Pune, May 06, 2025 (GLOBE NEWSWIRE) -- Telecom API Market Size Analysis:

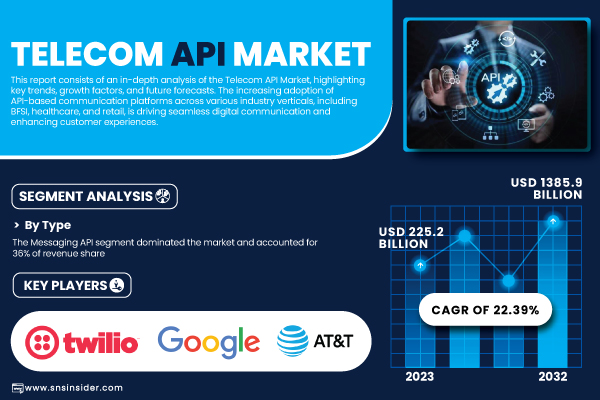

The Telecom API Market size was USD 225.2 Billion in 2023 and is expected to reach USD 1385.9 Billion by 2032, growing at a CAGR of 22.39% over the forecast period of 2024-2032.

Get a Sample Report of Telecom API Market@ https://www.snsinsider.com/sample-request/6249

Major Players Analysis Listed in this Report are:

- Twilio Inc. – Twilio Messaging API

- Google LLC – Google Maps API

- Cisco Systems, Inc. – Cisco Webex API

- AT&T Inc. – AT&T Speech API

- Oracle Corporation – Oracle Communication API

- Nokia Corporation – Nokia Network API

- Telefonica S.A. – Telefonica Open API

- Vonage Holdings Corp. – Vonage Video API

- Verizon Communications Inc. – Verizon Location API

- Huawei Technologies Co., Ltd. – Huawei Network API

- Ericsson AB – Ericsson IoT Accelerator API

- Infosys Limited – Infosys Communication API

- Tata Communications – Tata Smart API

- IBM Corporation – IBM Watson API

- Amazon Web Services (AWS) – AWS API Gateway

Telecom API Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 225.2 Billion |

| Market Size by 2032 | US$ 1385.9 Billion |

| CAGR | CAGR of 22.39 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | The growing adoption of APIs for voice, video, and messaging enhances digital engagement and boosts market growth. |

Telecom API Market Set for Robust Growth as 5G Expansion and Enterprise Demand Drive API Adoption Across Industries

The Telecom API Market is expected to grow at a good rate due to the dominance of API-centric services as an enabler for communication in different business domains. API-based platforms for cohesive communication and journey orchestration BFSI, healthcare, retail, and e-commerce companies are rapidly adopting API-based platforms that enable them to communicate cohesively, securely, and instantaneously with customers and partners. With the proliferation of 5G, the demand for high-speed APIs with minimal latency, especially for voice, video, and messaging, has increased.

The U.S. Telecom API Market was valued at USD 51.2 billion in 2023 and is projected to reach USD 308.0 billion by 2032, expanding at a CAGR of 22.20% between 2024 and 2032. This market growth is mainly attributed to the quick roll-out of 5G networks, increasing adoption of cloud-based solutions, and growing needs for real-time communication APIs. Moreover, the rise of IoT connectivity and proliferating digitalization in BFSI, retail, and healthcare sectors are contributing to the growth of the market. Looking ahead, the market is anticipated to continue to enjoy strong growth momentum, driven by the adoption of APIs monetization strategies of APIs, growing demand for improved security and authentication solutions, more pervasive role of voice, video, and messaging APIs in enterprise apps.

Segment Analysis

By Type, Messaging API Dominates Telecom API Market with 36% Share, While IVR API Segment Set to Witness Fastest Growth Through 2032

Messaging API held the maximum market share of 36% of the revenue share. Its popularity is largely due to the extensive application of SMS notifications, lead capturing, and promotional campaigns in industries such as BFSI, healthcare, and e-commerce. Such factors are continuing to enhance the drive in OTT mobile messaging applications and the need for real-time communication platforms. Furthermore, increasing adoption of smartphones and burgeoning expansion of 5G networks which is expected to help the Messaging API segment continue to proliferate at a fast pace over the forecast period, thus providing tailored, scalable, and secure messaging across the board.

IVR API segment to witness the fastest CAGR during 2024–2032. Enterprises are adopting IVR APIs to offer automated customer service solutions, such as secure payments, appointment scheduling, and voice-based authentication, among others, especially in BFSI, telecom, and retail sectors. The rise in the adoption of AI with IVRs for improved productivity and personalization is a key contributor to the segment's growth in the upcoming years.

By End-User, Enterprise Developers Dominate Telecom API Market Revenue in 2023, While Partner Developers Poised for Fastest Growth

The Enterprise Developer category dominated the market in 2023, in terms of revenue share. The increasing need for personalized communications platforms to improve digital services, application features, and secure payment systems is one of the driving factors. Big businesses from the BFSI, healthcare, and retail sectors are using APIs for digital transformation projects, increasing operational efficiency and the level of service provided to customers.

The Partner Developer segment is estimated to grow with the highest CAGR during the predicted period. The mobile telecom application market is driven by partnerships between telecom service providers and third-party application developers to build novel applications in areas such as IoT, OTT communication, and mobile payments. The emergence of 5G networks is also improving API capabilities, generating lucrative possibilities for partner developers' new product creation and portfolio enrichment.

Do you have any specific queries or need any customization research on Telecom API Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/6249

Telecom API Market Segmentation:

By Type

- Messaging API

- Web RTC API

- Payment API

- IVR API

- Location API

- Others

By End-Use

- Enterprise Developers

- Internal Telecom Developers

- Partner Developers

- Long Tail Developers

North America Dominates Telecom API Market in 2023, While Asia-Pacific Set to Lead Growth with Rapid 5G and Digitalization Boom

North America is still the strong leader in 2023, but the region will contribute only 32% of market revenues for Telecom API. Strong proliferation of advanced communication technology, dominance of telecom giants in the region, and increasing deployment of APIs across BFSI, healthcare, and retail are some of the factors boosting the market growth. Proliferation of 5G networks has also accelerated demand for real-time communication APIs for voice, messaging, and video use cases.

APAC will register the fastest CAGR from 2024 to 2032. Fast digitalisation, 5G network expansion, and increasing smartphone penetration in China, India, and Japan are the main growth drivers. APIs are already playing an important role in enabling digital services in different areas – from OTT platforms to payments, IoT applications, and the list goes on. Moreover, the start-up's adoption and massive investment in the telecom infrastructure complement the market dynamics of the region.

Recent Developments

- September 2024: Ericsson, in collaboration with twelve major telecom operators, including Verizon, Deutsche Telekom, and Reliance Jio, announced the formation of a joint venture to market network software based on network APIs. This initiative aims to elevate services such as credit card fraud detection and gaming experiences, with equal ownership among Ericsson and the participating telecom firms.

- November 2024: Nokia completed the acquisition of Rapid, the world's largest API hub and marketplace, from a U.S.-based company. This strategic move is designed to strengthen Nokia’s 5G and 4G network solutions, integrating Rapid’s technology and R&D prowess to improve network integration and API management services for global clients.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Telecom API Market Segmentation, by Type

8. Telecom API Market Segmentation, by End User

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

Autonomous Data Platform Market

Observability Tools And Platforms Market

Content Moderation Services Market