Pune, April 24, 2025 (GLOBE NEWSWIRE) -- Managed Domain Name System Market Size Analysis:

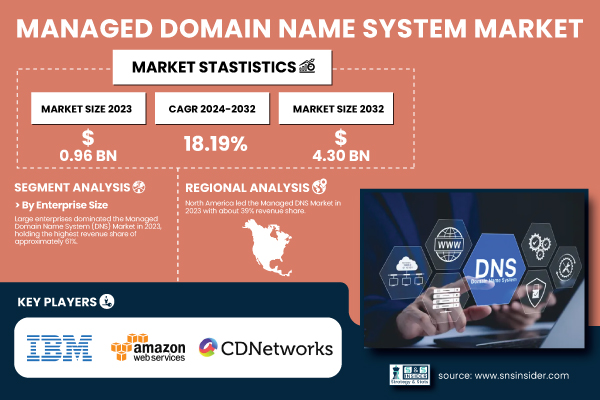

“The latest report from SNS Insider reveals that the Managed Domain Name System (DNS) Market was valued at USD 0.96 billion in 2023 and is projected to soar to USD 4.30 billion by 2032, registering an impressive CAGR of 18.19% from 2024 to 2032.”

Get a Sample Report of Managed Domain Name System Market@ https://www.snsinsider.com/sample-request/6400

Major Players Analysis Listed in this Report are:

- IBM [IBM NS1 Connect, IBM Cloud Internet Services]

- Amazon Web Services, Inc. (Amazon.com, Inc.) [Amazon Route 53, AWS Global Accelerator]

- CDNetworks Inc. [CDNetworks DNS, CDNetworks Cloud Security]

- Cloudflare, Inc. [Cloudflare DNS, Cloudflare Load Balancing]

- Corporation Service Company (CSC) [CSC Domain Management, CSC Security & Risk Management]

- DigiCert, Inc. (Clearlake Capital Group, L.P.) [DigiCert DNS Security, DigiCert Secure Site]

- Google LLC (Alphabet Inc.) [Google Cloud DNS, Google Public DNS]

- Infoblox [Infoblox Advanced DNS Protection, Infoblox Cloud Services Platform]

- Microsoft Corporation [Azure DNS, Microsoft Defender for DNS]

- Oracle Corporation [Oracle Cloud DNS, Oracle Traffic Management Steering]

- VeriSign, Inc. [Verisign Managed DNS, Verisign Recursive DNS]

- Vitalwerks Internet Anycast Networks, LLC [No-IP Plus Managed DNS, No-IP Enhanced Dynamic DNS]

- GoDaddy Inc. [GoDaddy Premium DNS, GoDaddy Domain Backorders]

- Neustar, Inc. (TransUnion LLC) [UltraDNS Managed Services, UltraDNS Traffic Controller]

- Akamai Technologies, Inc. [Akamai Edge DNS, Akamai Global Traffic Management]

Managed Domain Name System Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 0.96 Billion |

| Market Size by 2032 | US$ 4.30 Billion |

| CAGR | CAGR of 18.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Growing Cyber Threats Drive Demand for Secure and Resilient Managed DNS Solutions to Prevent DDoS Attacks, Spoofing, and Service Disruptions. |

The U.S. Managed Domain Name System (DNS) Market was valued at USD 0.3 billion in 2023 and is projected to reach USD 1.2 billion by 2032, growing at a CAGR of 17.92% from 2024 to 2032. Growth is driven by rapid cloud adoption, increasing DDoS attacks, and the rising deployment of multi-cloud and edge computing environments. The market will continue expanding as enterprises prioritize secure, scalable, and high-availability DNS services to support critical online infrastructure and compliance mandates.

By Service: DDoS Protection Segment Leads, While GeoDNS Registers Fastest Growth

The Distributed Denial of Service Protection segment dominated the market and accounted for 36% of the market share in 2023, owing to the alarming rise in volumetric and application-layer cyberattacks targeting enterprise infrastructure. Organizations across BFSI, IT, and government sectors are increasingly adopting managed DDoS protection services integrated with DNS to safeguard against service disruptions and maintain business continuity. The demand is expected to persist through 2032 as cyber threats evolve in sophistication, requiring multi-layered protection frameworks with intelligent traffic filtering.

The GeoDNS segment is projected to record the fastest CAGR from 2024 to 2032. The growing need for optimized content delivery, latency reduction, and localized user experiences is driving enterprises to adopt GeoDNS services that route user requests based on geographic location. This capability enhances website responsiveness, minimizes downtime risks, and supports global CDN strategies, making GeoDNS indispensable for multi-regional businesses, e-commerce platforms, and streaming services.

By Deployment: Cloud Segment Dominates and Records Fastest Growth

The Cloud segment dominated the Managed DNS market in 2023 and accounted for 36% of revenue share, and is expected to maintain its lead while also registering the fastest CAGR over the forecast period. Cloud-based DNS services offer unmatched scalability, flexibility, and cost-effectiveness compared to on-premises solutions. The rapid shift toward digital transformation, remote work environments, and SaaS integrations has driven enterprises to prefer cloud-native DNS platforms for improved performance, auto-scaling capabilities, and centralized management. This trend is anticipated to continue as businesses increasingly migrate workloads to public, private, and multi-cloud ecosystems, necessitating resilient and cloud-integrated DNS solutions.

By Enterprise Size: Large Enterprises Dominate, SMEs Post Fastest Growth

Large Enterprises segment dominated the market and accounted for 61% of revenue share in 2023, driven by their expansive global digital footprints, multiple data centers, and mission-critical cloud applications requiring high-availability DNS infrastructure. These organizations are leveraging managed DNS to strengthen cybersecurity defenses, mitigate DDoS attacks, and ensure seamless customer experience across multiple platforms and regions.

Small and Medium-sized Enterprises are expected to witness the fastest CAGR during the forecast period. As SMEs increasingly embrace cloud services, e-commerce, and remote work solutions, the need for managed DNS services for performance optimization and cybersecurity is growing.

By End-use: IT & Telecom Dominates, Retail & E-commerce Grows Fastest

The IT & Telecom segment emerged as the largest revenue contributor in 2023, attributed to the sector’s reliance on robust, high-speed, and secure internet infrastructure. Managed DNS solutions enable IT and telecom companies to ensure uninterrupted network operations, traffic routing, and cybersecurity management, supporting their critical services and customer-facing platforms.

The Retail & E-commerce segment is projected to register the fastest CAGR from 2024 to 2032. With online shopping, global e-commerce platforms, and mobile commerce experiencing exponential growth, the demand for high-availability DNS services that enhance website uptime, transaction speed, and security is surging. Managed DNS platforms offering geo-routing and DDoS protection are becoming integral to ensuring seamless, secure customer experiences and business continuity for online retailers.

Do you have any specific queries or need any customization research on Managed Domain Name System Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/6400

Managed Domain Name System Market Segmentation:

By Service

- Anycast Network

- Distributed Denial of Service (DDoS) Protection

- GeoDNS

- Others

By Deployment

- On-premises

- Cloud

By Enterprise Size

- Large Enterprises

- SMEs

By End-use

- BFSI

- IT & Telecom

- Media & Entertainment

- Retail & E-commerce

- Healthcare

- Government

- Others

Regional Insights: North America Dominates, Asia-Pacific Leads in Growth

North America dominated the global Managed DNS market in 2023 and accounted for 39% of revenue share, driven by the high concentration of tech giants, cloud service providers, and financial institutions. The region’s advanced IT infrastructure, frequent cybersecurity threats, and widespread adoption of multi-cloud strategies have made managed DNS services a fundamental part of enterprise digital strategy.

Asia-Pacific is expected to register the fastest CAGR between 2024 and 2032. Rapid digital transformation, growing internet penetration, and expanding cloud adoption in countries like China, India, and Southeast Asian nations are fueling demand for managed DNS services.

Recent Developments in 2024

- In February 2024, Cloudflare launched an enhanced managed DNS solution integrated with advanced threat intelligence and zero-trust networking features, aiming to bolster DNS security for enterprise clients globally.

- In March 2024, Akamai Technologies expanded its managed DNS platform with AI-powered anomaly detection capabilities to improve DDoS mitigation efficiency

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Managed Domain Name System Market Segmentation, By Service

8. Managed Domain Name System Market Segmentation, By Deployment

9. Managed Domain Name System Market Segmentation, By End-use

10. Managed Domain Name System Market Segmentation, By Enterprise Size

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

Attack Surface Management Market Size by 2032

Mobile Virtual Network Operator Market Share by 2032

Database Management System Market Analysis by 2032

Enterprise Search Market Forecast by 2032

Harbor Management Software Market Growth by 2032