Austin, May 14, 2025 (GLOBE NEWSWIRE) -- 3D IC and 2.5D IC Packaging Market Size & Growth Insights:

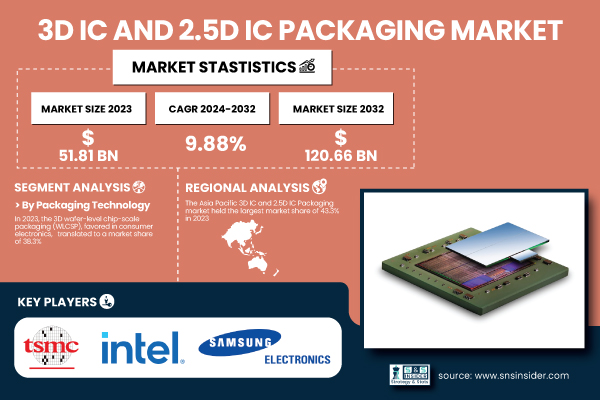

According to the SNS Insider Report, “The 3D IC and 2.5D IC Packaging Market was valued at USD 51.81 billion in 2023 and is expected to reach USD 120.66 billion by 2032, growing at a CAGR of 9.88% over the forecast period 2024-2032.”

Accelerating Adoption of 3D and 2.5D IC Packaging Driven by Performance Demands and Integration Needs

The growing demand for high-performance, energy-efficient semiconductor devices is significantly propelling the adoption of 3D and 2.5D IC packaging technologies. With rapid advancements in artificial intelligence (AI), high-performance computing (HPC), and 5G, traditional packaging methods are falling short in meeting the increasing requirements for speed, bandwidth, and power efficiency. 3D and 2.5D ICs offer improved interconnect density, higher bandwidth, reduced form factors, and enhanced thermal performance, making them ideal for next-generation applications. The U.S. 3D IC and 2.5D IC Packaging Market is estimated to be USD 11.13 Billion in 2023 and expected to reach USD 25.62 Billion by 2032 is projected to grow at a CAGR of 9.74%.

Get a Sample Report of 3D IC and 2.5D IC Packaging Market @ https://www.snsinsider.com/sample-request/6613

Leading Market Players with their Product Listed in this Report are:

- TSMC (CoWoS)

- Intel (Foveros)

- Samsung Electronics (X-Cube)

- ASE Group (VIPack)

- Amkor Technology (SLIM)

- JCET Group (3D eWLB)

- SPIL - Siliconware Precision Industries (2.5D SiP)

- Powertech Technology Inc. (3D TSV Packaging)

- Micron Technology (HBM2E Memory)

- IBM (3D TSV Integration)

- UMC (2.5D Interposer Technology)

- Deca Technologies (M-Series)

- Cadence Design Systems (3D-IC Advanced Package Design Tool)

- Synopsys (3DIC Compiler)

- Marvell Technology (2.5D Data Center SoC).

3D IC and 2.5D IC Packaging Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 51.81 Billion |

| Market Size by 2032 | USD 120.66 Billion |

| CAGR | CAGR of 9.88% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Packaging Technology (3D wafer-level chip-scale packaging (WLCSP), 3D Through-silicon via (TSV), 2.5D) • By Application (Logic, Imaging & Optoelectronics, Memory, MEMS/Sensors, LED, Others) • By End User (Consumer Electronics, Industrial, Telecommunications, Automotive, Military & Aerospace, Medical Devices) |

| Key Drivers | • Rising Demand for Energy Efficient High Performance Chips Accelerates 3D and 2.5D IC Packaging Adoption. • Automotive EV and Chip Sovereignty Drive Global Demand for Robust 3D and 2.5D IC Packaging. |

Moreover, the shift toward modular architecture and heterogeneous integration is gaining traction over monolithic approaches, enabling the combination of multiple chipsets and functionalities in a single package to reduce cost, power, and space. When advanced process nodes require more advanced packaging, semiconductor giants will have little option but to invest in these technologies. That growth is fueled even more in the U.S. by things like the CHIPS Act and the continued innovation by the likes of Intel, which further bolsters a healthy market.

Growth Drivers Across 3D IC & 2.5D IC Packaging by Technology, Application, and End User

By Packaging Technology

In 2023, 3D wafer-level chip-scale packaging (WLCSP) held a 38.3% market share, driven by its widespread use in consumer electronics like smartphones, tablets, and wearables. WLCSP offers a compact footprint, reduced packaging costs, and strong electrical performance, making it ideal for high-volume applications requiring miniaturization and efficiency.

The 3D Through-Silicon Via (TSV) segment is projected to register the highest CAGR from 2024 to 2032, owing to the increasing demand for high-bandwidth, low-latency applications. TSV allows vertical stacking of chips with reduced, shorter interconnects for AI, advanced computing, memory and data center applications that require high speed and high-density integration.

By Application

In 2023, the 3D IC and 2.5D IC packaging market was dominated by the Memory segment, which held a 34.3% share, due to increase in demand for high-bandwidth memory (HBM), 3D NAND, and stacked DRAM. These technologies are important for AI, cloud computing, as well as superior gaming, they provide high density, cost efficiency, low latency performance and low power consumption which are essential for data centers and HPC.

The MEMS/Sensors segment is expected to grow at the fastest CAGR from 2024 to 2032, due to the rising demand in automotive, healthcare, industrial, and consumer electronics verticals for a smarter and more miniaturized devices, and the necessity of the advanced and dependable packaging.

By End User

In 2023, the 3D IC and 2.5D IC packaging market was led by the Consumer Electronics segment, capturing a 33.7% share, because of the vast production of smart wearables, smartphones, tablets, and AR/VR devices. The products demand high-performance, low-power and small-form-factor features that are facilitated by the packaging like WLCSP, interposer-based designs.

The Automotive sector is projected to grow at the fastest CAGR from 2024 to 2032, due to developments in the electric vehicle, autonomous vehicle, and infotainment. The need for strong, thermally efficient protection is growing as sensors, LiDAR, radar and AI units are increasingly used.

For A Detailed Briefing Sessions with Our Team of Analyst, Connect Now @ https://www.snsinsider.com/request-analyst/6613

Asia Pacific Leads 3D IC and 2.5D IC Packaging Market with Strong Ecosystem and Strategic Investments

In 2023, Asia Pacific dominated the 3D IC and 2.5D IC packaging market with a 43.3% share and is projected to grow at the highest CAGR through 2032, due to strong semiconductor ecosystem, rapid technology adoption, and the presence of industry leaders such as TSMC, Samsung, and ASE Group. Strong demand from consumer electronics, automotive and AI computing industry is driving on-going R&D and capex in the region. Government Programs like China “Made in China 2025 “ and burgeoning SEMICONDUCTOR developments in India are also driving strength and market opportunity for Asia Pacific leadership and market growth.

Recent Development:

- May 2025, Synopsys enhances 3DIO solution for multi-die integration, delivering increased modularity, yield and scalability for more efficient heterogeneous SoC designs.

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Chip Design Trends

5.2 Fab Capacity Utilization

5.3 HDI PCB Usage in 5G Infrastructure

5.4 Integration Trends: Monolithic vs. Heterogeneous

6. Competitive Landscape

7. 3D IC and 2.5D IC Packaging Market, by Packaging Technology

8. 3D IC and 2.5D IC Packaging Market, by Application

9. 3D IC and 2.5D IC Packaging Market, by End User

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

Semiconductor Assembly & Packaging Industry Analysis Report

Panel Level Packaging Industry Analysis Report

Electronic Packaging Industry Analysis Report

Hermetic Packaging Industry Analysis Report

Semiconductor Packaging Industry Analysis Report