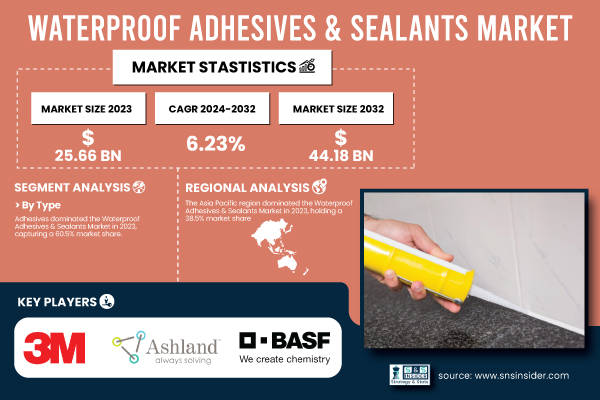

Austin, May 08, 2025 (GLOBE NEWSWIRE) -- The global waterproof adhesives & sealants market is projected to reach USD 44.18 billion by 2032, growing at a compound annual growth rate (CAGR) of 6.23% from 2024 to 2032.

Download PDF Sample of Waterproof Adhesives & Sealants Market @ https://www.snsinsider.com/sample-request/6497

The growing need for water-resistant construction materials and strict laws aimed at protecting the environment are driving the use of cutting-edge, environmentally friendly adhesive technology. Furthermore, rising global investments in green building, smart city initiatives, and electric vehicle (EV) production are fueling the need for high-performance waterproof adhesives and sealants. Bio-based, fast-curing, and hybrid polymer adhesives are being developed by manufacturers to satisfy changing industrial and consumer demands.

In North America, the United States led the regional waterproof adhesives & sealants market in 2023 with a valuation of USD 4.53 billion and is projected to reach USD 7.77 billion by 2032, growing at a CAGR of 6.19% from 2024 to 2032. The growth is strongly supported by the infrastructure modernization efforts under programs such as the U.S. Infrastructure Investment and Jobs Act (IIJA), which allocates over USD 1.2 trillion toward rebuilding roads, bridges, and public utilities. Additionally, the growing residential renovation trend and an increased focus on waterproofing solutions in commercial structures are significantly boosting the demand for waterproof adhesives and sealants.

Key Players:

- 3M Company (3M Marine Adhesive Sealant 5200, 3M Scotch-Weld Urethane Adhesive, 3M Fastbond Contact Adhesive)

- Ashland (Pliogrip Structural Adhesives, Aroset Emulsion Adhesive, Isogrip Adhesive)

- Avery Dennison Corporation (S7000 Adhesive, C4500 Waterproof Adhesive, Fasson Waterproof Label Adhesive)

- BASF SE (MasterSeal NP1, MasterSeal 700, MasterEmaco ADH 327)

- Bostik SA (Arkema Group) (Bostik 940 FS, Bostik MSP 107 Sealant, Simson ISR 70-03)

- DAP Products Inc. (Dynaflex 230, Alex Plus Acrylic Latex Sealant, Kwik Seal Ultra)

- Dow Chemical Company (DOWSIL 795 Silicone Sealant, DOWSIL 790, DOWSIL 991)

- H.B. Fuller Company (Swift Lock Adhesive, GorillaPro Sealant, Advantra Adhesive)

- Henkel AG & Co. KGaA (LOCTITE PL S40, TEROSON MS 939, Pritt Waterproof Adhesive)

- Huntsman Corporation (Araldite 2021, Araldite 2050, Renshape Adhesives)

- MAPEI SpA (Mapeflex PU45, Mapesil AC, Ultrabond Eco 995)

- PPG Industries, Inc. (SIGMASHIELD 880, Pitt-Guard Epoxy Sealant, Envirobase Waterproof Adhesive)

- Royal Adhesives & Sealants (H.B. Fuller Subsidiary) (Silaprene Adhesive, Supreme Seal 900, Fastbond Sealant)

- RPM International Inc. (Tremco Dymonic 100, Rust-Oleum LeakSeal, Euclid Flexolith)

- Sika AG (Sikaflex-221, Sikasil WS-305, SikaBond T-55)

- Solvay (Omnix Waterproof Adhesive, Conapoxy Adhesive, Reactsol Sealant)

- Uniseal, Inc. (Auto-Seal 400, Uniseal Bond, FlexSeal 700)

- Wacker Chemie AG (GENIOSIL XB 502, ELASTOSIL N 2199, Silres BS 280)

- Westlake Corporation (Westlake Epoxy Sealant, POLYBOND Adhesive, TUF-BOND)

- Worcester Adhesives & Sealants (WorcoBond 250, AquaSeal Pro, Duraseal 500)

Waterproof Adhesives & Sealants Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 25.66 Billion |

| Market Size by 2032 | USD 44.18 Billion |

| CAGR | CAGR of 6.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Adhesives [UV curing adhesives, Anaerobic adhesives, Epoxy adhesives, Cross linking PVA glue, Polyurethane adhesives, Epoxy glue, Construction glue, Others], Sealants [Silicone, Polyurethane, Bituminous, Others]) • By Base Material (Silicones, Polyurethanes, Acrylics, Epoxy, Polysulfide, Others) • By End-Use Industry (Building & Construction, Transportation, Electrical & Electronics, Packaging , Medical, Consumer, Others) |

| Key Drivers | • Rising Demand for Advanced Waterproofing in High-Rise and Smart Building Construction Drives the Waterproof Adhesives & Sealants Market Growth. |

Market Segmentation

By Type

The waterproof adhesives and sealants market was dominated by adhesives with a share of 60.5% in 2023. In turn, the waterproof adhesives and sealants market was entirely dominated by polyurethane adhesives. Polyurethane adhesives are used widely in the automotive, marine, and construction industries due to the flexibility, moisture resistance, and strong adhesion of the cured polyurethane to many substrates. According to the U.S. Green Building Council, the increasing number of LEED-certified structures is driving the market towards low-VOC polyurethane adhesives for waterproofing applications. Add to this the 2023 report of a 7% increase in residential construction projects from the National Association of Home Builders (NAHB), and you have a recipe for fueled demand.

By Material

Polyurethanes held the largest share, around 30.9%, in 2023. It is due to the Low-VOC polyurethane formulations are also being positioned by the U.S. Environmental Protection Agency (EPA) to be leadership elements for use in green infrastructure projects. The rise in road and bridge maintenance projects gives rise to demand for high-performance polyurethane sealant products for waterproofing expansion joints and concrete structures, the Federal Highway Administration (FHWA) states. Polyurethane sealants are for marine applications where a sealant is needed for boat manufacturing and deck sealing, as they are resistant to saltwater, UV, and harsh weather. Bio-based polyurethane adhesives introduced by frontrunners such as Dow, Henkel & others should reinforce their lead in the waterproof adhesives & sealants market.

By End-Use Industry

Building & Construction held the highest market share, around 40.3%, in 2023. It is due to the rising construction activities worldwide, especially under urban development and smart city projects, has led to increasing demand for high-performance waterproof adhesives and sealants for use in various residential, commercial, and structural projects, thereby boosting the growth of the waterproof adhesives and sealants market. U.S. construction spending exceeded $1.8 trillion in 2023, giving the market a significant boost, according to the National Association of Home Builders (NAHB). Also, focus on sustainability-based programs in rehabilitation of aging infrastructure, as well as the continuous demand for waterproofing solutions, particularly in bridge repair and tunnel sealing, was highlighted by ASCE.

If You Need Any Customization on Waterproof Adhesives & Sealants Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6497

Regional Analysis

The Asia Pacific was the largest market for waterproof adhesives and sealants in 2023, with a market share of 38.5%, driven by an increase in automotive production and infrastructure developments as well as rapid industrialization. And China blew past as it pumped vast sums into construction and smart city projects. As per the China Ministry of Housing and Urban-Rural Development, the high-rise buildings and urban infrastructure that are increasingly being built under government programs such as the 'New Urbanization Plan' also boost demand for waterproof adhesive. Even India contributed well by promoting urban construction using waterproof sealants through the Smart Cities Mission of the Indian Government. Additionally, according to the Japan Automobile Manufacturers Association (JAMA), more use of polyurethane adhesives in EV production has been made in the Japanese automotive industry.

Recent Developments

- In December 2023, Sika AG acquired a Japanese waterproof adhesives manufacturer, bolstering its presence in the Asia-Pacific infrastructure market and expanding its product portfolio for sustainable building solutions.

- In January 2024, Henkel AG & Co. KGaA introduced a new range of eco-friendly, hybrid waterproof sealants under the LOCTITE brand, featuring fast-curing technology and high durability for construction and industrial applications across Europe and North America.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Waterproof Adhesives & Sealants Market Segmentation, By Type

8. Waterproof Adhesives & Sealants Market Segmentation, By Base Material

9. Waterproof Adhesives & Sealants Market Segmentation, by End-Use Industry

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practice

13. Conclusion

Read Our Trending Reports:

Adhesives & Sealants Market Report Size 2024-2032

Aerospace Adhesives & Sealants Market Analysis by 2032

Hybrid Sealants and Adhesives Market Share & Forecast to 2032

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.