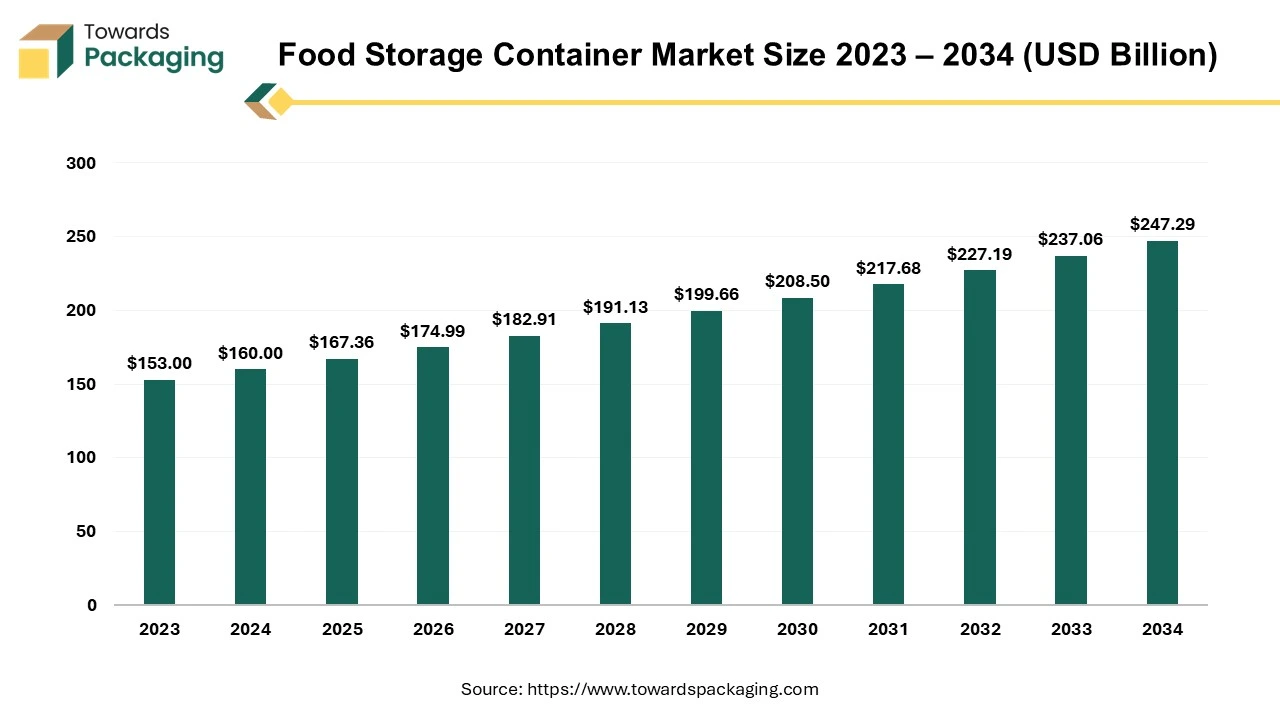

Ottawa, April 23, 2025 (GLOBE NEWSWIRE) -- The food storage container market size to record USD 167.36 billion in 2025 and is projected to grow beyond USD 247.29 billion by 2034, a study published by Towards Packaging a sister firm of Precedence Research. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and collaboration to develop new technology for manufacturing food storage container, which has estimated to drive the growth of the food storage container market in the near future.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardspackaging.com/download-brochure/5492

Market Overview:

Food can be kept in a freezer, refrigerator, or room temperature using a food storage container. Additionally, plastic containers come in a wide variety of shapes, sizes, and designs. From lightweight, throwaway containers to sturdy, stiff plastic containers, they come in a range of durability levels. Most of them have airtight lids and are made of colourful, frosted, and transparent plastic. Their airtight covers keep moisture from escaping, making them ideal for preserving food in the freezer and refrigerator. When kept at room temperature, the airtight lids prevent goods like cookies, crackers, chips, and cereals from going bad for an extended amount of time. All kinds of storage benefit greatly from the use of plastic containers.

The following are the main kitchen tasks that food storage containers can facilitate: for planning out meals, measuring the correct quantity of ingredient & spices, keeping leftovers fresh and well-organized in the refrigerator so people can quickly locate them when they need them is made possible by food storage and for food transportation.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Major Key Trends in Food Storage Container Market:

- Eco-friendly & Sustainable Materials

The key players operating in the market are shifting towards environmentally responsible packaging. Manufacturers are increasingly incorporating pots-consumer recycled (PCR) plastics, biodegradable materials, and plant-based alternatives into their products. For instance, Novolex revealed the launch of recyclable containers with at least 10% PCR content, aligning with global sustainability goals.

- Increase of Glass and Non-Toxic Alternatives

Health-conscious consumers are gravitating towards glass containers due to their non-toxic, BPA-free nature and recyclability. Glass options are perceived as safer for food storage, especially for reheating purposes, and are gaining popularity over traditional plastic containers.

- Tech-Enabled and Smart Containers

Innovations is smart packaging are emerging, with containers equipped with sensors to monitor freshness, expiration dates, and spoilage. For instance, OXO provides vacuum-sealed containers with smart features that assists to keep food fresh longer by minimizing oxygen exposure.

- Customization and Personalization

Consumers are seeking containers tailored to their specific demands, leading to a rise in customizable options. Manufacturers are providing containers in various colors, sizes, and functionalities, catering to individual preferences and lifestyles.

- Portability and Convenience

With busier lifestyles, there’s an increased demand for portable, leak-proof, and microwave-safe containers. Features like stackability and space-saving designs are becoming essential, especially for urban consumers and the expanding food delivery sector.

- Digital Integration and Transparency

Packaging is evolving to include digital elements like QR codes, offering consumers with detailed information about ingredients, nutrition, sourcing, and sustainability practices. This enhances transparency and allows brands to communicate their eco-friendly efforts effectively.

Limitations & Challenges in Food Storage Container Market:

- Environmental Concerns Around Plastic Use

Despite the shift to sustainable materials, a significant portion of containers is still made from traditional plastic, which faces increasing regulatory scrutiny and consumer backlash. Bans on single-use plastics and stricter government regulations in various countries are reducing demand for conventional plastic containers.

- High Cost of Sustainable Alternatives

Biodegradable, recyclable, or plant-based materials are often more expensive to produce than conventional plastics. This cost barrier makes it difficult for smaller manufacturers and price-sensitive markets to adopt sustainable packaging at scale.

- Durability and Performance Limitations

Eco-friendly and biodegradable materials sometimes lack the durability and performance (e.g., heat resistance, leak-proof design) that consumers expect, limiting their widespread use.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Emphasis on Eco-Friendly and Sustainable Food Containers Has Driven the Market Growth

Growing environmental awareness among consumers is steering the market towards sustainable packaging options. Materials such as biodegradable plastics, glass, silicone, and stainless steel are gaining popularity, especially in regions like Japan and Indi, where there’s strong shift towards eco-friendly packaging solutions.

- For instance, in March 2025, Researchers at the Indian Institute of Technology (IT) Roorkee have unveiled a novel, environmentally friendly packaging solution that would increase the shelf life of fruits and vegetables by one week, marking a significant advancement for the food packaging sector.

- The breakthrough, led by Professor Kirtiraj K. Gaikwad and PhD student Mr. Pradeep Kumar from the Department of Paper Technology, entails the creation of a novel ethylene scavenger employing optimal ratios of naturally existing modified clay minerals.

Regional Analysis:

North America’s Large Consumer Base to Dominate the Market in 2024

North America region held the largest share of the food storage container market in 2024, driven by the large consumer base for packed food. North American consumers have higher purchasing power, enabling them to spend on premium and innovative storage solutions. There’s and increasing need for high-quality, convenient, and stylish containers, particularly among urban dwellers and young professionals. North American consumers have higher purchasing power, enabling them to spend on premium and innovative storage solutions. There’s an increasing demand for high-quality, convenient, and stylish containers, particularly among urban dwellers and young professionals. The rise of e-commerce platforms like Instacart, Amazon Fresh, and Uber Eats has increased the demand for durable and protective packaging in North America region.

- The U.S. and Canadian governments, along with NGOs, are actively promoting sustainability and recycling. Consumers are aligning with this trend by choosing reusable, recyclable, and biodegradable containers, which supports the eco-friendly product segment. North America is a hub for innovation in packaging materials and smart storage technologies.

Asia’s Online Food Ordering Trend Supports the Growth

Asia Pacific region is seen to grow at the fastest rate in the food storage container market during the forecast period. Urbanization in countries like China, India, and Southeast Asia is leading to more nuclear families and smaller living spaces. This drives demand for stackable, compact, and space-efficient food storage containers. With rising disposable income, especially in China and India, consumers are spending more on lifestyle and kitchen organization products. There’s growing interest in branded, premium, and health-conscious storage solutions. Platforms like Amazon, Shoppee, Swiggy, Bigbasket, JD.com and Zomato, make food storage products widely accessible, even in smaller towns.

- Countries like China and India are imposing bans or restrictions on single-use plastics. This is encouraging the development and adoption of compostable, biodegradable, and reusable food containers. The COVID-19 pandemic heightened awareness around food safety, hygiene, and contamination. Asia Pacific, especially China and India, is a manufacturing powerhouse, offering low-cost production and innovation in materials and design.

More Insights in Towards Packaging:

- E-Commerce Packaging Market Investment Opportunities & Competitive Benchmarking: https://www.towardspackaging.com/insights/e-commerce-packaging-market

- Microwave Packaging Market Scenario Planning & Strategic Insights for 2034: https://www.towardspackaging.com/insights/microwave-packaging-market-sizing

- Material-Neutral Packaging Market Growth Drivers, Challenges and Opportunities: https://www.towardspackaging.com/insights/material-neutral-packaging-market-sizing

- Pharmaceutical Packaging Market Benchmarking, Consumer Insights & Growth Strategies: https://www.towardspackaging.com/insights/pharmaceutical-packaging-market

- Food and Beverage Packaging Materials Market Key Business Drivers & Industry Forecast: https://www.towardspackaging.com/insights/food-and-beverage-packaging-materials-market-sizing

- Edible Packaging Market Research Insight: Industry Insights, Trends and Forecast: https://www.towardspackaging.com/insights/edible-packaging-market

- Meal Prep Containers Market Research, Consumer Behavior, Demand and Forecast: https://www.towardspackaging.com/insights/meal-prep-containers-market-sizing

- Milk Packaging Market Research, Consumer Behavior, Demand and Forecast: https://www.towardspackaging.com/insights/milk-packaging-market-sizing

- Fresh Food Packaging Market Consumer Insights & Growth Strategies: https://www.towardspackaging.com/insights/fresh-food-packaging-market-sizing

- Pet Food Packaging Market Strategic Review, Key Business Drivers & Industry Forecast: https://www.towardspackaging.com/insights/pet-food-packaging-market

- Baby Food Packaging Market Performance, Trends and Strategic Recommendations: https://www.towardspackaging.com/insights/baby-food-packaging-market-sizing

Segment Outlook

Product Type Insights

The flexible packaging segment dominated the food storage container market with the largest share in 2024. Flexible packaging (like pouches and wraps) is significantly lighter and more compact than rigid containers. It minimizes transportation and storage costs, making it ideal for both manufacturers and consumers. Flexible packaging typically requires less raw material than rigid alternatives.

Lower production and shipping costs make it attractive for large-scale food brands and SMEs alike. Many flexible packaging materials offer excellent moisture, oxygen, and light barrier properties. This assists to preserve freshness, flavor, and quality, particularly for snacks, dry foods, and ready-to-eat meals. Resealable zippers, tear notches, and spouts add ease of utilize and portability. Consumers prefer these features for on-the-go lifestyles and single-serve packaging.

Flexible packages provide full-surface printing, enabling vibrant branding, marketing messages, and QR codes. They provide manufacturers with a competitive edge in shelf visibility and brand recognition. E-commerce growth boosts the need for lightweight, durable, and cost-efficient packaging. Flexible packaging reduces damage during shipping and lowers carbon footprint due to reduced bulk.

The rigid packaging segment is anticipated to witness lucrative growth during the forecast period. Rigid containers are typically reusable, making them popular among eco-conscious consumers. Brands and consumers prefer them for storing leftovers, meal prep, and pantry organization due to their long-lasting value. Rigid packaging ensures secure, spill-proof transport for hot and cold meals. Restaurants, meal-kit, and cloud kitchens services increasingly rely on rigid containers to enhance presentation and safety. Rigid packaging adds a premium look and feel, which appeals to higher-end markets and gourmet food brands. It supports aesthetic and tactile brand experiences, important for in-store displays and gifting.

Innovations in PCR plastics, biodegradable rigid polymers, glass recycling, and compostable rigid trays are addressing environmental concerns. Rigid containers that are both durable and sustainable are gaining market traction. The trend of kitchen and pantry organization (boosted by social media) has increased consumer interest in aesthetically pleasing, stackable rigid containers for dry storage and leftovers. Rigid packaging is often preferred for products that need tamper-evident features and longer shelf life, especially in regulated markets like North America and Europe. Rigid containers (e.g., plastic tubs, glass jars, metal tins) offer robust protection against crushing, contamination, and moisture.

Application Insights

The meat processed goods segment accounted for the largest food storage container market share in 2024. As the food storage container offer critical benefits that address safety, freshness, and convenience it is used extensively for packaging meat. Meat is highly perishable and prone to spoilage; airtight food storage containers assists to prevent exposure to air, moisture, and contaminants. Vacuum-sealed and modified atmosphere packaging (MAP) options in rigid or semi-rigid containers extend shelf-life. Meat can carry harmful bacteria like Salmonella or E.coli. Leak-proof and sealed containers reduce the risk of contamination during transport and storage.

The dairy goods segment is anticipated to show the fastest growth during the forecast period. Dairy packaging often includes features like resealable lids or portion-sized cups for consumer convenience. deal for products like yogurt, cream, or cheese spreads where resealability adds value. Sealed containers reduce the risk of contamination from external bacteria, mold, or odors — crucial for dairy’s safety and taste. Tamper-evident lids and hygienic materials (like BPA-free plastics or glass) enhance consumer trust.

End User Insights

The restaurants segment dominated the food storage containers market globally. Restaurant’s has to follow strict food safety regulations (like HACCP). Airtight, food-grade containers prevent cross-contamination and bacterial growth, especially when storing raw and cooked items separately.

The catering segment is anticipated to show the fastest growth during the forecast period. Catering often involves delivering food in bulk to events. Durable containers protect food during transit, preventing spillage, contamination, or damage. Insulated or thermal food storage containers keep hot foods hot and cold foods cold, preserving freshness and ensuring compliance with food safety regulations during transport. Food storage containers allow caterers to portion dishes ahead of time, streamlining setup at the event location.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results—schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in Global Food Storage Container Market:

- In April, 2025, Caraway, the non-toxic cookware company, has introduced its Glass Airtight Storage Containers as part of its ongoing innovation for healthier homes. With high-quality materials and a modern, space-efficient design, this most recent invention improves kitchen storage while lowering exposure to microplastics and increasing freshness and organization.

- On March 31, 2025, Placon, a pioneer in eco-friendly, creative thermoformed food packaging, announced the debut of its new Fresh 'n Clear Dip Cup range for dips, spreads, and hummus. In response to growing consumer demand for more environmentally friendly food packaging choices for the expanding market for hummus, spread, and dip, the dip cup line was created. The dip cups and matching lids are constructed from Placon's unique EcoStar material, which has a #1 resin code and at least 10% recycled PET. Easy stacking and marketing are made possible by the product line's circular shape and recyclable crystal-clear packaging.

Global Food Storage Container Market Segments

By Product Type

- Flexible Packaging

- Paperboard

- Rigid Packaging

- Metal

- Glass

By Application

- Grain Mill Products

- Dairy Goods

- Fruits & Vegetables

- Bakery Products

- Meat Processed Products

By End User

- Restaurants

- Catering

- Hotels

- Bars

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Global Food Storage Container Market Players

- Bemis Company, Inc.

- Berry Plastics Corporation

- Graham Packaging Company

- Graphic Packaging International, LLC

- Ball Corporation

- Constar International UK Ltd.

- Anchor Glass Container Corporation

- Plastipak Holdings, Inc.

- PRINTPACK

- Alcan Packaging

- Fold-Pak

Invest in Premium Global Insights @ https://www.towardspackaging.com/price/5492

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Our Trusted Data Partners:

Precedence Research | Statifacts |Towards Automotive | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/