Austin, May 13, 2025 (GLOBE NEWSWIRE) -- Veterinary Diagnostics Market Size & Growth Analysis:

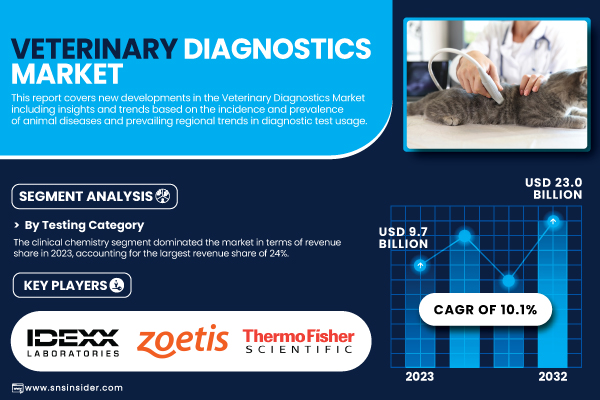

According to SNS Insider, the Veterinary Diagnostics Market was valued at USD 9.7 billion in 2023 and is projected to reach a market size of USD 23 billion by 2032, growing at a CAGR of 10.1% during the forecast period of 2024 to 2032.

Rising incidence of zoonotic and infectious diseases, expanding companion animal population, and increasing demand for quick and accurate veterinary medicine diagnosis solutions all combine to propel the fast development of the market. As understanding of animal health increases and pet insurance grows more common, pet owners and veterinary professionals are choosing diagnostic screening for diseases including parvovirus, canine distemper, feline leukemia, and others more and more. Apart from the increasing trend of pet humanization, molecular diagnostics, PCR testing, and point-of-care testing equipment are boosting diagnosis efficiency and accessibility, using technical improvements.

Get a Sample Report of Veterinary Diagnostics Market@ https://www.snsinsider.com/sample-request/6352

Rising at a CAGR of 9.96%, the U.S. veterinary diagnostics market was worth USD 2.95 billion in 2023 and is projected to reach USD 6.92 billion by 2032. Supported by increasing pet ownership, robust infrastructure for animal healthcare, and proactive government policies, the United States has a substantial share of the global veterinary diagnostics market in 2023. The American Pet Products Association (APPA) claims that over 66% of American homes have pets, which drives the need for preventive veterinarian treatment. Additionally, actively supporting animal health projects and disease monitoring programs that so assist market expansion are the U.S. Department of Agriculture (USDA) and the Centers for Disease Control and Prevention (CDC).

Key Veterinary Diagnostics Companies Profiled in the Report

- IDEXX Laboratories, Inc. (SNAP Test Kits, SediVue Dx Urine Sediment Analyzer)

- Zoetis Inc. (Vetscan VS2 Chemistry Analyzer, Vetscan Imagyst)

- Thermo Fisher Scientific Inc. (VetMAX PCR Test Kits, PrioCHECK Serology Assays)

- bioMérieux SA (VITEK 2 Compact, VIDAS Immunoassay System)

- Heska Corporation (Element HT5 Hematology Analyzer, Element i Immunodiagnostic Analyzer)

- NEOGEN Corporation (GeneSeek Genomic Profiling, Reveal for Salmonella Test)

- Bio-Rad Laboratories Inc. (BioPlex 2200 Multiplex System, iQ-Check Real-Time PCR Kits)

- Virbac (Speed Reader, Speed Duo FeLV/FIV Test)

- FUJIFILM Holdings Corporation DRI-CHEM NX500 Veterinary Chemistry Analyzer, FDC-VET Clinical Chemistry Reagents)

- Shenzhen Mindray Animal Medical Technology Co. Ltd. (BC-5000Vet Hematology Analyzer, BS-240Vet Chemistry Analyzer)

- INDICAL BIOSCIENCE GmbH (VetMAX Pathogen Detection Kits, IndiMag Pathogen Kit)

- BioNote, Inc. (Vcheck V200 Analyzer, Vcheck Canine NT-proBNP Test Kit)

- Biogal Galed Labs (PCRun Molecular Detection, VacciCheck Antibody Test Kit)

- Agrolabo S.p.A. (Agroscan Diagnostic Kits, Rapid Test Kits)

- Innovative Diagnostics SAS (ID Screen ELISA Kits, ID Gene PCR Kits)

- Randox Laboratories Ltd. (Evidence Investigator Analyzer, VetBiochip Array Technology)

- BioChek BV (Avian Influenza Antibody Test Kit, Salmonella Enteritidis Antibody Test Kit)

- Fassisi GmbH (Fassisi Parvo Test, Fassisi FIP Test)

- Alvedia (QuickTest DEA 1, QuickTest Feline AB)

- Antech Diagnostics, Inc. (Mars Inc.) (Accuplex4, Imaging Services)

Veterinary Diagnostics Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.7 billion |

| Market Size by 2032 | US$ 23 billion |

| CAGR | CAGR of 10.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | The increasing prevalence of zoonotic diseases, such as avian influenza and rabies, underscores the need for advanced veterinary diagnostics to ensure early detection and control. |

Segment analysis

By Testing Category

The clinical chemistry segment leads the Veterinary Diagnostics Market in 2023, with 24% of total revenue. Veterinary offices routinely use clinical chemistry tests to evaluate organ performance and metabolic profiles, therefore enabling the detection of liver, kidney, and electrolyte abnormalities. These tests guide treatment recommendations for both companion and agricultural animals and offer vital understanding of chronic conditions.

The section gains from veterinarians' quick decisions made possible by the growing acceptance of in-clinic diagnostic tools with fast return times. Furthermore, driving demand for such testing is the move toward preventative veterinary care and wellness screening. The expansion of telemedicine and mobile veterinary services is also improving access to clinical chemistry diagnostics in remote or rural areas, further expanding the segment’s market share over the forecast period.

By Animal Type

The companion animals dominated the veterinary diagnostics market in 2023, comprising 58% of revenue share. Dogs, cats, and other domestic animals are part of this section. Key drivers driving market expansion are the worldwide rising trend in pet ownership, especially in metropolitan areas, and the developing emotional link between pet owners and their animals. Demand is further increasing as knowledge of pet health and the availability of sophisticated diagnostic testing for early identification of ailments such as diabetes, cancer, and cardiac problems rise. Moreover, the growing number of pet wellness visits combined with the availability of pet insurance in industrialized nations motivates owners to make consistent health screening and diagnosis investments.

By Product

Withheld 53% share consumables, reagents & kits segment dominated the Veterinary Diagnostics Market, the consumables, reagents & kits segment held in 2023. Routine and advanced diagnostic tests conducted throughout veterinary clinics, hospitals, and laboratories depend on these goods. Among the items in the section are urinalysis strips, blood chemistry reagents, hematology reagents, and test kits for infectious disorders. The constant demand for these consumables in diagnostic procedures guarantees uniform demand, which greatly influences market income. Furthermore, the rise in point-of-care diagnostics has driven demand for quick testing kits, especially for small animal hospitals and pet clinics.

By End Use

The veterinarians segment leading end-use segment with 57% of the veterinary diagnostics market share in 2023. Particularly in preventative care and illness treatment, veterinary specialists mostly rely on diagnostic tests to evaluate and monitor animal conditions. The predominance of this segment is supported by the rising number of veterinary clinics, both stand-alone and hospital-based, as well as by rising caseloads of animals, including cattle. To provide high-quality and prompt treatment, veterinarians are using sophisticated diagnostic instruments, including in-clinic analyzers, imaging systems, and molecular diagnostics, more and more.

For A Detailed Briefing Session with Our Team of Analysts, Connect with Us Now@ https://www.snsinsider.com/request-analyst/6352

Veterinary Diagnostics Market Segmentation

By Product

- Consumables, Reagents & Kits

- Equipment & Instruments

By Animal Type

- Production Animals

- Cattle

- Poultry

- Swine

- Other Production Animals

- Companion Animals

- Dogs

- Cats

- Horses

- Other Companion Animals

By Testing Category

- Clinical Chemistry

- Microbiology

- Parasitology

- Histopathology

- Cytopathology

- Hematology

- Immunology & Serology

- Imaging

- Molecular Diagnostics

- Other Categories

By End-use

- Reference Laboratories

- Veterinarians

- Animal Owners/ Producers

Regional Developments

With 39% of the global veterinary diagnostics market share the North America led in 2023. The area gains from modern veterinary infrastructure, high pet ownership frequency, and favourable reimbursement rules. Furthermore, influencing innovation and product availability in the United States are the presence of top diagnostic businesses as IDEXX Laboratories, Zoetis Inc., and Thermo Fisher Scientific. Further contributing to North America's supremacy are higher pet healthcare expenses and the broad availability of sophisticated diagnostic tools.

Asia Pacific is expected to achieve the quickest CAGR over the projection period, driven by growing awareness of animal health, expanding cattle population, and government efforts to reduce zoonotic illnesses. Veterinary care infrastructure and diagnosis availability are expanding in nations such as India, China, and South Korea. Another important element driving market growth in the area is the increase in meat consumption and the consequent demand for programs controlling animal diseases.

Recent Developments

- IDEXX Laboratories debuted a new complete diagnostic platform for in-clinic testing using artificial intelligence for faster results and improved accuracy in January 2024.

- Strengthening its portfolio in infectious disease diagnostics, Zoetis Inc. revealed in March 2024 the acquisition of a European diagnostics startup focused on real-time PCR veterinary solutions.

Buy a Single-User PDF of Veterinary Diagnostics Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/6352

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Veterinary Diagnostic Test Usage Trends (2023)

5.2 Veterinary Diagnostics Device Volume and Market Growth (2020-2032)

5.3 Healthcare Spending in Veterinary Diagnostics (2023), by Source

5.4 Regulatory Compliance and Approval Trends (2023)

6. Competitive Landscape

7. Veterinary Diagnostics Market by Product

8. Veterinary Diagnostics Market by Animal Type

9. Veterinary Diagnostics Market by Testing Category

10. Veterinary Diagnostics Market by End-use

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Related Reports

Companion Animal Health Market Report

Veterinary Imaging Market Analysis

Veterinary Therapeutics Market Overview

Veterinary Software Market Trends

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.