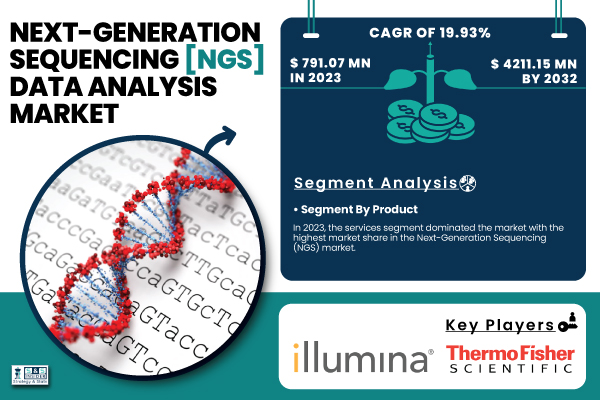

Austin, April 26, 2025 (GLOBE NEWSWIRE) -- The Next-Generation Sequencing (NGS) Data Analysis Market is valued at USD 791.07 million in 2023, and is predicted to reach USD 4,211.15 million by 2032, expanding at a CAGR of 19.93% from 2024 to 2032.

The major drivers behind Next-Generation Sequencing (NGS) Data Analysis Market development are the growing need for personalized healthcare, lowering sequencing costs, and the quick expansion of genomic research programs. Advances in computational biology, big data analytics, and AI-based bioinformatics tools help to further enable faster and more accurate study of vast NGS databases.

Get a Sample Report of Next-generation Sequencing (NGS) Data Analysis Market@ https://www.snsinsider.com/sample-request/5520

The United States NGS Data Analysis Market value was USD 290.15 million in 2023, predicted to climb to USD 1,509.44 million in 2032 with a CAGR of 19.63% over the forecast period. Strong healthcare infrastructure, significant government support for genomics research, and the presence of premier genomic companies and academic institutions drive the U.S. business. Programs such as the NIH’s All of Us Research Program and continuous financing in cancer genomics and rare disease research serve to speed the acceptance of NGS technology and analytical tools all around.

The increasing prevalence of complex genetic diseases, cancer, and infectious diseases, high-throughput sequencing technologies. Popular in clinical diagnostics and translational research, NGS enables comprehensive and fairly priced investigations of genomes, transcriptomes, and epigenomes. The industry benefits also from the growing popularity of cloud-based bioinformatics platforms and automated data interpretation tools, which streamline procedures and reduce analysis time.

Key Next-generation Sequencing (NGS) Data Analysis Companies Profiled in the Report

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Qiagen N.V.

- Agilent Technologies

- F. Hoffmann-La Roche Ltd.

- 10x Genomics, Inc.

- PacBio

- Oxford Nanopore Technologies

- Bio-Rad Laboratories, Inc.

- PerkinElmer, Inc.

- Becton, Dickinson, and Company

- DNAnexus, Inc.

- Partek Incorporated

- Seven Bridges Genomics

- GeneDx

- Strand Life Sciences

- BlueBee

- Genialis

- Deep Genomics

- Illumina-owned Edico Genome

Next-generation Sequencing (NGS) Data Analysis Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 791.07 million |

| Market Size by 2032 | US$ 4211.15 million |

| CAGR | CAGR of 19.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Product

The NGS Data Analysis Market in 2023 was dominated by the services segment. This segment consists of tertiary and secondary data analysis tools supplied by academic institutions, business service providers, and bioinformatics enterprises. The rise in demand for data analysis outsourcing results from clinical labs and smaller biotech companies without internal bioinformatics capacity. Many companies currently depend on outside knowledge to control raw NGS data, therefore ensuring suitable interpretation for clinical or research purposes. Along with the complexity and volume of NGS databases, the need for scalable, cloud-based solutions and customized service models grows. Highly sought-after are companies offering end-to-end solutions, including quality control and alignment, as well as variant calling and annotation. This has also led to alliances between academic labs, CROs, and hospitals, including specialized data analysis organizations, therefore enhancing market dominance in this segment.

By Read Length

The 70% of the market share in 2023 was held by the short-read sequencing segment. Short-read technologies such as those presented by Illumina remain the gold standard due to their remarkable accuracy, low cost, and general acceptance in clinical and academic research. Applications in oncology, pharmacogenomics, and infectious disease diagnostics find these technologies very useful for discovering small genetic variants. The analytical pipelines for short-read data are likewise more established and readily available with various open-source tools for variant finding, genome assembly, and transcriptome analysis. Because of scalability, throughput, and established methods in both diagnostics and research environments, short-read technologies still predominate even if long-read sequencing is becoming more and more interesting.

By End-Use

A 52% of the NGS data analysis market share was held by the academic research segment in 2023. Leading participants in genomic research, colleges, and labs investigate disease paths, population genetics, and therapeutic targets. These facilities demand for robust tools and services for analysis and generate massive volumes of sequencing data. Government subsidies and financial initiatives greatly help the academic support of NGS research. For example, the National Human Genome Research Institute (NHGRI) keeps funding large-scale studies meant to raise demand for data analytics. Interactions between university labs and commercial businesses, which ensure translocation of research into clinical practice and encourage inventiveness, underline even more the primacy of this sector.

For A Detailed Briefing Session with Our Team of Analysts, Connect with Us Now@ https://www.snsinsider.com/request-analyst/5520

NGS Data Analysis Market Segmentation

By Product

- Services

- NGS Commercial Software

- Platform OS/UI

- Analytical software

- QC/Pre-processing tools

- Alignment tools & software

- DNA sequencing Alignment

- RNA sequencing Alignment

- Protein sequencing Alignment

- others

By Workflow

- Primary Data Analysis

- Secondary Data Analysis

- Read mapping

- Variant alignment & variant calling

- Tertiary Data Analysis

- Variant annotation

- Application-specific data analysis

- Targeted sequencing/ gene panel

- Exome

- RNA sequencing

- Whole genome sequencing

- Chip sequencing

- Others

By Mode

- In-house Data Analysis

- Outsourced Data Analysis

By Read Length

- Short Read Sequencing

- Long Read Sequencing

- Very Long Read Sequencing

By End-use

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other Users

Regional analysis

With 48% revenue share, the North America region dominated the NGS data analysis market in 2023. Strong financing from institutions like NIH and NSF, presence of genetic giants like Illumina, Thermo Fisher Scientific, and Agilent Technologies, and strong funding from agencies such as NIH and NSF. Supported by prestigious universities and a well-developed regulatory framework for genomic diagnostics, advanced bioinformatics research is focused particularly in the United States.

Asia-Pacific is expected to grow at the fastest CAGR over the forecast period, driven by increasing investments in genomic infrastructure, a vast population base, and an increasing burden of genetic diseases. Funding national genome sequencing projects and building internal bioinformatics expertise are nations such as China, India, and Japan. Government initiatives as GenomeAsia 100K and India's Genomics for Public Health Initiative, raise regional demand for NGS data interpretation. China's great biotechnology drive and the rise of companies like BGI Genomics are turning APAC into a major player in the sector. Rising R&D funding and fast digitization in the healthcare industry define the main direction of development.

Recent developments

- Illumina launched Dragena 4.0, a high-speed, cloud-compatible secondary analysis tool, in January 2024, to expedite whole-genome sequencing activities.

- Integrating AI-based interpretation tools, Qiagen in December 2023 joined with UK-based Genomics England to increase NGS data processing for cancer research.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Data Analysis Tool Adoption, by Type (2023)

5.2 Technology Integration Trends (2023)

5.3 R&D Investments, by Region (2023)

5.4 User Demographics, By User Type and Roles, 2023

5.5 Integration Capabilities

6. Competitive Landscape

7. Next-generation Sequencing (NGS) Data Analysis Market by Product

8. Next-generation Sequencing (NGS) Data Analysis Market by Workflow

9. Next-generation Sequencing (NGS) Data Analysis Market by Mode

10. Next-generation Sequencing (NGS) Data Analysis Market Read Length

11. Next-generation Sequencing (NGS) Data Analysis Market End-use

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Related Reports:

Next Generation Sequencing Market

NGS based RNA Sequencing Market Report

Single-Cell Sequencing Market Size

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.