Austin, April 25, 2025 (GLOBE NEWSWIRE) -- Raman Spectroscopy Market Size & Growth Insights:

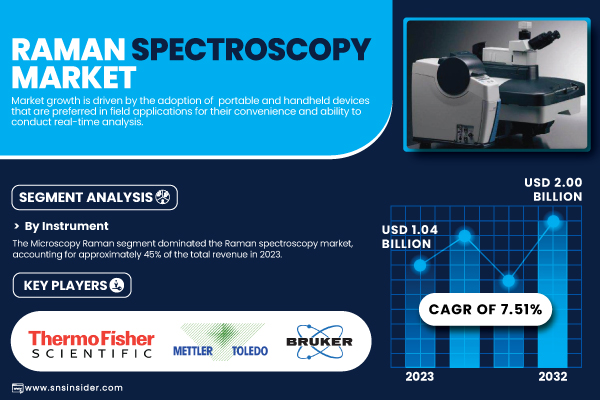

According to the SNS Insider Report, “The Raman Spectroscopy Market was valued at USD 1.04 billion in 2023 and is projected to reach USD 2.00 billion by 2032, growing at a CAGR of 7.51% from 2024 to 2032.”

Raman Spectroscopy Market Dynamics Highlight Growth Driven by Portability and Advancements in Field Applications

The Raman Spectroscopy Market is experiencing strong growth due to the widespread adoption of portable and handheld devices, which are preferred for their convenience and ability to perform real-time analysis in field applications. This surge is further supported by increasing demand for non-destructive testing methods across industries such as pharmaceuticals, food, and chemicals, where regulatory and quality control requirements are stringent. In the U.S., the market reached a valuation of USD 0.72 billion in 2023 and is projected to grow to USD 1.27 billion by 2032, registering a CAGR of 6.48%. Vendors are actively investing in Raman spectroscopy technologies and offering application-specific customizations for sectors such as material science, biotechnology, and healthcare.

Get a Sample Report of Raman Spectroscopy Market @ https://www.snsinsider.com/sample-request/6349

Leading Market Players with their Product Listed in this Report are:

- Thermo Fisher Scientific Inc. (USA) – Offers DXR3 Raman Microscope, DXR3xi Imaging Microscope, and TruScan™ RM Handheld Raman Analyzer.

- Mettler Toledo (Switzerland) – Provides ReactRaman in-situ Raman analyzers for real-time process monitoring.

- Agilent Technologies Inc. (USA) – Manufactures Agilent RapID Raman System and Resolve Handheld Raman Spectrometer.

- Bruker (Germany) – Produces SENTERRA II Raman Microscope and BRAVO Handheld Raman Spectrometer.

- Renishaw Plc (UK) – Offers inVia™ Raman Microscope and Virsa™ Raman Analyzer.

- Rigaku Corporation (Japan) – Develops Xantus-2 and Progeny Handheld Raman Spectrometers.

- Oxford Instruments (UK) – Provides WITec Alpha300 Raman Imaging System.

- Endress+Hauser Group Services AG (Switzerland) – Specializes in Raman Rxn analyzers for process control.

- HORIBA Ltd. (Japan) – Manufactures XploRA PLUS, LabRAM HR Evolution, and MacroRAM Raman Spectrometers.

- PerkinElmer Inc. (USA) – Offers Spectrum Two and RamanStation 400 Spectrometers.

- Hamamatsu Photonics K.K. (Japan) – Produces miniature Raman spectrometers and Raman-compatible detectors.

- Metrohm AG (Switzerland) – Provides Mira P and Mira DS Handheld Raman Spectrometers.

- Anton Paar GmbH (Austria) – Develops Cora Raman Spectrometers for laboratory and industrial applications.

Raman Spectroscopy Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 1.04 Billion |

| Market Size by 2032 | USD 2.00 Billion |

| CAGR | CAGR of 7.51% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Instrument (Microscopy Raman, FT Raman, Handheld & Portable Raman, Others) • By Sampling Technique (Surface-enhanced Raman Scattering, Tip-enhanced Raman Scattering) • By Application (Life Sciences, Pharmaceuticals, Material Science, Carbon Materials , Semiconductors) |

| Key Drivers | • Revolutionizing Field Applications with the Rise of Portable Raman Spectroscopy Devices. • Enhancing Raman Spectroscopy with AI and Machine Learning for Advanced Data Analysis. |

However, technical challenges such as fluorescence interference persist, particularly in samples with intrinsic fluorescence like biological tissues, organic compounds, and certain chemicals. This interference can obscure Raman peaks, making it difficult to distinguish the Raman signal from background fluorescence, which complicates analysis in applications like drug testing and material studies. While methods such as spectral filtering and time-resolved techniques are being developed to mitigate these issues, fluorescence remains a limiting factor for certain sample types.

Key Industry Segmentation Analysis

By Instrument

In 2023, the Microscopy Raman segment led the Raman spectroscopy market with around 45% of total revenue, driven by its extensive use in life sciences, pharmaceuticals, materials science, and nanotechnology for high-resolution, non-destructive chemical imaging. Combining optical microscopy with Raman spectroscopy, it enables precise molecular analysis, especially in biological cells and nanomaterials.

The FT-Raman segment is the fastest-growing from 2024 to 2032, owing to its ability to reduce fluorescence interference using near-infrared excitation. Its rising application in drug development, polymer analysis, and environmental monitoring, along with AI advancements, is boosting its adoption across various industries.

By Sampling Technique

The Tip-Enhanced Raman Scattering (TERS) segment dominated the Raman spectroscopy market in 2023, accounting for approximately 59% of revenue due to its exceptional spatial resolution at the nanoscale, ideal for applications in nanomaterial characterization, single-molecule detection, and surface analysis. Its growing use in semiconductors, life sciences, and pharmaceuticals is supported by advances in plasmonic tip design, laser excitation, and machine learning-based spectral analysis.

The Surface-Enhanced Raman Scattering (SERS) segment is the fastest-growing through 2032, driven by its ultra-sensitive detection capabilities using nanostructured metallic surfaces. Its expanding use in diagnostics, environmental monitoring, and food safety is boosting adoption, particularly in portable Raman devices.

By Application

The pharmaceuticals segment is expected to lead the Raman spectroscopy market in revenue from 2024 to 2032, driven by its vital role in drug development, quality control, and counterfeit detection through non-destructive molecular analysis. Raman spectroscopy ensures precise identification of APIs, contaminants, and polymorphic forms, aligning with regulatory standards. The growing use of process analytical technology (PAT), personalized medicine, and biopharmaceuticals further supports this trend.

The life sciences segment is the fastest-growing over the foreecatts period 2024-2032, fueled by increasing applications in biomedical research, cancer detection, and cellular analysis. AI integration, portable Raman systems, and real-time diagnostics are expanding its role in advanced healthcare solutions.

For A Detailed Briefing Sessions with Our Team of Analyst, Connect Now @ https://www.snsinsider.com/request-analyst/6349

Raman Spectroscopy Market Growth in Asia-Pacific and Rapid Expansion in North America

In 2023, the Asia-Pacific region dominated the Raman spectroscopy market, accounting for approximately 40% of total revenue, driven by the rapid growth of its pharmaceutical, biotechnology, and semiconductor industries. Key countries such as China, Japan, and India are heavily investing in drug development, nanotechnology, and environmental monitoring, fueling demand for Raman spectroscopy in quality control, material characterization, and research. Additionally, the rise of AI-integrated Raman systems, portable spectroscopy devices, and advancements in SERS technology are accelerating adoption across various sectors. Growing focus on food safety, forensic science, and biomedical diagnostics further contributes to market expansion. Government initiatives supporting scientific research, smart manufacturing, and healthcare innovation are reinforcing the region's leadership in Raman spectroscopy.

North America is the fastest-growing market for Raman spectroscopy from 2024 to 2032, driven by advancements in pharmaceuticals, biotechnology, and semiconductors. The region's emphasis on drug discovery, personalized medicine, and miniaturized portable devices is boosting market growth, supported by AI, government funding, and regulatory frameworks.

Recent Development:

- 13 Nov, 2024, Thermo Fisher Scientific recently launched the Thermo Scientific™ Nicolet™ iS50 FTIR Spectrometer, featuring improved sensitivity and higher throughput for diverse applications. The company continues to enhance its Raman spectroscopy solutions with AI-driven data analysis for better chemical imaging and material characterization.

- Jan 29 2025, Bruker recently launched the LUMOS™ II ILIM, an infrared imaging microscope utilizing quantum cascade laser (QCL) technology, offering enhanced spatial resolution for pharma and life science research. The system's patented coherence reduction method ensures artifact-free imaging, enabling rapid chemical analysis of biological tissues with large field views and full automation.

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Adoption of Portable and Handheld Devices:

5.2 Regulatory and Quality Control

5.3 Cost Reductions and Affordability

5.4 Customization and Versatility

6. Competitive Landscape

7. Raman Spectroscopy Market, by Instrument

8. Raman Spectroscopy Market, by Sampling Technique

9. Raman Spectroscopy Market, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

IR Spectroscopy Industry Analysis Report

Atomic Force Microscopy Industry Analysis Report

Acoustic Microscopy Industry Analysis Report

Industrial Microscope Industry Analysis Report

Semiconductor Inspection Microscope Industry Analysis Report