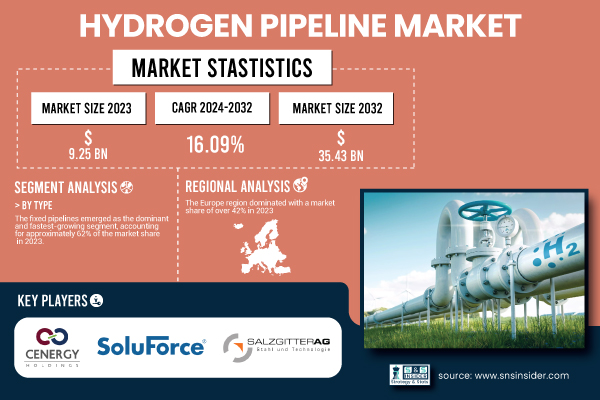

Austin, May 15, 2025 (GLOBE NEWSWIRE) -- The Hydrogen Pipeline Market was estimated at USD 9.25 billion in 2023 and is expected to reach USD 35.43 billion by 2032, with a growing CAGR of 16.09% over the forecast period 2024–2032.

Download PDF Sample of Hydrogen Pipeline Market @ https://www.snsinsider.com/sample-request/6589

Growing sustainability momentum and increased investment in green hydrogen, along with new generation pipeline infrastructure, are driving the hydrogen pipeline market swiftly. Hydrogen is an important and priority fuel for the clean energy transition in government and private industry agendas.

The U.S. hydrogen pipeline market is anticipated to reach USD 3.88 billion by 2032, a considerable growth from USD 1.01 billion in 2023, growing at a CAGR of 16.14%. The growth is being driven by increased investment in clean energy infrastructure and demand for low-emission fuels. This is demonstrating consistent annual market gains, an indicator of the continued hydrogen transportation evolution across the country.

Key Players:

- Cenergy Holdings (composite and steel pipeline systems for hydrogen transport)

- SoluForce B.V. (flexible reinforced thermoplastic hydrogen pipelines)

- Salzgitter AG (hydrogen-ready steel pipes and tubes)

- Gruppo Sarplast S.r.l (GRP and thermoplastic piping systems for hydrogen applications)

- Tenaris (high-pressure hydrogen transmission pipes)

- Hexagon Purus (hydrogen distribution pipe systems and Type 4 composite pressure vessels)

- Pipelife International GmbH (plastic hydrogen pipeline solutions)

- Europe Technologies (pipeline welding and inspection technologies for hydrogen infrastructure)

- H2 Clipper, Inc. (long-distance hydrogen transport systems including pipelines and airships)

- NPROXX (high-pressure hydrogen storage and pipeline components)

- GF Piping Systems (polymer-based pipeline systems suitable for hydrogen transport)

- ArcelorMittal (hydrogen-compatible steel pipeline products)

- Jindal Saw Limited (welded and seamless pipes for hydrogen infrastructure)

- Vallourec (seamless pipes for hydrogen transport and storage)

- Tata Steel (hydrogen-ready pipeline steel solutions)

- Liberty Steel Group (pipeline products for hydrogen energy systems)

- ILJIN Steel (specialized steel pipelines for hydrogen applications)

- Butting Group (corrosion-resistant stainless steel pipelines for hydrogen)

- Welspun Corp (large-diameter hydrogen pipeline manufacturing)

- Tubacex Group (high-alloy and stainless-steel piping for hydrogen transport)

Hydrogen Pipeline Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 9.25 Billion |

| Market Size by 2032 | USD 35.43 Billion |

| CAGR | CAGR of 16.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Mobile Pipelines, Fixed Pipelines) • By Distance (Upto 300 Km, More than 300 Km) • By Hydrogen (Gas, Liquid) • By Pipeline Structure (Metal, Plastics & Composites) |

| Key Drivers | • Growing concerns over climate change and carbon emissions are accelerating the adoption of hydrogen as a clean fuel, driving demand for dedicated pipeline infrastructure. |

Buy Full Research Report on Hydrogen Pipeline Market 2024-2032 @ https://www.snsinsider.com/checkout/6589

Fixed Pipelines and Metal Structures Dominate Infrastructure Choices

By Type: Fixed pipelines emerged as the dominant and fastest-growing segment, accounting for approximately 62% of the market share in 2023. These pipelines are permanent hydrogen transport infrastructures for medium- and short-distance fast transmission. They have become quite popular due to their operating reliability and ability to handle tall hydrogen flows. Due to their low cost of operation and their encouragement for the long-term replacement of green energy alternatives, fixed pipelines are the option that governments, along with industries, are looking at becoming a priority.

By Distance: The Up to 300 km segment dominated with a market share of over 38% in 2023. Pipelines in this spectrum are effective for regional hydrogen transport from hubs supplying hydrogen to cities or industrial users. Low capital and efficient-operational segment, it relies on the country's modular pipeline projects and hydrogen corridors, making it a suitable target for starter hydrogen economies.

By Hydrogen State: The gas segment held a 58% market share in 2023, continuing to lead the market. Gas hydrogen is more economical and versatile than liquid hydrogen. Because of their myriads of positive attributes, which include durability, suitability for use in high-pressure ranges, and resistance to hydrogen embrittlement, they are incredibly important. It is cost-effective, and it also helps scale large hydrogen projects since older oil and gas pipelines with built infrastructure can be adapted to transport hydrogen.

By Pipeline Structure: Metal pipelines commanded a 72% share in 2023, making them the most dominant and widely used infrastructure in the hydrogen pipeline market. They find utility due to their high strength and resistance to hydrogen embrittlement, as they are used in specialized applications in high-pressure environments. By replacing existing metallic infrastructures with hydrogen-compatible components, retrofitting legacy oil and gas pipelines presents an economically efficient and scalable approach for large-scale hydrogen implementation.

Europe Leads Global Hydrogen Pipeline Market with 42% Share in 2023; Middle East & Africa Emerge as Fastest-Growing Regions.

The Europe region held over 42% of the market share in 2023, owing to the ambitious climate targets and structured policy support. The European Hydrogen Strategy and the Green Deal have driven large-scale hydrogen infrastructure investments. Meanwhile, Germany, France, and the Netherlands are taking the lead on major initiatives and transnational hydrogen pipeline networks. Europe is additionally capitalizing on its key maturing gas pipeline infrastructure, redeveloping old assets for gas transport. That surrounding region features developed industrial partnerships, public-private schemes, and regulatory incentives that together promote its hydrogen pipeline market dominance. It aims to accelerate decarbonization and innovation across the hydrogen value chain to establish itself as a global hub for the hydrogen economy.

The Middle East and Africa are emerging as the fastest-growing regions, supported by ambitious clean energy visions and vast renewable resources. Meanwhile, countries such as Saudi Arabia and the UAE are initiating mega-projects like the NEOM green hydrogen project, which sets a robust groundwork for hydrogen pipeline infrastructure. In conclusion, low-cost hydrogen production with plenty of solar and wind energy potential, and the attraction of foreign direct investment to the sector are some examples of supportive policies by the government. African countries, now especially in the North and Sub-Saharan ones, are working with international energy companies to create large-scale hydrogen systems. These strategic moves highlight the importance of the region as a future hydrogen hub

If You Need Any Customization on Hydrogen Pipeline Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6589

Recent Developments:

In November 2024: Air Liquide committed €50 million to build a low-carbon hydrogen supply chain along France’s Seine Axis. This includes hydrogen packaging, transportation, and distribution infrastructure. The project will use renewable hydrogen generated by the upcoming 200 MW Normand’Hy electrolyzer, enabling clean fuel access to mobility stations and industrial customers.

In August 2024: Linde partnered with Shell for the REFHYNE II project at Shell’s Energy and Chemicals Park Rheinland. The 100 MW renewable hydrogen plant will produce up to 44,000 kg of hydrogen daily, supporting decarbonization efforts at Shell's facilities and supplying local industries. This milestone project underscores the scalability and industrial relevance of green hydrogen pipelines.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Hydrogen Pipeline Market Segmentation, By Type

8. Hydrogen Pipeline Market Segmentation, By Distance

9. Hydrogen Pipeline Market Segmentation, By Hydrogen

10. Hydrogen Pipeline Market Segmentation, By Pipeline Structure

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practice

14. Conclusion

Read Our Trending Reports:

Pipeline Monitoring System Market Report Size 2024-2032

Oil & Gas Pipeline Leak Detection Market Share & Forecast to 2032

Water Recycle and Reuse Market - Global Research by 2032

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.