Pune, April 15, 2025 (GLOBE NEWSWIRE) -- Continuous Delivery Market Size Analysis:

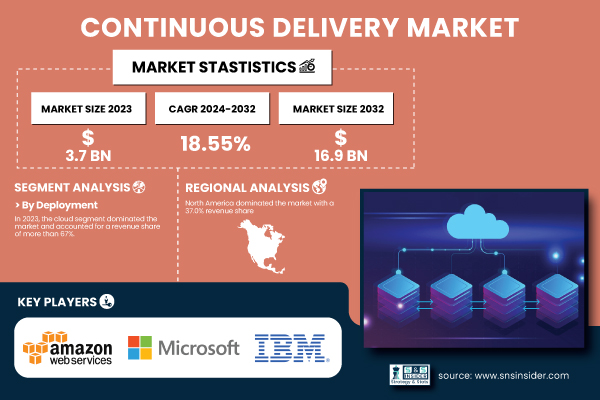

“The SNS Insider report indicates that the Continuous Delivery Market size was valued at USD 3.7 billion in 2023 and is estimated to reach USD 16.9 billion by 2032, growing at a CAGR of 18.55% during the forecast period of 2024-2032.”

Get a Sample Report of Continuous Delivery Market@ https://www.snsinsider.com/sample-request/5712

Major Players Analysis Listed in this Report are:

- Amazon Web Services (AWS) – AWS CodePipeline

- Microsoft – Azure DevOps

- Google – Google Cloud Build

- IBM – UrbanCode Deploy

- GitLab – GitLab CI/CD

- Atlassian – Bitbucket Pipelines

- Red Hat – OpenShift Pipelines

- CircleCI – CircleCI

- Jenkins (CloudBees) – Jenkins

- Travis CI – Travis CI

- GitHub – GitHub Actions

- Puppet – Puppet Enterprise

- Spinnaker (Netflix OSS) – Spinnaker

- Harness – Harness CI/CD

- Chef Software – Chef Automate

Dispatch Console Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 3.7 Billion |

| Market Size by 2032 | USD 16.9 Billion |

| CAGR | CAGR of 18.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Growing demand for faster and more reliable software deployment is fueling the adoption of CI/CD tools and DevOps methodologies. |

In the U.S., the Continuous Delivery Market was valued at USD 1.00 billion in 2023 and is projected to reach USD 4.55 billion by 2032, growing at a CAGR of 18.29%. This growth is driven by the rapid adoption of DevOps, increasing demand for faster software release cycles, and significant cloud infrastructure investments across industries. The U.S. also benefits from a strong ecosystem of tech giants and early adoption of automation tools.

By Deployment: Cloud Segment Dominates While On-Premise Sees Fastest Growth

The cloud segment dominated the market in 2023 and accounted for a revenue share of more than 67% due to its scalability, flexibility, and reduced infrastructure costs. Enterprises are rapidly migrating to the cloud for CI/CD tools integration, making cloud deployment more favorable. With support for automated pipelines, reduced downtimes, and dynamic provisioning, cloud-based solutions continue to attract both SMEs and large corporations.

The on-premise segment is anticipated to witness the fastest CAGR during 2024–2032. The surge in security concerns, compliance demands, and customization requirements across highly regulated industries such as BFSI and healthcare is encouraging companies to opt for on-premise solutions. These deployments offer tighter control over data and environments, especially for legacy systems integration.

By Enterprise Size: Large Enterprises Lead, SMEs Growing Fastest

Large enterprises dominated the continuous delivery market in 2023 and accounted for significant revenue share, primarily due to their substantial IT budgets and complex software systems requiring continuous integration and delivery. These organizations are integrating CD tools with DevOps pipelines to accelerate product innovation, reduce software delivery time, and improve operational efficiency.

The small and medium enterprises are projected to grow at the fastest CAGR through 2032. Cloud-based CD solutions that offer affordability and flexibility are increasingly being adopted by SMEs to streamline development and compete with larger players. Their growing need to improve time-to-market and enhance customer experience is propelling CD adoption.

By End-Use: BFSI Leads While Education Emerges as Fastest Growing Sector

The BFSI sector dominated the market in 2023 and accounted for significant revenue share, due to its heavy reliance on secure, compliant, and uninterrupted software delivery. Continuous delivery tools help banks and financial institutions implement agile frameworks to respond faster to customer needs while maintaining regulatory compliance.

The education segment is anticipated to grow at the fastest pace between 2024–2032. Educational institutions are embracing digital platforms for e-learning, student management, and content delivery. With the rise of EdTech platforms, there’s a growing need for continuous integration and software updates, pushing the demand for CD tools in this vertical.

Do you have any specific queries or need any customization research on Dispatch Console Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/5712

Dispatch Console Market Segmentation:

By Deployment

- On-premise

- Cloud

By Enterprise Size

- SMEs

- Large Enterprises

By End-Use

- BFSI

- Telecommunications

- Media And Entertainment

- Retail And E-commerce

- Healthcare

- Manufacturing

- Education

- Others

Key Regional Insights: North America Dominates, Asia-Pacific Grows Fastest

North America dominated the market and held the largest share of more than 37% of the revenue share of the continuous delivery market in 2023, driven by early adoption of DevOps practices, mature IT infrastructure, and leading tech giants fostering CD solutions. Strong government support for digital innovation also plays a role.

Asia-Pacific is set to record the fastest CAGR during the forecast period. Rapid digitalization, cloud adoption, and booming start-up ecosystems in countries like India, China, and Japan are pushing the demand for agile software development tools, thereby accelerating CD adoption.

Recent Developments in the Continuous Delivery Market (2024)

- February 2024: GitLab launched AI-powered features to streamline CI/CD pipelines, boosting productivity for development teams.

- March 2024: IBM Cloud Continuous Delivery was updated with advanced observability tools to enhance DevOps efficiency and security.

- January 2024: Microsoft Azure DevOps expanded its CD integrations with GitHub Actions for improved pipeline automation.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Continuous Delivery Market Segmentation, By Deployment

8. Continuous Delivery Market Segmentation, by Enterprise Size

9. Continuous Delivery Market Segmentation, by End-Use

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Cloud Content Delivery Network Market Size by 2032

Content Delivery Network Market Forecast by 2032

Application Delivery Controller Market Share by 2032

Online Grocery Market Overview by 2032

Sales Training Software Market Analysis by 2032