Austin, April 18, 2025 (GLOBE NEWSWIRE) -- Selective Laser Sintering Equipment Market Size & Growth Insights:

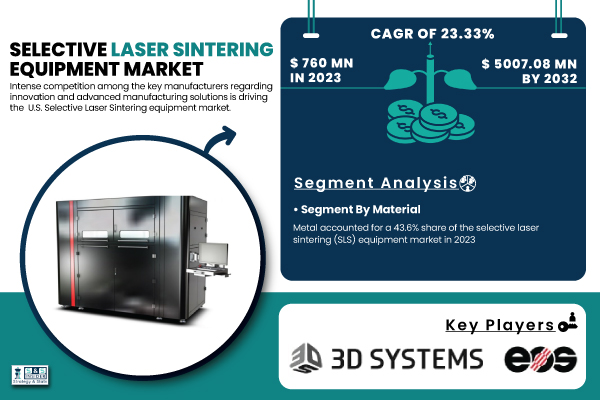

According to the SNS Insider Report, “The Selective Laser Sintering Equipment Market Size was valued at USD 760 Million in 2023 and is expected to reach USD 5007.08 Million by 2032 and grow at a CAGR of 23.33% over the forecast period 2024-2032.”

Rising Adoption of Advanced Technologies Boosts Selective Laser Sintering Equipment Market Growth

Driven by increasing demand across aerospace, automotive, healthcare, and electronics sectors. Manufacturers are embracing innovation through smart manufacturing, AI integration, and IoT-enabled process monitoring to enhance efficiency, accuracy, and sustainability. SLS technology’s ability to produce lightweight, high-precision, and complex components with minimal material waste supports industry-wide goals for performance and eco-friendliness. The U.S. Selective Laser Sintering (SLS) Equipment Market, valued at USD 189.31 million in 2023, is expected to grow at a CAGR of 23.31%As Industry 4.0 gains momentum, companies are integrating SLS into digital manufacturing strategies to optimize cost and output.

Get a Sample Report of Selective Laser Sintering Equipment Market @ https://www.snsinsider.com/sample-request/6195

Leading Market Players with their Product Listed in this Report are:

- 3D Systems Inc. (ProX SLS 6100)

- EOS GmbH (EOS P 500)

- Farsoon Technologies (FS271M)

- Prodways Group (ProMaker P1000X)

- Formlabs Inc. (Fuse 1)

- Ricoh Company Ltd (AM S5500P)

- Sinterit Sp. z o.o. (Lisa Pro)

- Sintratec AG (Sintratec S2)

- Sharebot SRL (SnowWhite)

- Red Rock SLS (Red Rock 3D Printer)

- Natural Robotics (VIT SLS)

- Z Rapid Tech (iSLA-650 Pro)

- Aerosint (Aerosint SLS Printer)

- Aspect Inc. (Aspect SLS Printer)

- Jenoptik (JENOPTIK-VOTAN BIM).

Selective Laser Sintering Equipment Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 760 Million |

| Market Size by 2032 | USD 5007.08 Million |

| CAGR | CAGR of 23.33% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Metal, Plastics, Nylon) • By Laser Type (Solid Laser, Gas Laser) • By Technology (Desktop Printer, Industrial Printer) • By End Use (Automotive, Aerospace & Defense, Healthcare, Electronics, Others) |

| Key Drivers | • Revolutionizing Manufacturing with SLS Technology Driving Growth in Automotive Aerospace Healthcare and Smart Manufacturing. • Expanding SLS Opportunities in Healthcare Electronics and SMEs with Biocompatible Materials and Affordable Printers. |

For A Detailed Briefing Sessions with Our Team of Analyst, Connect Now @ https://www.snsinsider.com/request-analyst/6195

Additionally, environmental regulations are pushing the development of recyclable and biodegradable powder materials, aligning advanced manufacturing with green initiatives. With faster print speeds, improved material compatibility, and better mechanical properties, SLS equipment is becoming a cornerstone of modern production, especially for applications requiring strength-to-weight optimization and advanced design flexibility.

Material, Laser, and Application Innovations Shaping the Future of Selective Laser Sintering Equipment Market

By Material

In 2023, metal held a 43.6% share of the Selective Laser Sintering (SLS) equipment market, owing to its extensive applications in aerospace, automotive and healthcare sectors. This leads Grand View Research to show that metal SLS is preferred due to the need for lightweight, durable, high-strength, and tough components, which are crucial for applications that need precision and performance. A further bolstering of its dominance is due to a consistent demand for metal 3D printing in tooling, spare parts, and structural components.

The plastic-based SLS segment is expected to register the fastest CAGR from 2024 to 2032, due to increasing utilization in prototyping, consumer products, and medical applications. Polymer materials have become more affordable and processing them has become easier because of innovations in them. Moreover, the increasing utilization of biocompatible plastics for dental prosthetics and medical implants will create considerable growth opportunities, making the plastic SLS segment a potential area of growth through the forecast period.

By Laser Type

Gas lasers led the SLS market in 2023 with a 62.2% share, driven by their high power, stability, and precision in industrial applications. CO₂ gas lasers, in particular, have been widely adopted for sintering polymers, metals, and composites, establishing a strong foothold in automotive, aerospace, and electronics sectors due to their ability to consistently produce high-quality parts with favorable mechanical properties.

Solid-state lasers are expected to witness the highest CAGR from 2024 to 2032, owing to their energy efficiency, compact design, and improved processing capabilities. Additionally, developments in fiber and diode laser technology are making solid lasers more and more attractive for high-precision applications, especially in metal SLS printing and miniaturized components used in healthcare and electronics. With an increase in demand for versatile, efficient, and compact laser systems, the solid-state lasers seem to be leading in taking their place in the future expansion of SLS equipment market.

By Technology

Industrial SLS printers dominated the market in 2023 with a 73.2% share, driven by their precision, scalability, and use in large-scale manufacturing across industries like automotive, aerospace, and healthcare. Capable of processing a wide range of materials, they produce complex, high-quality components.

Desktop SLS printers will experience the highest growth during 2024–2032, driven primarily by increasing adoption from small businesses, research, education, and customized medical or prototyping applications.

By End Use

The automotive sector led the SLS equipment market in 2023 with a 24.6% share, driven by its use in lightweight components, prototyping, and custom parts, especially for EVs and complex designs.

Healthcare is expected to grow fastest from 2024 to 2032, due to increasing demand for customized implants, prosthetics, & dental applications and technological advances in biocompatible materials and medical-grade 3D printing, which enables the development of personalized surgical solutions.

Buy a Single-User PDF of Selective Laser Sintering Equipment Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/6195

Expanding Global Footprint of SLS Equipment Market Driven by Innovation and Industrial Adoption

In 2023, North America held a 34.7% share of the Selective Laser Sintering (SLS) equipment market, supported by a mature manufacturing ecosystem, strong R&D investments, and widespread adoption across automotive, aerospace, and healthcare sectors. Leading companies like 3D Systems, Stratasys, and Formlabs drive innovation, while major players such as General Motors and Boeing utilize SLS for lightweight, high-performance parts. Healthcare applications are growing too, with institutions like Mayo Clinic leveraging SLS for customized surgical guides and implants.

Asia-Pacific is projected to witness the fastest CAGR from 2024 to 2032, due to accelerating industrial growth, government-supported programs and rising demand for additive manufacturing. Nations such as China, Japan and South Korea pouring money into advanced manufacturing, with SLS being used in EV production at companies like NIO and BYD. Indian healthcare services growth is also driving the need for 3D printed implants, and large-scale industrial grade SLS adoption is being extended into use cases by firms such as Farsoon Technologies.

Recent Development:

- Nov 19, 2024, EOS launched its upgraded P 396 SLS 3D printer in November 2024, dubbed the "P3 Next," offering 50% more throughput with faster layer builds, quick-change build units, and high material reuse—optimizing production scalability.

- On March 17, 2025, Farsoon unveiled its upgraded FS1521M-U system, now supporting up to 32 × 500W fiber lasers—enabling faster, large-scale metal 3D printing with enhanced efficiency and reduced production costs.

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Competitive & Business Performance

5.2 Digital & Smart Manufacturing

5.3 Software & Automation Metrics

5.4 Machine & Material Efficiency

6. Competitive Landscape

7. Selective Laser Sintering Equipment Market, by Material

8. Selective Laser Sintering Equipment Market, by Laser Type

9. Selective Laser Sintering Equipment Market, by Technology

10. Selective Laser Sintering Equipment Market, by End Use

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Research Insights on Selective Laser Sintering Equipment Market Report Forecast @ https://www.snsinsider.com/reports/selective-laser-sintering-equipment-market-6195

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.