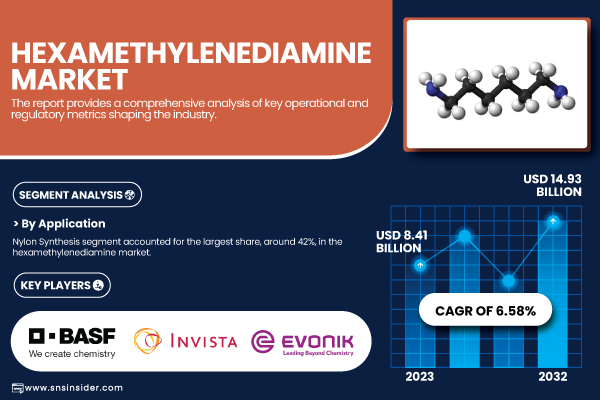

Austin, May 19, 2025 (GLOBE NEWSWIRE) -- The Hexamethylenediamine Market Size was valued at USD 8.41 billion in 2023 and is expected to reach USD 14.93 billion by 2032, growing at a CAGR of 6.58% over the forecast period of 2024-2032.

Download PDF Sample of Hexamethylenediamine Market @ https://www.snsinsider.com/sample-request/6633

Widening Industrial Usage and Innovations Propel Demand for Essential Nylon Intermediate Across Diverse End-Use Sectors

Hexamethylenediamine plays a key role in nylon synthesis, coatings, and various chemical applications, driving its industrial demand. Its growing use in automotive, textile, and electronics sectors is significantly boosting market expansion. The compound is also gaining traction in biocides and adhesives. Notably, the U.S. Department of Energy highlights its relevance in sustainable material applications, signaling long-term growth potential. The automotive industry's need for durable nylon components has notably increased consumption. In the U.S., companies like BASF and Huntsman Corporation are advancing production technologies to improve efficiency and reduce costs, enhancing Hexamethylenediamine’s industrial relevance. These innovations are expanding its applications into sectors such as electronics and healthcare, further solidifying its market footprint. The ongoing shift toward high-performance, nylon-based, and sustainable materials continues to anchor Hexamethylenediamine’s strategic importance across industries.

The US Hexamethylenediamine Market Size was valued at USD 1.33 billion in 2023 and is projected to reach USD 2.40 billion by 2032, growing at a CAGR of 6.84% from 2024 to 2032.

The U.S. Hexamethylenediamine market is primarily driven by the increasing demand for durable and lightweight automotive components, a key application of Hexamethylenediamine, and its use in synthetic fibers for textiles. Additionally, technological advancements in Hexamethylenediamine production methods are making it more cost-effective.

Key Players:

- BASF SE (Ultramid, Polyhexamethylene Adipamide)

- INVISTA (ADN, DYTEK A)

- Ascend Performance Materials (Vydyne, Hexatran)

- Evonik Industries AG (Vestamid, TEGOSTAB)

- Radici Group (Radilon, Heraflex)

- Toray Industries Inc. (Amilan, TORELINA)

- Solvay (Technyl, Ixef)

- LANXESS (Durethan, Ultramid B3)

- DSM Engineering Materials (Stanyl, Akulon)

- UBE Corporation (UBE NYLON 6, UBE NYLON 66)

- Shandong Haili Chemical Industry Co., Ltd. (HMDA, Nylon 66 Salt)

- Genomatica, Inc. (bio-HMDA, GENO™ Nylon)

- Asahi Kasei Corporation (Leona, Hexalon)

- DOMO Chemicals (Technyl, Stabamid)

- Mitsubishi Chemical Corporation (Novamid, DURANEX)

- LANXESS AG (Caprolactam, Adipic Acid)

- UBE Industries Ltd. (Hexamethylene Diamine, Adiponitrile)

- Liaoning Shuangyi Chemical Co., Ltd. (HMDA 99.9%, Nylon Salt)

- Hengshui Haoye Chemical Co., Ltd. (Industrial HMDA, Refined HMDA)

- Rennovia Inc. (Bio-Adipic Acid, Bio-HMDA)

Hexamethylenediamine Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 8.41 Billion |

| Market Size by 2032 | USD 14.93 Billion |

| CAGR | CAGR of 6.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Nylon Synthesis, Coating Intermediates, Biocides, Lubricants, Adhesives, Others) • By End Use (Automotive, Textile, Paints & Coatings, Petrochemicals, Others) |

| Key Drivers | • Increasing use of Nylon 66 in automotive and textile applications is significantly driving the hexamethylenediamine market growth. |

Buy Full Research Report on Hexamethylenediamine Market 2024-2032 @ https://www.snsinsider.com/checkout/6633

Evolving Regulations Reshape Hexamethylenediamine Manufacturing and Global Supply Strategies

- EPA regulations under TSCA increase operational costs for safe Hexamethylenediamine handling and disposal.

- EU REACH compliance raises safety assessment costs, affecting market entry for manufacturers.

- OSHA mandates safety upgrades in production to reduce worker exposure risks.

- Asia's stricter environmental rules are shifting production hubs and impacting supply chains.

- Global climate policies are driving greener technologies, increasing R&D spending for sustainable production.

By Application, Nylon Synthesis Dominated the Hexamethylenediamine Market in 2023 with a 42% Market Share

The dominance is attributed to its essential role in producing Nylon 6,6. This nylon is heavily used in automotive, electronics, and textiles for its strength and heat resistance. The growing demand for lightweight, high-performance materials in vehicles and industrial components is a major driver. Companies like Invista and Ascend have ramped up nylon production to meet global demand. Moreover, sustainable alternatives such as bio-based nylon still rely on Hexamethylenediamine, reinforcing this segment’s long-term market position.

By End Use, Automotive Dominated the Hexamethylenediamine Market in 2023 with a 32% Market Share

The dominance is driven by the growing adoption of lightweight nylon parts. Hexamethylenediamine-based materials are used for components like radiator tanks and air intake manifolds, replacing heavier metals. The push for improved fuel efficiency and stricter emission norms has accelerated this shift. Furthermore, EV manufacturers such as Ford and GM increasingly utilize these materials in battery housings and under-hood systems. The compound’s durability and thermal stability ensure its continued demand in automotive applications.

Asia Pacific Dominated the Hexamethylenediamine Market In 2023, Holding a 38% Market Share.

The Asia Pacific region held the largest market share in the Hexamethylenediamine market in 2023. China and India are key drivers of growth due to rapid industrialization, urbanization, and expansion in automotive and textile sectors. The increasing production of nylon and Hexamethylenediamine-derived products, coupled with the rise in consumer goods demand, is further boosting market growth. Government initiatives to enhance the manufacturing capabilities of chemicals, including Hexamethylenediamine, also support this dominance. With China being a major producer of automotive parts and textiles, Hexamethylenediamine’s applications continue to increase in this region.

North America Emerged as the Fastest Growing Region in Hexamethylenediamine Market with A Significant Growth Rate in The Forecast Period

North America is the fastest-growing region in the Hexamethylenediamine market, primarily due to technological innovations in chemical manufacturing and the increasing demand for sustainable products. The U.S. leads with advanced production techniques, ensuring high-quality Hexamethylenediamine production. Additionally, the automotive industry’s push toward lightweight materials is propelling growth, with Hexamethylenediamine playing a key role in manufacturing durable and high-strength automotive parts.

If You Need Any Customization on Hexamethylenediamine Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6633

Recent Developments

- March 2025: At in-cosmetics Global 2025, DIC Corporation subsidiary, Sun Chemical, launched two new cosmetic effect pigments. These pigments (patent-pending) improve the aesthetic of cosmetics. The launch highlights DIC's pledge to innovation in the global Hexamethylenediamine marketplace.

- March 2025: Debut Biotechnology announced the biomanufacturing of an animal-free carmine red pigment. Using the proprietary enzyme-based process, the company reached a 95% purity level, compared to the 10% of carmine. The innovation provides the cosmetic industry a sustainable and ethical option.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Hexamethylenediamine Market Segmentation, By Application

8. Hexamethylenediamine Market Segmentation, By End-Use

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practice

12. Conclusion

Read Our Trending Reports:

Hexane Market Report Size 2024-2032

Ethyleneamines Market Share & Forecast to 2032

Pentanediamine Market - Global Research by 2032

Aliphatic Hydrocarbon Solvents & Thinners Market Analysis by 2032

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.