, and forces companies to restructure their investments accordingly. These trends should likely benefit producers with vertically integrated business models even more. The US market is estimated to be USD 2.0 billion in 2023 and is projected to reach USD 6.62 billion by 2032 at a CAGR of 14.20% during the forecast period. At the same time, new tariffs on semiconductors and solar electronics serve to raise costs for foreign equipment and could spur a resurgence in domestic and regional production. With investments exceeding USD 52.7 billion raised through advanced manufacturing and R&D projects, production capacity for thin film solar will increase by over 25% through 2027. This combination of financial and regulatory measures is one of the key elements to pave the way for the market in the long run.

Get a Sample Report of Thin Film Photovoltaics Market Forecast @ https://www.snsinsider.com/sample-request/6742

Leading Market Players with their Product Listed in this Report are:

- First Solar (USA): CdTe modules

- Solar Frontier (Japan): CIS modules

- Hanergy Thin Film Power Group (China): Flexible CIGS panels

- MiaSolé (USA): CIGS technology

- Ascent Solar Technologies (USA): Lightweight flexible CIGS panels

- Solibro GmbH (Germany): CIGS modules

- Global Solar Energy (USA): CIGS-based thin film solar panels

- SunPower Corporation (USA): High-efficiency silicon solar panels

- Tata Power Solar (India): Thin-film PV modules

- Solexel (USA): High-efficiency silicon-based thin-film solar cells

- Pristine Sun (USA): Thin-film solar installations

- Nanosolar (USA): CIGS-based thin-film technology

- GCL-Poly Energy (China): CIGS thin-film solutions

- SolarWorld (Germany): High-efficiency thin-film panels

- Sharp Solar (Japan): Amorphous silicon-based thin-film solar cells

Thin Film Photovoltaics Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 7.15 Billion |

| Market Size by 2032 | USD 28.33 Billion |

| CAGR | CAGR of 16.53% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Material (Cadmium telluride (CDTE), Amorphous silicon (A-SI), Copper indium gallium selenide (CIGS), Perovskite, Organic PV, Copper zinc tin sulfide (CZTS), Quantum dot thin film solar cells, All-silicon tandem) • By Technology(Single-junction thin film, Multi-junction thin film, Flexible thin film, Transparent thin film) • By Installation Type(Ground-mounted, Rooftop, Floating solar, Building-integrated (BIPV)) • By Application(Utility-scale power generation, Building-integrated Photovoltaics (BIPV), Wearable devices, Others) • By End User (Agricultural, Automotive, Commercial & Industrial, Consumer electronics, Residential, Utility, Others) |

| Key Drivers | • Cost-Efficiency and Sustainability of Thin Film Solar Technology. • Perovskite Power Surge Unlocking the Next Frontier in Thin Film Photovoltaics. |

Purchase Single User PDF of Thin Film Photovoltaics Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6742

Thin Film Photovoltaics Market Analysis by Material, Technology, Installation, Application, and End User Segments (2023–2032)

By Material

Cadmium Telluride (CdTe) thin film solar technology led the market in 2023, accounting for approximately 28% of global revenue due to its cost-effectiveness, relatively high efficiency, and low-cost manufacturing processes. Widely adopted in utility-scale projects, CdTe remains a preferred choice in cost-sensitive regions.

The Copper Indium Gallium Selenide (CIGS) segment is projected to witness the fastest growth from 2024 to 2032, owing to CIGS' higher efficiency, flexibility, and applicability for various purposes such as building-integrated photovoltaics as well as consumer electronics. In addition, continued progress in efficiency, price and scale are fuelling more CIGS adoption in commercial and residential applications.

By Technology

Single-junction thin film will be the largest market segment, with a revenue share of about 59% in 2033 due to their cost-effectiveness, commercial maturity, and utilization of materials such as amorphous silicon (a-Si) and cadmium telluride (CdTe). They are popular for their cheap manufacture and reliable operation under low-light conditions, which is suitable for solar farms.

The transparent thin film segment is poised for rapid growth from 2024 to 2032, with development of perovskite and transparent conductive materials. Its increasing implementation in architectures like building skins, windows, and consumer electronics is further widening its appeal for various applications.

By Installation Type

In 2023, the ground-mounted segment led the thin film photovoltaics market with around 54% of the revenue, as it is used on large-scale utility-scale projects and independent power producer projects that have an abundance of sun and no restrictions from space. These systems are perfectly suited for rural and open space environments and are cost-effective and have very high energy generation.

The building-integrated photovoltaics (BIPV) segment is set to grow the fastest from 2024 to 2032, increasing requirement of energy efficient sustainable non- residential and residential buildings are factors triggering growth in the BIPV market, which in turn is creating opportunities for solar energy industry.

By Application

The utility-scale power generation segment led the thin film photovoltaics market in 2023, contributing around 61% of the revenue, on account of large solar farms operated by CdTe and CIGS. These projects have low cost and high production in open sites.

The building-integrated photovoltaics (BIPV) market is expected to register the highest growth between 2024 and 2032 based on the fact of huge solar farms operated by CdTe and CIGS. Those projects have less cost and higher production in open lands.

By End User

In 2023, the agricultural segment led the thin film photovoltaics market with around 39% revenue share, due to the use of solar energy for irrigation as well as for greenhouses solar installations in rural areas. Thin-film panels are well-suited to agricultural purposes as they are light weight, are flexible, and have a low land use ratio.

From 2024 to 2032, the commercial and industrial segment is expected to grow rapidly With increasing focus on cost-effective sustainable energy, the demand for utility PV systems is expected to rise during the forecast period. Technology advances, savings from increased efficiency, and government incentives will continue to accelerate adoption at the commercial and industrial segment.

North America and Asia Pacific Regional Growth in Thin Film Photovoltaics Market

North America dominated the thin film photovoltaics market in 2023 with around 41% revenue share, due to the lucrative government incentives and favorable renewable energy policies, as well as growing adoption from the residential, commercial, and utility-scale sectors. Moreover, technological advancements and high eco-friendly awareness in the region further stimulate the regional demand.

Asia Pacific is expected to experience the fastest growth from 2024 to 2032, which will be led by China, India, and Japan. Fast solar energy adoption, encouraging government policies, financial subsidies and infrastructure investments drive this growth. Furthermore, cost reductions and thin film solar panel efficiency improvements make these the technologies well-suited for multiple applications in the region. Focus on energy security, sustainability and environmental issues increasingly serves to promote the use of thin film photovoltaics while gaining traction in a competitive global market looking to meet future expansion across Asia Pacific.

Do you have any specific queries or need any customized research on Thin Film Photovoltaics Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6742

Recent Developments:

- In Feb 2025, First Solar sales 14.1 GW of thin-film solar modules in 2024, totaling USD 4.2 billion in revenue, including sale of USD 857 million of Section 45X tax credits from its US facilities.

- In March 2025, Ascent Solar Technologies has concluded a new order to expand upon its CIGS thin film solar module for use in space power after the successful testing of the prototype. The company is in the process of refining the design, to increase efficiency and output.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1. Material Utilization Rate

5.2. Efficiency Degradation Rate

5.3. Installed Capacity Trends

5.4. Efficiency Degradation Rate

6. Competitive Landscape

7. Thin Film Photovoltaics Market Segmentation, by Material

8. Thin Film Photovoltaics Market Segmentation, by Technology

9. Thin Film Photovoltaics Market Segmentation, by Installation Type

10. Thin Film Photovoltaics Market Segmentation, by Application

11. Thin Film Photovoltaics Market Segmentation, by End User

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.