Pune, March 27, 2025 (GLOBE NEWSWIRE) -- Asset Management Market Size Analysis:

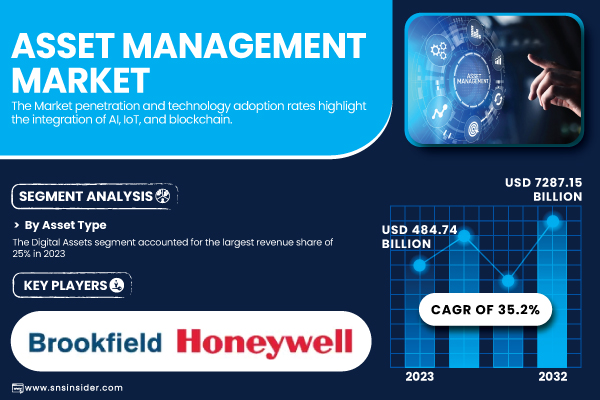

“The Asset Management Market, valued at USD 484.74 billion in 2023, is projected to grow to USD 7,287.15 billion by 2032, expanding at a CAGR of 35.2% during the forecast period from 2024 to 2032.”

Get a Sample Report of Asset Management Market@ https://www.snsinsider.com/sample-request/5744

Major Players Analysis Listed in this Report are:

- ABB Inc. (ABB Ability™ Asset Suite, ABB Ability™ Smart Sensor)

- Adobe Systems Inc. (Adobe Experience Manager Assets, Adobe Workfront)

- Brookfield Asset Management Inc. (Brookfield Infrastructure Asset Solutions, Brookfield Asset Lifecycle Management)

- Honeywell International Inc. (Honeywell Forge Asset Performance Management, Honeywell RTLS for Asset Tracking)

- IBM Corp. (IBM Maximo Application Suite, IBM TRIRIGA)

- Oracle Corp. (Oracle Enterprise Asset Management (EAM), Oracle Primavera Unifier)

- Rockwell Automation, Inc. (FactoryTalk AssetCentre, Rockwell Automation LifecycleIQ Services)

- Siemens AG (Siemens Teamcenter Asset Management, Siemens MindSphere)

- WSP Global Inc. (WSP Asset Management Advisory, WSP Infrastructure Asset Solutions)

- Zebra Technologies Corp. (Zebra MotionWorks Asset Tracking, Zebra RFID Asset Management)

- Hitachi, Ltd. (Hitachi Lumada Asset Performance Management, Hitachi Asset Lifecycle Management)

- General Electric Company (GE Digital APM (Asset Performance Management), GE Predix Asset Performance Management)

- Bentley Systems, Incorporated (Bentley AssetWise, Bentley OpenUtilities)

- Hexagon AB (Hexagon HxGN EAM (Enterprise Asset Management), Hexagon Asset Lifecycle Intelligence)

- AssetWorks, Inc. (AssetWorks EAM, AssetWorks FleetFocus)

- SAP SE (SAP Intelligent Asset Management, SAP Enterprise Asset Management)

Asset Management Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 484.74 Billion |

| Market Size by 2032 | US$ 7287.15 Billion |

| CAGR | CAGR of 35.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Increasing Adoption of IoT, AI, and Blockchain Technologies Drives Growth in the Asset Management Market |

Do you have any specific queries or need any customization research on Asset Management Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/5744

This growth is fueled by the rising use of digital technologies, including artificial intelligence and machine learning, in asset management activities. The technologies optimize portfolio management, risk analysis, and decision-making, which appeals to a wider investor base. Additionally, increased demand for customized investment solutions, increasing prosperity, and the transition toward sustainable investing practices are fuelling the market growth. Moreover, the increased demand for alternative investments and the development of financial markets worldwide also contribute to the rapid growth of the market.

The U.S. Asset Management Market, valued at USD 65.50 billion in 2023, is projected to grow to USD 377.94 billion by 2032, expanding at a CAGR of 21.5% during the forecast period from 2024 to 2032.

The U.S. Asset Management Market will witness tremendous growth owing to rising demand for complex investment solutions fueled by an expanding base of high-net-worth individuals and institutional investors. The use of cutting-edge technologies such as AI and data analytics is optimizing investment strategies and portfolio management. Also, the increasing trend for sustainable and ESG (Environmental, Social, and Governance) investments, together with increased financial awareness, continues to drive market growth, promising high growth in the predicted period.

By Asset Type, Digital Assets Segment Leads Market Growth with 25% Revenue Share in 2023

In 2023, the Digital Assets business secured the highest revenue market share of 25%, spurred by expanding demand for secure, scalable, and AI-driven asset management solutions. Financial services, media, and healthcare sectors are progressively making investments in blockchain, cloud storage, and AI-driven analytics to manage growing digital asset portfolios. Such advanced asset management platforms are allowing businesses to streamline processes, reduce costs, and increase asset utilization. The transition to digital transformation and the requirement for effective management practices in various industries are likely to keep driving the growth of this segment.

By Function, Location & Movement Tracking Segment Leads Asset Management Market with 37% Revenue Share in 2023

The Location & Movement Tracking category led the Asset Management Market in 2023, with a 37% share of revenues. This development is fueled by growing demand for real-time tracking visibility, increased operational efficiency, and improved security across industries. Businesses are leveraging technologies such as IoT, RFID, GPS, and AI-enabled tracking solutions to optimize asset use, avoid loss, and increase productivity. Such innovations are changing asset management through better monitoring and optimization of assets throughout their lifespan.

By Application, Aviation Asset Management Segment Dominates Asset Management Market with 63% Revenue Share in 2023

In 2023, the Aviation Asset Management segment commanded the Asset Management Market with a revenue share of 63%. The growth is driven by increasing demand for fleet optimization, predictive maintenance, and digital tracking solutions. Airlines and airports are increasingly implementing cutting-edge technologies such as AI, IoT, blockchain, and cloud-based solutions to automate asset lifecycle management, lower operational costs, and enhance safety compliance. These technologies are contributing significantly towards improving overall operational efficiency in the aviation industry.

Asset Management Market Segmentation:

By Component

- Solution

- Real-Time Location System (RTLS)

- Barcode

- Mobile Computer

- Labels

- Global Positioning System (GPS)

- Others

- Service

-

- Strategic Asset Management

- Operational Asset Management

- Tactical Asset Management

By Asset Type

- Digital Assets

- Returnable Transport Assets

- In-transit Assets

- Manufacturing Assets

- Personnel/ Staff

By Function

- Location & Movement Tracking

- Check In/ Check Out

- Repair and Maintenance

- Others

By Application

- Infrastructure Asset Management

- Transportation

- Energy Infrastructure

- Water & Waste Infrastructure

- Critical Infrastructure

- Others

- Enterprise Asset Management

- Healthcare Asset Management

- Aviation Asset Management

- Others

Buy an Enterprise-User PDF of Asset Management Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/5744

North America Leads Asset Management Market in 2023 with 38% Share, Driven by High Technology Adoption and Strong Regulatory Frameworks

North America led the Asset Management Market in 2023, accounting for an estimated 38% market share. The demand is largely driven by swift adoption of cutting-edge technologies, strong regulatory policies, and heavy investments in digital asset management tools. Major industry players like IBM, Oracle, Rockwell Automation, and Honeywell are the forerunners of innovation, combining AI, IoT, and cloud-based technologies to enhance asset management and operational effectiveness across business sectors.

Asia Pacific Experiences Fastest Growth in Asset Management Market, with 39.4% CAGR Driven by Industrialization and Digital Transformation

Asia Pacific region is experiencing the maximum growth in the Asset Management Market, expected to grow at a CAGR of 39.4%. This growth is fueled by aggressive industrialization, continuous digital transformation efforts, and growing investments in infrastructure development and intelligent asset management solutions. As organizations in the region implement advanced technologies, the need for efficient and scalable asset management systems keeps on increasing, driving growth in both industrial and commercial segments.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Asset Management Market Segmentation, By Application

8. Asset Management Market Segmentation, By Component

9. Asset Management Market Segmentation, By Asset Type

10. Asset Management Market Segmentation, By Function

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Asset Management Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/asset-management-market-5744

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.