Austin, April 22, 2025 (GLOBE NEWSWIRE) -- Bioprocess Validation Market Size & Growth Analysis:

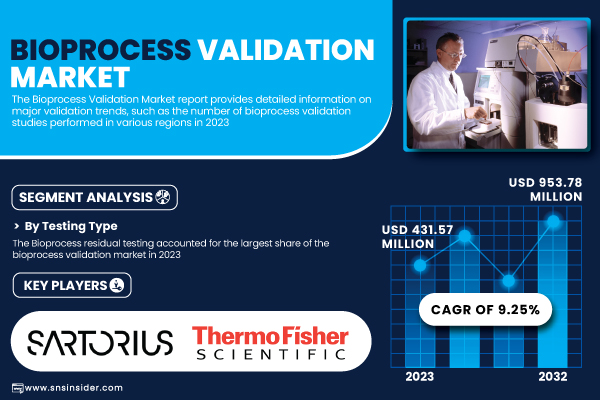

According to SNS Insider, the Bioprocess Validation Market was valued at USD 431.57 million in 2023 and is anticipated to reach USD 953.78 million by 2032, expanding at a compound annual growth rate (CAGR) of 9.25% during the forecast period 2024 to 2032.

The market growth is primarily driven by the rising demand for biopharmaceuticals, increasing regulatory scrutiny, and the need for stringent quality assurance in manufacturing processes. In 2024, the surge in biosimilar production and advancements in bioprocessing technologies are accelerating validation requirements. Companies are investing in robust validation protocols to ensure compliance with evolving global regulatory standards, reduce production risks, and enhance product safety. Additionally, the growth of contract manufacturing organizations (CMOs) and increased R&D investments in biotechnology are boosting the demand for bioprocess validation services. These trends are expected to sustain market momentum through 2032, as the biopharmaceutical industry continues to expand.

Get a Sample Report of Bioprocess Validation Market@ https://www.snsinsider.com/sample-request/5968

U.S. Bioprocess Validation Market Trends

In 2023, the U.S. Bioprocess Validation Market was valued at USD 132.08 million and is projected to reach USD 285.96 million by 2032, expanding at a compound annual growth rate (CAGR) of 9.00% from 2024 to 2032. The U.S. holds leadership in the North American Bioprocess Validation Market because of its well-established biopharmaceutical manufacturing base, stringent regulatory policies, and high R&D spending. This leadership is also backed by the presence of large-scale market players and sophisticated technological infrastructure.

Key Bioprocess Validation Companies Profiled in the Report

- Sartorius AG

- Genedata

- Thermo Fisher Scientific

- Pall Corporation

- Merck KGaA

- GE Healthcare Life Sciences

- Danaher Corporation

- Lonza Group

- Charles River Laboratories

- WuXi AppTec

- Eurofins Scientific

- SGS Life Sciences

- Tosoh Bioscience

- Agilent Technologies

- Bio-Rad Laboratories

- PerkinElmer

- Repligen Corporation

- Eppendorf AG

- MilliporeSigma

- 3M Company

Bioprocess Validation Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 431.57 million |

| Market Size by 2032 | US$ 953.78 million |

| CAGR | CAGR of 9.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Highlights

By Testing Type, Bioprocess Residual Testing Leads Market, Extractables & Leachables (E&L) Testing Segment Poised for Fastest Growth

In 2023, bioprocess residual testing accounted for the largest proportion of the bioprocess validation market. Its essential function in removing impurities—host cell proteins, DNA, endotoxins, and antibiotic residues—has fueled demand. Stringent FDA and EMA guidelines, as well as increasing production of monoclonal antibodies, biosimilars, and cell and gene therapies, have necessitated extensive impurity validation. Automated and high-throughput testing technologies have further increased their market leadership.

The Extractables & Leachables (E&L) testing segment is anticipated to grow at the fastest rate until 2032, driven by the increasing application of single-use bioprocessing systems, disposable bioreactors, and plastic-based equipment. Toxic chemical leaching from materials into biologics has raised growing concerns. Tightened regulatory requirements from the USP, EMA, and ICH, coupled with the development of improved analytical methods, are compelling the broad adoption of E&L testing for patient safety assurance.

By Stage, Continued Process Verification (CPV) Dominates Bioprocess Validation Market in 2023 with 42.55% Share

The Continued Process Verification (CPV) area dominated the bioprocess validation market in 2023, with a 42.55% market share. Its dominance is being fueled by increasing regulatory focus on continuous monitoring and control of biopharmaceutical manufacturing. The FDA, EMA, and ICH guidelines necessitate CPV to ensure consistent product quality, safety, and efficacy. CPV differs from conventional practices in employing real-time data, predictive analytics, and statistical control to drive increased production efficiency and catch problems early.

By Mode, In-house Bioprocess Validation Dominates Market, Outsourced Bioprocess Validation to Experience Fastest Growth

In 2023, the in-house segment accounted for the largest proportion of the bioprocess validation market at 68.42%. This is due to biopharmaceutical firms' growing emphasis on stringent regulatory compliance, data security, and process control in their own facilities. In-house validation provides more control and flexibility over bioprocess workflows, guaranteeing the highest quality for proprietary biologics and biosimilars. Investment in cutting-edge manufacturing and automation has simplified and streamlined in-house validation, minimizing the need for third-party providers.

The outsourcing segment of the bioprocess validation segment is expected to expand at the fastest CAGR of 10.2% during the forecast period. Small biotech and emerging biopharmaceutical firms tend to lack the infrastructure and capabilities to conduct in-house validation and hence outsource validation services to Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs). Growing regulatory requirements and rising complexities in bioprocess validation are making companies more inclined toward specialized third-party providers, hence driving outsourcing growth further.

For A Detailed Briefing Session with Our Team of Analysts, Connect with Us Now@ https://www.snsinsider.com/request-analyst/5968

Bioprocess Validation Market Segmentation

By Testing Type

- Extractables & Leachables Testing

- Bioprocess Residuals Testing

- Viral Clearance Testing

- Filtration & Fermentation Systems Testing

- Others

By Stage

- Process Design

- Process Qualification

- Continued Process Verification

By Mode

- In house

- Outsourced

Regional Insights

North America Leads Bioprocess Validation Market, Asia Pacific Set for Fastest Growth

North America led the bioprocess validation market with a share of 40.10% in 2023. The reason behind its dominance is its developed biopharmaceutical industry, robust regulatory framework, and high R&D spending. Major biopharmaceutical firms like Pfizer, Amgen, and Bristol-Myers Squibb lead the demand for strict validation to achieve FDA approval. The high adoption of single-use technology and gene therapies within the region, coupled with the increase in CDMO services, only makes its market leadership stronger.

The Asia Pacific region is the bioprocess validation market's fastest growth area, at an estimated 10.22% CAGR over the forecast period. The biopharmaceutical industry in the region is growing fast as a result of biosimilar manufacturing investment and government incentives for biologics manufacturing. China, India, and South Korea are becoming major manufacturing bases. Partnerships between global pharma firms and local CDMOs and increased use of single-use systems are fueling market growth.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Number of Bioprocess Validation Studies Conducted (2023), by Region

5.2 Adoption Trends of Bioprocess Validation Services, by Region (2023)

5.3 Bioprocess Validation Spending, by Region (Pharmaceutical, Biotechnology, CMOs, CROs), 2023

5.4 Validation Testing Volume, by Region (2020-2032)

6. Competitive Landscape

7. Bioprocess Validation Market by Testing Type

8. Bioprocess Validation Market by Stage

9. Bioprocess Validation Market by Mode

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Related SNS Insider Reports:

Biosimilars Market Forecast Report

Single-Use Bioprocessing Market Trends

Upstream Bioprocessing Market Insights

Biopharmaceutical Market Forecast

Biopharmaceutical CMO Market Overview

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.