Austin, May 15, 2025 (GLOBE NEWSWIRE) -- Flexible PCB Market Size & Growth Insights:

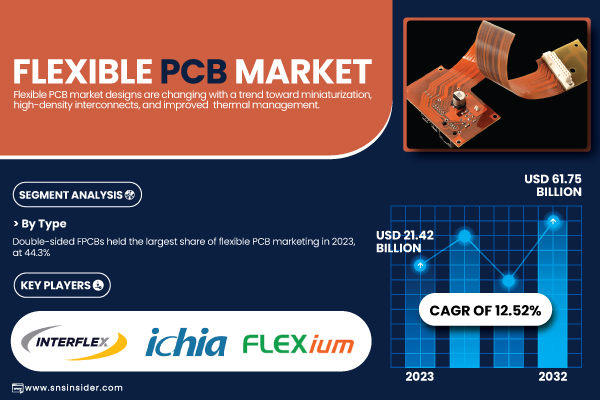

According to the SNS Insider,“The Flexible PCB Market was valued at USD 21.42 billion in 2023 and is expected to reach USD 61.75 billion by 2032, growing at a CAGR of 12.52% over the forecast period 2024-2032.”

Growth of the Flexible PCB Market Driven by Demand for Miniaturized Electronics and Automotive Systems

Rising adoption of miniaturized, lightweight, and high-performance electronics in various application industries is boosting growth of the market for Flexible PCB Market. Compact and flexible circuits increasingly come into play in consumer electronics like smartphones, wearables and foldable devices. Moreover, rising penetration of electric vehicles (EVs) and ADAS in the automotive industry is increasing the utilization of flexible PCBs that provide enhanced signal integrity, lightweight material, and durability in complex automotive modules. U.S. Flexible PCB Market is expected to reach USD 1.80 Billion by 2023, at a CAGR of 13.53%.

Get a Sample Report of Flexible PCB Market Forecast @ https://www.snsinsider.com/sample-request/6700

Leading Market Players with their Product Listed in this Report are:

- Nippon Mektron (Flex Circuit Board)

- Zhen Ding Technology Holding Ltd. (HDI Flexible PCB)

- Sumitomo Electric Industries (Flexible Printed Wiring Board)

- Interflex Co. Ltd. (Flexible Printed Circuit for Display Modules)

- Career Technology (Mfg.) Co., Ltd. (Automotive FPC)

- Ichia Technologies Inc. (Flexible Touch Panel PCB)

- Multi-Fineline Electronix, Inc. (MFLEX) (High-Density Interconnect FPC)

- NewFlex Technology Co., Ltd. (LED Lighting FPC)

- FLEXium Interconnect, Inc. (Wearable Device FPC)

- Daeduck GDS (Rigid-Flex PCB for Smartphones)

- SIFlex Co., Ltd. (Mobile Application FPC)

- BHflex Co., Ltd. (Camera Module FPC)

- Interconnect Systems Inc. (Flex Assembly Subsystems)

- Samsung Electro-Mechanics (Flexible OLED Display PCB)

- Nitto Denko Corporation (Flexible Printed Circuit Substrates)

Flexible PCB Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 21.42 Billion |

| Market Size by 2032 | USD 61.75 Billion |

| CAGR | CAGR of 12.52% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type (Single Sided FPCBs, Double Sided FPCBS, Multilayer FPCBS, Rigid-Flex PCBS, Others) • By End Use (Industrial Electronics, Aerospace & Defense, IT & Telecom, Automotive, Consumer Electronics, Other) |

| Key Drivers | • Flexible PCBs Drive Growth with Rising Demand in Compact Electronics EVs and Advanced Automotive Systems. • 5G IoT Medical Electronics and Advanced Materials Drive Growth of Flexible PCBs in Critical Industries. |

New manufacturing technologies like additive print techniques, or laser direct imaging are making the production of electronic components more accurate, higher-performing, and more affordable. Booming demand in the automotive, medical and consumer electronics industries, in combination with government-backed research and development programs will drive consistent growth. Expectation is that this development in miniaturization and flexible hybrid electronics will drive usage of FPCBs in different industry verticals.

Purchase Single User PDF of Flexible PCB Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6700

Flexible PCB Market Growth by Type and End Use Key Trends and Projections

By Type

Double-sided FPCBs held the largest market share in 2023 at 44.3%, providing highly sophisticated circuitry This would result in cost-effective, spatially-efficient circuit design. They are more complicated to manufacture than single-sided boards, but can be lean enough to be mass-produced on a budget, lending them scrutiny in consumer electronics, automotive, and other industries.

Multilayer FPCBs, expected to grow at the highest CAGR from 2024 to 2032, are developed to address the need for miniaturization, high electrical performance and stability in compact electronics, such as mobile phones, medical, aerospace, and 5G devices. These boards allow for more features and reliability, satisfying the demand for more miniaturization in the industry, even under conditions of narrow installation.

By End Use

In 2023, the Consumer Electronics segment led the Flexible PCB market with a 51.3% share, as a result of the high demand for flexible and lightweight circuits solutions in devices such as smartphones, tablets, laptops, smartwatches and similar wearable devices. Consumer electronic devices have continued to minimize and aggregated while evolution to smarT terminals more increased FPCB demands.

The IT & Telecom segment is expected to register the fastest growth from 2024 to 2032, n account of 5G infrastructure expansion, investments in data centers and rising demand for high-speed communication equipment.

Flexible PCB Market Growth in Asia Pacific and North America

In 2023, Asia Pacific dominated the Flexible PCB market with a 74.7% share, driven by a robust manufacturing ecosystem and leading electronics producers like China, Japan, South Korea, and Taiwan. Major companies such as Samsung Electronics, Sony, and Foxconn rely heavily on flexible PCBs for devices like smartphones, smartwatches, and display modules. Additionally, increasing demand for electric vehicles and wearable devices in the region is fueling market growth, positioning Asia Pacific as both a production hub and a major consumer.

North America is expected to experience the highest CAGR from 2024 to 2032, on account of progress in 5G, aerospace, defense, and medical applications. Businesses of Lockheed Martin and Raytheon Technologies are increasingly adopting rigid-flex PCBs in defense systems, and companies of Cisco and Qualcomm are spurring demand for high-performance FPCBs in telecom and IoT equipment. Increasing R&D spends and high end applications are projected to drive the market in the region.

Do you have any specific queries or need any customized research on Flexible PCB Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6700

Recent Developments:

- July 2024, Sumitomo Electric Industries (SEI) to invest USD 27.4 million in two projects to expand its production of flexible circuit boards in Hanoi, Vietnam. This investment is aimed at expanding the capacity and output of its subsidiary, SEI Electronic Components (Vietnam) Co., Ltd in the coming years, which will concentrate more in doing export production.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Flexible PCB Design Trends

5.2 Flexible PCB Fab Capacity Utilization

5.3 Emerging Applications and Technological Integrations

5.4 Advanced Manufacturing Techniques

6. Competitive Landscape

7. Flexible PCB Market Segmentation, by Type

8. Flexible PCB Market Segmentation, by End Use

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.