Austin, May 14, 2025 (GLOBE NEWSWIRE) -- Sterilization Equipment Market Size & Growth Analysis:

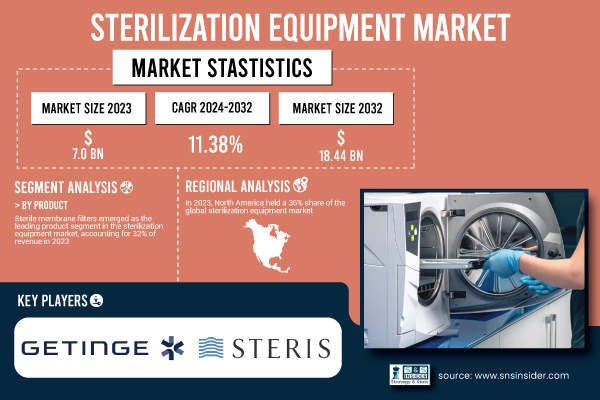

“According to SNS Insider, The Sterilization Equipment Market was valued at USD 7.0 Billion in 2023 and is projected to hit USD 18.44 Billion by 2032, growing at a CAGR of 11.38% over the forecast period 2024-2032.”

Rising incidence of hospital-acquired infections (HAIs), more surgical operations, growing knowledge of hygienic practices, and rigorous regulatory standards on sterilizing techniques in laboratories and hospitals help to explain this development. In medical and pharmaceutical uses, government organizations, including the European Medicines Agency (EMA) and the U.S. Centers for Disease Control and Prevention (CDC), are enforcing more rigorous sterilizing policies. The COVID-19 epidemic has sped up investments in sterilizing technologies, therefore promoting fast technological development and acceptance in research, pharmaceutical, and healthcare environments.

Get a Sample Report of Sterilization Equipment Market@ https://www.snsinsider.com/sample-request/6438

The U.S. sterilization equipment market is predicted to reach USD 4.86 billion by 2032 from USD 1.86 billion in 2023 in reflecting a CAGR of 11.25%. Strong demand from hospitals, dentists' offices, pharmaceutical manufacturing facilities, and research labs fuels development. Particularly for reusable medical equipment, the Food and Drug Administration (FDA) has been aggressive in releasing sterilizing standards. Advanced sterilizing systems are being invested in by major healthcare providers and businesses to guarantee efficiency, compliance, and safety. In addition, rising surgical volume and the expansion of outpatient care centers further bolster the market in the U.S.

Major Players Analysis Listed in this Report are:

- Getinge Group (Steam Sterilizers, Dry Heat Sterilizers)

- STERIS Corporation (V-PRO Low Temperature Sterilizers, AMSCO Steam Sterilizers)

- 3M Healthcare (Attest Biological Indicators, Steri-Vac Ethylene Oxide Sterilizers)

- Medtronic plc (Gas Plasma Sterilizers, Steam Sterilizers)

- Asahi Kasei Corporation (ETO Sterilizers, Plasma Sterilizers)

- Ansell Ltd (Sterilization Wraps, Barrier Surgical Gloves)

- Cantel Medical Corporation (AEROFLEX Automatic Endoscope Reprocessor, DSD Edge Sterile Processor)

- Belimed AG (WD 290 Washer-Disinfector, MST V 446 Steam Sterilizer)

- Crosstex International, Inc. (Sure-Check Sterilization Pouches, Biological Monitoring Systems)

- Amsco, Inc. (Century Steam Sterilizers, Eagle Series Sterilizers)

- MATACHANA Group (S1000 Series Steam Sterilizers, Low Temperature Sterilizers)

- MMM Group (Selectomat PL Steam Sterilizers, Vacuklav Autoclaves)

- Steelco S.p.A. (VS L Series Steam Sterilizers, LAB 640 Washer-Disinfectors)

- Tuttnauer (Elara 11 Class B Autoclave, T-Edge 10 Autoclave)

- Midmark Corporation (M11 Steam Sterilizer, M3 UltraFast Automatic Sterilizer)

- Bausch + Ströbel (Syringe Filling Machines, Vial Filling and Closing Machines)

- Wilco AG (Leak Testing Machines, Visual Inspection Systems)

- Hindustan Syringes & Medical Devices (Dispovan Single-Use Syringes, IV Cannulas)

- Medisafe International (Sonic Irrigation Systems, Instrument Cleaning Chemistries)

- DE LAMA S.p.A. (DLOV Steam Sterilizers, DLST Superheated Water Sterilizers)

Sterilization Equipment Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.0 billion |

| Market Size by 2032 | US$ 18.44 billion |

| CAGR | CAGR of 11.38% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | The increasing number of surgical procedures worldwide has heightened the demand for effective sterilization equipment to ensure patient safety and prevent infections. |

Segment Analysis

By Product

Sterile membrane filters dominated the market in 2023 and held 32% of the total revenue share. Pharmaceuticals, biotechnology, and laboratory uses all benefit from these filters to guarantee sterile fluid filtration. Their effectiveness in removing bacteria, fungi, and other microorganisms without altering the chemical composition of the filtered substance makes them essential in drug formulation, vaccine production, and microbiological testing. Particularly post-pandemic, the growing demand for biopharmaceuticals and injectable medications has greatly helped to explain the predominance of this section. Furthermore, laws about sterile processing in industrial plants have encouraged the development of sterile filtering systems. Furthermore, increasing global acceptance of sterile membrane filters is the growing use of single-use technologies in laboratories and cleanrooms.

Over the forecast period, heat sterilizers are expected to have the fastest CAGR. Fundamental in hospitals, dental offices, and laboratories for sterilizing surgical equipment, laboratory glassware, and other heat-resistant materials, these systems include both dry and moist heat sterilizers. Their simplicity of use, low cost, and proven ability to eradicate infections have made them important in many different kinds of medical use. In heat sterilization, technological advances have improved cycle efficiency, safety, and energy economy. Growing government-funded programs for infection control and expanding healthcare infrastructure in underdeveloped areas are driving the acceptance of scalable and reasonably priced heat sterilizing systems. Furthermore, the growing reusing of medical tools resulting from cost control policies calls for consistent and repeatable heat sterilizing processes.

For A Detailed Briefing Session with Our Team of Analysts, Connect with Us Now@ https://www.snsinsider.com/request-analyst/6438

Sterilization Equipment Market Segmentation

By Product

- Heat Sterilizers

- Depyrogenation Oven

- Steam Autoclaves

- Sterile Membrane Filters

- Radiation Sterilization Devices

- Electron Beams

- Gamma Rays

- Others

- Low-Temperature Sterilizers

- Ethylene Oxide Sterilizers

- Hydrogen Peroxide Sterilizers

- Others

Regional Developments

With 36% of the global revenue share, North America dominated the sterilizing equipment market in 2023. Strong healthcare infrastructure, great acceptance of modern medical equipment, and strict regulatory control help the area. Driven by agencies such as the CDC and Health Canada, the United States and Canada lead in sterilizing requirements.

Over the next forecast period, Asia Pacific is expected to show significant growth. Rapid development of healthcare infrastructure in nations such as China, India, and Southeast Asia, as well as growing medical tourism and government support in hospital hygiene, are driving market growth. Government initiatives to stop HAIs and improve public hospitals have provided a suitable habitat for sterilizing tools.

Strict sterilization and disinfection rules set by the European Medicines Agency and national healthcare authorities help Europe to remain a strong market. Increased sterilization requirements are resulting from the rise in the older population and chronic disease patients needing operations and inpatient treatment.

Recent Developments

- Designed for quicker cycle times and greater throughput in hospitals, STERIS plc revealed in March 2024 the expansion of its low-temperature sterilizing portfolio with the launch of the V-PROTM maX 2 Low Temperature Sterilization System.

Buy a Single-User PDF of Sterilization Equipment Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/6438

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Healthcare-Associated Infections (HAIs) (2023)

5.2 Adoption Trends by Healthcare Facilities (2023)

5.3 Regulatory Compliance and Standards, by Region

5.4 Healthcare Spending on Sterilization Equipment (2023)

5.5 Technological Advancements and Innovation Trends

6. Competitive Landscape

7. Sterilization Equipment Market by Product

8. Regional Analysis

9. Company Profiles

10. Use Cases and Best Practices

11. Conclusion

Related Reports

UV Disinfection Equipment Market Report

Infection Control Market Report

Medical Device Cleaning Market Report

Ultrasound Probe Disinfection Market Report

Dental Sterilization Market Report

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.