Pune, May 13, 2025 (GLOBE NEWSWIRE) -- Reverse Factoring Market Size Analysis:

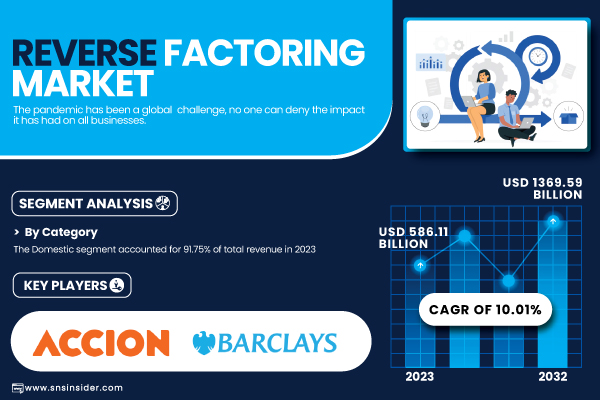

“The SNS Insider report indicates Reverse Factoring Market size was valued at USD 586.11 billion in 2023 and is estimated to reach USD 1369.59 billion by 2032, growing at a CAGR of 10.01% during the forecast period of 2024–2032.”

Get a Sample Report of Reverse Factoring Market@ https://www.snsinsider.com/sample-request/6328

Major Players Analysis Listed in this Report are:

- Accion International – (Microfinance Solutions, SME Lending)

- Banco Bilbao Vizcaya Argentaria, S.A. – (Supply Chain Finance, Trade Credit Solutions)

- Barclays Plc – (Invoice Financing, Working Capital Solutions)

- Credit Suisse Group AG – (Structured Trade Finance, Asset-Backed Lending)

- Deutsche Factoring Bank – (Domestic Factoring, Reverse Factoring)

- Drip Capital Inc. – (Export Financing, Freight Factoring)

- eFactor Network – (Supply Chain Financing, Receivables Discounting)

- HSBC Group – (Trade Finance, Supplier Payment Solutions)

- JP Morgan Chase & Co. – (Commercial Lending, Dynamic Discounting)

- Mitsubishi UFJ Financial Group, Inc. – (Invoice Discounting, Working Capital Loans)

- PrimeRevenue, Inc. – (Early Payment Programs, Multi-Funder Platform)

- Societe Generale – (Factoring Services, Structured Credit)

- Trade Finance Global – (Export Credit, Supply Chain Finance)

- TRADEWIND GMBH – (Cross-Border Factoring, Export Financing)

- Viva Capital Funding, LLC – (Accounts Receivable Financing, Small Business Loans)

Reverse Factoring Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 586.11 Billion |

| Market Size by 2032 | US$ 1369.59Billion |

| CAGR | CAGR of 10.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | Increasing Need for Working Capital Optimization Drives the Growth of the Reverse Factoring Market |

The U.S. reverse factoring market was valued at USD 34.17 billion in 2023 and is projected to reach USD 65.12 billion by 2032, growing at a CAGR of 7.55% during 2024–2032. Growth is driven by the rapid digitization of financial services, widespread SME adoption, and strong fintech-bank collaborations. Future expansion will be supported by regulatory support for supply chain finance and increasing demand for efficient working capital solutions.

By Category: Domestic Leads, International Gains Traction with Fastest CAGR

The domestic segment dominated the reverse factoring market and accounted for 91.7% of revenue share, owing to well-established local networks, reduced legal complexities, and trusted financial collaborations within national borders. Many enterprises prefer working with domestic suppliers and financial institutions due to faster processing and lower transaction risks. These factors, combined with favorable local banking policies and integration with domestic enterprise resource planning systems, support the dominance of the domestic segment. Going forward, this trend is likely to continue, especially in countries with strong SME bases and robust internal financial ecosystems.

The international segment is set to register the fastest CAGR during 2024–2032. This growth is fueled by the increasing globalization of supply chains and the need for cross-border financing solutions. International reverse factoring is becoming essential for multinational corporations seeking seamless working capital management across different geographies. Additionally, technological innovations and the expansion of digital trade platforms are minimizing the barriers of currency exchange, jurisdiction, and compliance, making international reverse factoring more accessible and secure.

By Financial Institution: Banks Hold Sway While NBFCs Gain Ground Rapidly

Banks' segment dominated the reverse factoring market in 2023 and accounted for 80.49% of revenue share, due to their established credibility, large customer base, and access to capital. They also offer a wide range of integrated financial services that make them the preferred choice for large enterprises engaging in reverse factoring. Regulatory confidence, strong risk assessment frameworks, and deep-rooted supplier-buyer relationships allow banks to maintain a stronghold in the segment. Moreover, digital transformation across banking institutions has made onboarding and transaction processing smoother, further cementing their dominance.

Non-banking financial institutions are poised to witness the fastest growth rate during the forecast period. These entities are increasingly targeting underserved SMEs with flexible, technology-driven reverse factoring solutions. Their faster decision-making processes, low operational barriers, and customer-centric models allow them to penetrate niche markets where traditional banks may be constrained. The growing fintech revolution and collaborations between NBFCs and digital platforms are expected to further accelerate growth in this segment.

By End-Use: Manufacturing Dominates, Healthcare Races Ahead

The manufacturing segment dominated the reverse factoring market in 2023 and accounted for 29.79% of revenue share, as it involves extensive supplier networks, large invoice volumes, and capital-intensive operations, all of which benefit from liquidity optimization. Reverse factoring solutions help manufacturers strengthen supplier relationships, secure discounts, and maintain uninterrupted production cycles. Given the complex nature of the manufacturing supply chain and its reliance on timely payments, this segment has seen the highest adoption of reverse factoring to ensure operational continuity and financial efficiency.

The healthcare segment is expected to register the fastest CAGR during 2024–2032. The rise in demand for medical supplies, equipment, and pharmaceuticals, especially after the pandemic, has placed significant financial stress on healthcare providers. Reverse factoring provides hospitals and healthcare organizations a means to pay suppliers on time while preserving working capital. Furthermore, increasing private investments in health infrastructure and a shift towards value-based care are expected to drive continued adoption.

Do you have any specific queries or need any customization research on Reverse Factoring Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/6328

Reverse Factoring Market Segmentation:

By Category

- Domestic

- International

By Financial Institution

- Banks

- Non - banking Financial Institutions

By End - use

- Manufacturing

- Transport & Logistics

- Information Technology

- Healthcare

- Construction

- Others (Retail, Food & Beverages, Among Others)

Key Regional Development: Europe Dominated the Market, Latin America to Register Fastest CAGR

Europe dominated the reverse factoring market in 2023 and accounted for 59.12% of revenue share, due to its well-developed financial infrastructure, strong regulatory frameworks, and widespread adoption of supply chain finance practices. Countries such as Germany, the UK, and France have shown significant uptake, driven by a large base of multinational corporations and technologically advanced banking institutions. The presence of leading reverse factoring service providers and government initiatives to support SMEs has also reinforced Europe’s position as a market leader. The trend is expected to continue, with digital adoption and ESG-aligned financing boosting further growth.

Latin America is projected to register the fastest CAGR during the forecast period of 2024–2032. Increasing demand for working capital solutions, coupled with improving financial inclusion and digital transformation in countries like Brazil, Mexico, and Colombia, is accelerating adoption. The region’s growing startup ecosystem and supportive fintech regulations are also making reverse factoring more accessible and scalable.

Recent Developments in 2024

- April 2024 – Taulia, a leading provider of working capital solutions, launched a new AI-powered reverse factoring platform to streamline supplier onboarding and credit assessment.

- February 2024 – Citi Bank expanded its digital supply chain finance services in Latin America, focusing on cross-border reverse factoring for mid-sized enterprises.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Reverse Factoring Market Segmentation, By Category

8. Reverse Factoring Market Segmentation, By Financial Institution

9. Reverse Factoring Market Segmentation, By End-use

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

Immersive Entertainment Market

Construction Estimating Software Market