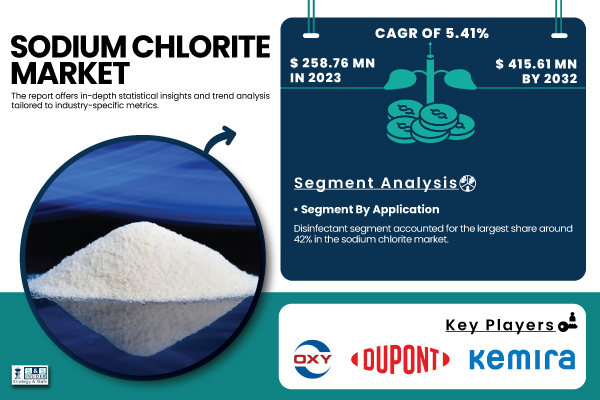

Austin, May 09, 2025 (GLOBE NEWSWIRE) -- The Sodium Chlorite Market Size was valued at USD 258.76 Million in 2023 and is expected to reach USD 415.61 Million by 2032, growing at a CAGR of 5.41% over the forecast period of 2024-2032.

Download PDF Sample of Sodium Chlorite Market @ https://www.snsinsider.com/sample-request/6560

Growing Industrial Demand and Regulatory Shifts Accelerate Global Integration of Sodium Chlorite Across Water, Medical, and Textile Sectors

Sodium chlorite is gaining traction across industrial and healthcare applications due to its strong oxidative and disinfectant capabilities. According to the U.S. Environmental Protection Agency (EPA), it plays a critical role in eliminating pathogens in municipal and industrial water treatment. In 2022, the U.S. FDA introduced updated guidelines for sodium chlorite in medical surface sterilization, boosting its use in clinical settings. The textile sector, supported by data from the American Association of Textile Chemists and Colorists (AATCC), is also adopting sodium chlorite more frequently for its superior bleaching efficiency. Sustainability trends in countries like India and China have further driven demand. To keep pace, key players like OxyChem and Ercros S.A. expanded their production capacities between 2022 and 2023, reinforcing sodium chlorite’s expanding industrial relevance.

The US Sodium Chlorite Market Size was valued at USD 54.34 Million in 2023 and is projected to reach USD 88.34 million by 2032, growing at a CAGR of 5.55% from 2024 to 2032.

The U.S. Sodium Chlorite market is experiencing steady growth due to the expanding application in municipal water treatment, healthcare disinfection, and textile industries. The EPA’s regulations promoting safe disinfectants and the FDA’s backing of sodium chlorite for medical sterilization have opened new avenues. Companies such as Occidental Chemical Corporation (OxyChem) continue to invest in sodium chlorite production infrastructure across U.S. regions.

Key Players:

- OxyChem (Purox S, OxyChlorite)

- Dupont (Chlorine Dioxide Generator, Oxidizing Biocide)

- Kemira (FennOx 250, FennOx 150)

- Shree Chlorates (Sodium Chlorite 80%, Sodium Chlorite Solution 31%)

- Ercros S.A. (Sodium Chlorite ER-80, Chlorine Dioxide ER-S)

- American Elements (AE Sodium Chlorite Powder, AE Sodium Chlorite Solution)

- Akzo Nobel N.V. (Dioxychlor, Eka Chlorine Dioxide)

- Gulbrandsen Chemicals (Sodium Chlorite Technical Grade, GCI-Chlorite 31%)

- Arkema S.A. (Sodium Chlorite High Purity, Chlorate Disinfectant)

- Ankine Pharmaceuticals (Sodium Chlorite USP Grade, Ankine Chlorite Liquid)

- Triveni Interchem Pvt. Ltd. (Triveni Sodium Chlorite 80%, Triveni Chlorite Solution)

- Surpass Chemical Company, Inc. (Surpass Sodium Chlorite, Surpass Chlorine Dioxide Base)

- Shandong Gaomi Gaoyuan Chemical Co., Ltd. (Gaoyuan Sodium Chlorite Powder, Gaoyuan Chlorite Solution)

- OxyChem Corporation (Occidental Chemical Corporation) (OxyChem Chlorite 25%, OxyChem Chlorite 80%)

- Jinan Realfine Chemical Co., Ltd. (Realfine Sodium Chlorite Solution 31%, RF-SC Powder)

- Sigma-Aldrich (a part of Merck Group) (Sodium Chlorite Reagent Grade, Sodium Chlorite ACS)

- Carus Group Inc. (Carusol, Carus 8500)

- Yancheng Longshen Chemical Co., Ltd. (Longshen Chlorite Liquid, Longshen Sodium Chlorite 80%)

- BASF SE (Oxidant SC-90, Chlorite Clean)

- Nanjing Kaimubo Pharmatech Co., Ltd. (KM-Sodium Chlorite 80%, KM-Chlorite Liquid 31%

Sodium Chlorite Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 258.76 Million |

| Market Size by 2032 | USD 415.61 Million |

| CAGR | CAGR of 5.41% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Disinfectant, Antimicrobial Agent, Bleaching Agent, Others) • By End Use (Water treatment, Paper, Textile, Medical, Other) |

| Key Drivers | • Rising demand for clean water and disinfection solutions drives the sodium chlorite market growth globally across sectors. |

Regulatory Shifts Fueling Sodium Chlorite Adoption in Healthcare Sector

- The FDA's updated guidelines for using sodium chlorite in medical surface sterilization have boosted its hospital adoption.

- The EPA's endorsement of sodium chlorite for disinfecting hospital water systems has increased its use in healthcare facilities.

- The European Chemicals Agency's recognition of sodium chlorite under BPR supports its widespread use in healthcare disinfection across the EU.

- The World Health Organization recommends chlorine dioxide (from sodium chlorite) for hospital disinfection, increasing global demand.

- New sanitation certification requirements for U.S. healthcare facilities are driving the demand for EPA-registered disinfectants like sodium chlorite.

By Application, Disinfectant Segment Dominated the Sodium Chlorite Market in 2023 with a 42% Market Share

Sodium chlorite is extensively used in the generation of chlorine dioxide, a compound widely adopted in municipal water disinfection, medical surface sterilization, and sanitation of public facilities. Amid the rise in hospital-acquired infections (HAIs), U.S. hospitals have increasingly deployed sodium chlorite-based disinfectants, as indicated by reports from the Centers for Disease Control and Prevention (CDC). Moreover, major water utilities in regions like California and Texas have shifted towards sodium chlorite due to its superior microbial reduction efficacy. In industrial settings, food processing plants also employ sodium chlorite-based formulations to ensure hygiene. In 2023, companies like Evoqua Water Technologies reported an uptick in demand for their sodium chlorite-based systems across North America. This strong uptake across municipal, healthcare, and industrial sanitation sectors ensures the disinfectant segment remains at the forefront.

By End Use, Water Treatment Segment Dominated the Sodium Chlorite Market in 2023 with a 52% Market Share

This dominance is fueled by rising concerns over waterborne diseases and the growing emphasis on safe drinking water in both developed and developing regions. In the U.S., the Safe Drinking Water Act (SDWA) mandates stringent disinfection, prompting widespread adoption of sodium chlorite for chlorine dioxide generation. Moreover, the surge in industrial wastewater treatment in sectors such as oil & gas, mining, and textiles has further increased demand. For instance, Dow Chemical and Chemtrade Logistics have ramped up sodium chlorite supply contracts with municipal water boards in 2023. The compound’s efficiency in oxidizing contaminants like iron and manganese, combined with lower formation of harmful byproducts, makes it a preferred choice. Its compatibility with automated dosing systems has further driven adoption in large-scale treatment facilities.

If You Need Any Customization on Sodium Chlorite Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6560

Asia Pacific Dominated the Sodium Chlorite Market In 2023, Holding A 44% Market Share.

The Asia Pacific region leads the sodium chlorite market, driven by industrial growth and rising potable water demand. Countries like China, India, and Indonesia have expanded municipal water treatment systems, with government initiatives such as India's Jal Jeevan Mission. China's Ministry of Ecology and Environment highlights significant investments in chlorine dioxide-based plants. Sodium chlorite is also crucial for bleaching in textile hubs like India and Bangladesh, as noted in the 2023 Indian Textile Journal. Additionally, healthcare facilities in Japan are adopting sodium chlorite-based disinfectants, further boosting regional demand.

North America Emerged as the Fastest Growing Region in Sodium Chlorite Market with A Significant Growth Rate in The Forecast Period

The U.S. benefits from advanced water treatment infrastructure and a growing focus on hygiene and healthcare. Federal agencies like the CDC and EPA advocate for sodium chlorite due to its low toxic residue and effectiveness against pathogens like Cryptosporidium and Giardia. Healthcare facilities favor it for its broad-spectrum activity and environmental safety. In 2023, companies like Olin Corporation and Evoqua Water Technologies expanded their sodium chlorite portfolios, driven by demand from municipal and private utilities. Additionally, the ongoing upgrades to U.S. water infrastructure under the Infrastructure Investment and Jobs Act (2021) are further accelerating market growth.

Recent Developments

- February 2023: Ercros' new sodium chlorite production plant in Sabiñánigo became fully operational, doubling its production capacity. This expansion positions Ercros as Europe's largest sodium chlorite manufacturer, with over 75% of production exported, utilizing advanced technology for improved efficiency and sustainability.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Sodium Chlorite Market Segmentation, By Application

8. Sodium Chlorite Market Segmentation, By End Use

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practice

12. Conclusion

Read Our Trending Reports:

Sodium Nitrite Market - Global Research by 2032

Sodium Benzoate Market Report Size 2024-2032

Sodium Gluconate Market Analysis by 2032

Sodium Nitrate Market Share & Forecast to 2032

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.