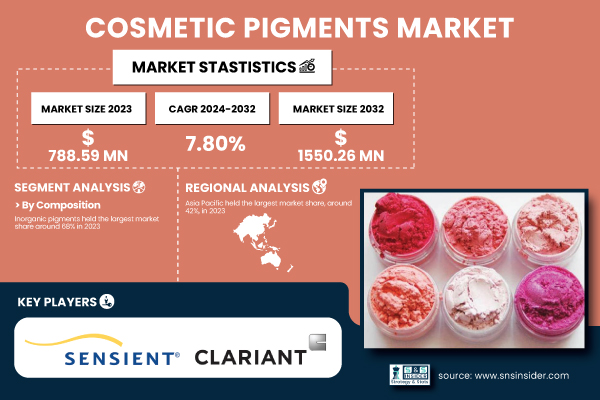

Austin, April 25, 2025 (GLOBE NEWSWIRE) -- The Cosmetic Pigments Market Size was valued at USD 788.59 Million in 2023 and is expected to reach USD 1550.26 Million by 2032, growing at a CAGR of 7.80% over the forecast period of 2024-2032.

Download PDF Sample of Cosmetic Pigments Market @ https://www.snsinsider.com/sample-request/6750

The Sustainable Cosmetic Pigments Market: Growth is driven by consumer demand and innovation

Increasing inclination of consumers towards beauty and personal care products & innovations in colorants have contributed significantly to the growth of cosmetic pigments market. In the makeup sector, organic and inorganic pigments are becoming more popular in applications such as facial, lip, and eye makeup because of their bright and durable effects. An increasing need for non-toxic, skin-friendly, and environmentally-friendly products backs this trend. Online sales, social media, and influencer fads are all making the global market bigger, faster. Brands such as L'Oréal and Estée Lauder are responding to this trend by developing lines of sustainably sourced batter, mineral based pigments owing to a burgeoning interest in wellness and natural beauty. Despite this fact, both the American Chemical Society (ACS) and FDA are in support of these pigments, encouraging their use in cosmetics.

The US Cosmetic Pigments Market Size was valued at USD 131.85 Million in 2023 and is projected to reach USD 272.78 Million by 2032, growing at a CAGR of 8.41% from 2024 to 2032.

Rising demand for bright as well as long-lasting colors in beauty products is propelling the US Cosmetic Pigments market growth. Increasing customer demand for clean natural beauty products, as well as innovations in sustainable pigments, are crucial to market expansion. As cosmetic cultures shift towards cleaner, higher quality formulations, companies such as L'Oréal and Revlon still invest in new emerging pigment technologies.

Key Players:

- Sensient Cosmetic Technologies (Unipure Red LC 381, Covapearl White ST 925)

- Merck Group (Ronastar Golden Jewel, Colorona SynBerry Pink)

- Clariant (Vibracolor Ruby Red, Hostaperm Pink E)

- Sun Chemical (SunPURO Orange 5, SunCROMA Yellow Iron Oxide)

- Eckart GmbH (Syncrystal Soft Ivory, Prestige Silver)

- Kobo Products Inc. (KOBOPEARL Perpetual Tan, Iron Oxide Red 229C)

- DayGlo Color Corp. (Zinc Sulfide Orange, Elara Glow Pigment)

- BASF (Cosmenyl Red B, Reflecks MultiDimensions Glistening Gold)

- LANXESS (Bayferrox 130 C, Colortherm Yellow 20)

- Geotech International B.V. (Bi-Lite Silver 250, Gemtone Ruby Red)

- Neelikon (Neeligran Red 6, Neeligran Yellow 5)

- Toyal America Inc. (Aluminum Silver PG-903, Pearl Black S-901)

- Nihon Koken Kogyo Co., Ltd. (Cokemica Red Iron Oxide, Cokemica Mica Pearl)

- Miyoshi America, Inc. (MiyoNAT Yellow Iron Oxide, MiyoNAT Mica Titanium)

- Venator Materials PLC (Durasheen 102, UV-Titan M160)

- Kolortek Co., Ltd. (Holographic Pigment KTP, Thermochromic Pigment KT-WA)

- Oxen Special Chemicals Co., Ltd. (Oxen Pearl Gold, Oxen Silver Crystal)

- Sudarshan Chemical Industries (Sumicos White S210, Sumicos Copper S410)

- Harman Finochem Ltd. (HFPink CP01, HFYellow CY02)

- Yipin Pigments (Yipin Yellow Iron Oxide 920, Yipin Red 110)

Cosmetic Pigments Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 788.59 Million |

| Market Size by 2032 | USD 1550.26 Million |

| CAGR | CAGR of 7.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Composition (Organic Pigments, Inorganic Pigments) • By Type (Special Effect Pigments, Surface Treated Pigments, Nano Pigments, Natural Colorants), • By Application (Facial Makeup, Lip Products, Hair Color Products, Eye Makeup, Others) |

| Key Drivers | • Rising consumer demand for organic and eco-friendly cosmetic pigments accelerates the cosmetic pigments market growth. |

Shifting Consumer Preferences Toward Clean and Sustainable Beauty

- The rising preference among consumers for non-toxic, cruelty-free, and sustainable cosmetic products for cosmetics and personal care is further fueling the growth of premium-grade cosmetic pigments.

- Platforms like Instagram & TikTok drive purchase behavior and the brands that make the wish list of clean beauty trends.

- Awareness among people regarding skin safety and environmental effects of chemical compounds present in cosmetics has increased and thus demand for natural and safe pigments is growing.

By Composition, Inorganic Pigments Dominated the Cosmetic Pigments Market in 2023 with a 68% Market Share

Such pigments are used in foundations, eye makeup, and facial makeup and are characterized by higher color strength, stability, and safety. Inorganic pigments (e.g. titanium dioxide and iron oxides) are highly regarded for their lack of toxicity, allowing for safe contact with skin. This is indeed great news for the growing clean beauty and sustainable cosmetics trends as one of the advantages of these well-known pigments is their long-lasting colors, without the need for unfriendly chemicals. The increasing use of these ingredients in mineral-based makeup collections from the leading brands such as L'Oréal has been instrumental in the growing share of this segment.

By Type, Surface Treated Pigments Dominated the Cosmetic Pigments Market in 2023 with a 36% Market Share

These pigments are chemically treated to make them more dispersed, stable, and performing, and are used in many premium cosmetic formulas. They offer better color pay off and are perfect for high impact durable products like eye shadows and lipsticks. The increasing trend of advanced formulation cosmetics, with products that require better color delivery and skin safety, has driven the demand for surface-coated pigments. Surface-treated pigments are gaining a major share in the surface-treated pigments market due to the rising investment in this segment by various leading companies in the cosmetic sector to introduce products that are compatible with skin and exhibits greater color stability.

By Application, Facial Makeup Segment Dominated the Cosmetic Pigments Market in 2023 with a 25% Market Share

The increasing demand for natural and flawless base products such as foundation, concealers, blushes, and powders, drives the consumption of pigments in this segment. The increase in clean beauty trends is leading to higher demand for organic and inorganic pigments for use in facial makeup owing to trends toward nontoxic, mineral-based ingredients. This is a very prominent trend for the years to come, and so innovations in formulas providing long-hour lasting coverage and hydration and skincare benefits with makeup have surely driven the sales of facial make-up category. Such demand is all the more backed by prominent players in the market who are continuously coming with new & improved compositions that can aid to the needs of the consumers.

If You Need Any Customization on Cosmetic Pigments Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6750

Asia Pacific Dominated the Cosmetic Pigments Market in 2023, Holding a 42% Market Share.

The increasing consumer base in countries like China, India, Japan, etc., is leading to a rise in demand for premium quality cosmetic items. Increasing urbanization, rising disposable incomes, and an expanding middle class have contributed to increased penetration of cosmetic products, including organic and inorganic pigments. The growth of the cosmetic market in this region is driven by companies such as Shiseido and Amorepacific that are investing in the development of new products.

North America Emerged as the Fastest Growing Region in Cosmetic Pigments Market with A Significant Growth Rate in The Forecast Period

North America emerged as the fastest-growing region in cosmetic pigments market in 2023 owing to the rising willingness of the consumer base to spend more on premium beauty products. We are witnessing an increase in the demand for performance-driven, chemically free, and sustainable cosmetics, specifically in North America where consumers lean towards high-performance cosmetic products that follow the health and natural beauty trend. The speaker cites the launch of new product lines with sustainable pigments by companies including Estée Lauder and Revlon as a driver for the fast growth of the area. Development for the region will proceed along this path, fueled by technological advancements with pigments and the clean beauty movement.

Recent Developments

- March 2025: At in-cosmetics Global 2025, DIC Corporation subsidiary, Sun Chemical, launched two new cosmetic effect pigments. These pigments (patent-pending) improve the aesthetic of cosmetics. The launch highlights DIC's pledge to innovation in the global cosmetic pigments marketplace.

- March 2025: Debut Biotechnology announced the biomanufacturing of an animal-free carmine red pigment. Using the proprietary enzyme-based process, the company reached a 95% purity level, compared to the 10% of carmine. The innovation provides the cosmetic industry a sustainable and ethical option.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Cosmetic Pigments Market Segmentation, By Composition

8. Cosmetic Pigments Market Segmentation, By Type

9. Cosmetic Pigments Market Segmentation, By Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practice

13. Conclusion

Read Our Trending Reports:

Color Cosmetics Market Growth & Forecast to 2032

Cosmetic Preservative Market Size Report 2024-2032

Dyes and Pigments Market Analysis by 2032

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.