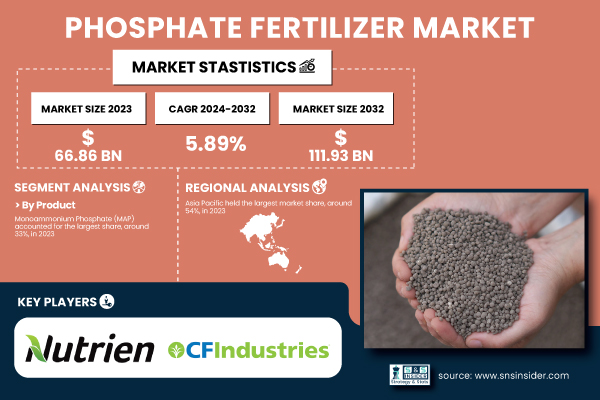

Austin, April 21, 2025 (GLOBE NEWSWIRE) -- The Phosphate Fertilizer Market Size was valued at USD 66.86 Billion in 2023 and is expected to reach USD 111.93 Billion by 2032, growing at a CAGR of 5.89% over the forecast period of 2024-2032.

Download PDF Sample of Phosphate Fertilizer Market @ https://www.snsinsider.com/sample-request/6556

Rising Global Demand for Phosphate Fertilizers Driven by Agricultural Advancements and Population Growth

The Phosphate Fertilizer market is expanding rapidly due to the growing need for high-yield crops and enhanced agricultural techniques, particularly in emerging economies. As the global population's food demands increase, the pressure on crop production intensifies, driving the need for effective fertilizers. In the U.S., phosphate fertilizers are vital for improving the productivity of staple crops such as wheat, corn, and soybeans. Data from the U.S. Geological Survey shows over 27 million metric tons of phosphate rock were produced in 2023, contributing to global supply. Advanced fertilizers like MAP and DAP are gaining popularity for boosting yields. Additionally, technological innovations in fertilizer production and distribution have improved both quality and affordability, further fueling market growth. Phosphate fertilizers play a key role in ensuring soil health and sustainable agricultural practices.

The US Phosphate Fertilizer Market Size was valued at USD 8.91 Billion in 2023 and is projected to reach USD 15.48 Billion by 2032, growing at a CAGR of 6.34% from 2024 to 2032.

The demand is driven by the need for improved agricultural productivity and sustainable farming methods. For example, the U.S. agricultural sector is increasingly adopting precision farming techniques, where phosphate fertilizers are used efficiently to optimize crop yields. The Fertilizer Institute (TFI) projects that the market will see robust growth as precision agriculture practices expand. Additionally, the U.S. government continues to support fertilizer usage through subsidy programs and grants for farmers adopting environmentally friendly technologies, further driving market growth.

Key Players:

- Nutrien Ltd. (MAP, DAP)

- Yara International ASA (YaraMila, YaraLiva)

- The Mosaic Company (MicroEssentials, K-Mag)

- EuroChem Group AG (EuroChem MAP, EuroChem NP)

- OCP Group (Triple Superphosphate, DAP)

- ICL Group Ltd. (PKpluS, Polysulphate)

- CF Industries Holdings, Inc. (DAP, MAP)

- PhosAgro (Ammophos, NP Complex Fertilizers)

- Coromandel International Limited (GroShakti Plus, Paramfos)

- Sinofert Holdings Limited (MAP, NP Fertilizer)

- Indorama Eleme Fertilizer & Chemicals (DAP, TSP)

- Ravensdown (Superphosphate, Cropzeal)

- Ma’aden (Saudi Arabian Mining Company) (MAP, DAP)

- SPIC (Southern Petrochemical Industries Corporation) (SPIC Phosphatic, Vigore)

- Agrium Inc. (ESSENTIALS MAP, ESSENTIALS DAP)

- Jordan Phosphate Mines Company (Phosphate Rock, DAP)

- WengFu Group (MAP, Compound Phosphate)

- Fauji Fertilizer Company (Sona Urea, Sona DAP)

- ZACL (Zambia Fertilizer Company) (Zamfos, Compound D)

- IFFCO (Indian Farmers Fertiliser Cooperative Limited) (Sagarika, Phalodhan)

Phosphate Fertilizer Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 66.86 Billion |

| Market Size by 2032 | USD 111.93 Billion |

| CAGR | CAGR of 5.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), Single Superphosphate (SSP), Triple Superphosphate (TSP), Others) •By Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others) |

| Key Drivers | • Rising global demand for high-yield crops to ensure food security drives the phosphate fertilizer market. |

Key Dynamics Driving the Global Phosphate Fertilizer Supply Chain and Market Distribution Challenges

- Phosphate fertilizers are produced from phosphate rock extracted in countries like Morocco, China, and the U.S.

- Global trade connects major exporters like Morocco and the U.S. to markets in Asia-Pacific, Europe, and North America.

- Fertilizer transport relies on sea and rail shipping, with strategic ports enabling global distribution.

- The supply chain is influenced by raw material costs, regulations, and policies in phosphate-rich nations.

- Retail and distribution networks ensure timely fertilizer availability through partnerships with cooperatives and direct sales.

By Product, Monoammonium Phosphate (MAP) Segment Dominated the Phosphate Fertilizer Market in 2023 with a 33% Market Share

This dominance is attributed to its high nutrient concentration, which makes it highly efficient for a variety of crops, including cereals and oilseeds. MAP is preferred for its effectiveness in supporting early-stage plant growth, which is essential for maximizing yield. The growing trend towards optimized nutrient management and the preference for high-efficiency fertilizers continue to fuel its adoption in both developed and emerging markets. The availability of specialized formulations such as high-analysis MAP has further augmented its widespread usage in precision farming, ensuring higher crop production with minimal environmental impact. Furthermore, the segment’s growth is supported by manufacturers investing in MAP production capacity to meet increasing global agricultural demands, particularly in countries like India and China where high crop yields are essential for food security.

By Application, Cereals & Grains Segment Dominated the Phosphate Fertilizer Market in 2023 with a 47% Market Share

This segment’s dominance stems from the widespread use of phosphate fertilizers in staple crops like wheat, rice, and corn, which are vital for global food security. The increasing demand for these crops, particularly in regions such as Asia Pacific and North America, is driving the growth of this segment. With a focus on improving crop yields and quality, the cereals and grains sector remains a key driver of phosphate fertilizer consumption. For instance, in the U.S., corn and wheat are major agricultural products, and phosphate fertilizers are essential in ensuring these crops receive the necessary nutrients for optimal growth. In Asia Pacific, governments are heavily subsidizing fertilizers to promote food security, further bolstering the growth of the cereals and grains sector.

If You Need Any Customization on Phosphate Fertilizer Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6556

Asia Pacific Dominated the Phosphate Fertilizer Market In 2023, Holding a 54% Market Share.

Asia-Pacific leads the global phosphate fertilizer market due to strong agricultural activity in countries like China, India, and Southeast Asia. Government subsidies on fertilizers and the adoption of modern farming techniques drive consumption. China is a major producer, and India's agricultural sector also contributes significantly to the demand. These factors, combined with growing food needs, are expected to continue propelling the region's dominance in the market.

North America Emerged as the Fastest Growing Region in Phosphate Fertilizer Market with A Significant Growth Rate in The Forecast Period

The growth of the phosphate fertilizer market in the U.S. and Canada is driven by the adoption of sustainable farming and advanced technologies. Farmers use precision tools for efficient nutrient application, boosting crop production, particularly for corn, soybeans, and wheat. Additionally, the shift towards organic farming and the focus on soil fertility further increase the demand for phosphate fertilizers. These trends are expected to continue, enhancing farm productivity and supporting long-term agricultural sustainability.

Recent Developments

- January 2025: Paradeep Phosphates signed an MoU with Odisha’s government for ₹4,000 crore investment, aiming to enhance phosphate fertilizer production and meet growing agricultural demands.

- January 2025: Chinese firm Asia-Potash plans a $10bn investment in Egypt's phosphate sector, creating a major production complex to supply global fertilizer markets, with support from the Egyptian government.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Phosphate Fertilizer Market Segmentation, By Product

8. Phosphate Fertilizer Market Segmentation, By Application

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practice

12. Conclusion

Related Reports:

Fertilizers Market Growth & Emerging Trends by 2032

Nano Fertilizer Market Size Research Report 2024-2032

Green Fertilizer Market Overview Report by 2032

Potash Fertilizers Market Share & Forecast to 2032

Nitrogenous Fertilizer Market Analysis by 2032

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.