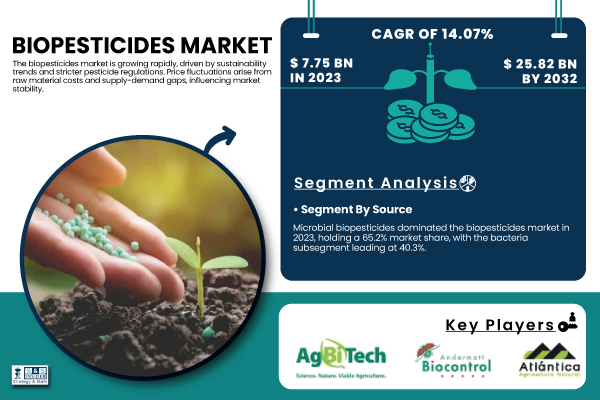

Austin, March 27, 2025 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Biopesticides Market Size was valued at 7.75 Billion in 2023 and is expected to reach USD 25.82 Billion by 2032, growing at a CAGR of 14.07% over the forecast period of 2024-2032.”

Surging Biopesticides Market Driven by Organic Farming, Government Support, and Rising Demand for Sustainable Agriculture Solutions

The biopesticides market is witnessing robust growth due to rising awareness about sustainable agricultural practices and increasing governmental support for organic farming. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Food Safety Authority (EFSA) have been actively promoting biopesticides as a safer alternative to chemical pesticides, ensuring faster approval processes. The USDA reported a 12% increase in organic farmland between 2022 and 2024, further driving demand for biopesticides. Additionally, in 2023, Bayer AG expanded its biological crop protection portfolio with innovative biopesticide solutions to enhance crop yield while reducing environmental impact. Companies such as Marrone Bio Innovations and Syngenta have been investing in R&D to develop novel microbial-based solutions. The Asia-Pacific region has witnessed significant policy shifts, with India’s Ministry of Agriculture promoting bio-based pesticides under its National Mission for Sustainable Agriculture. Moreover, consumer demand for pesticide-free food has surged, leading to increased adoption by farmers. The growing global emphasis on soil health, biodiversity conservation, and chemical residue-free food is expected to propel the biopesticides market further over the forecast period.

Download PDF Sample of Biopesticides Market @ https://www.snsinsider.com/sample-request/5789

Key Players:

- AgBiTech Pty Ltd. (Fawligen, Heligen, Surtivo Plus)

- Agri Life (VBT, MycoShield, BioNematon)

- Andermatt Biocontrol AG (Madex, Virosoft CP4, Helicovex)

- Amit Biotech Pvt. Ltd. (Amit's Bt, Amit's Tricho, Bio Nematicide)

- Arizona Biological Control, Inc. (BotaniGard, Mycotrol, AZA-Direct)

- Atlántica Agrícola (Funginat, BioAtlantis, ProBac)

- BASF SE (Velifer, Serifel, Rhapsody)

- Bayer AG (Serenade, BioAct, Poncho Votivo)

- Biobest Group NV (PreFeRal, Asperello, Limonica)

- Bioceres Crop Solutions (Rizoderma, BlueN, Microstar Bio)

- Bioworks Inc. (RootShield, BotaniGard, MilStop)

- Certis Biologicals (formerly Certis USA LLC) (BoteGHA, Double Nickel, LifeGard)

- Corteva Agriscience (Hearken, Reklemel, Lumidapt Bio)

- FMC Corporation (Quartzo, Presence, Accudo)

- Koppert Biological Systems (Trianum, Mycotal, Costar)

- Lallemand Inc. (Lalguard M52 GR, LalRise VITA, LalStop G46)

- Novozymes A/S (Met52, JumpStart, Actinovate)

- Seipasa SA (Pirecris, Seican, Seifree)

- T. Stanes & Company Limited (Phytogard, Stanes Bio-Catch, Stanes Shield)

- UPL Ltd. (Xentari, NPP Zorvec, Phosgard Bio)

Biopesticides Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 7.75 Billion |

| Market Size by 2032 | USD 25.82 Billion |

| CAGR | CAGR of 14.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Microbial Biopesticides [Bacteria, Fungi, Viruses, Protozoa], Biochemicals [Botanical Extracts, Semiochemicals, Minerals, Others], Plant-Incorporated Protectants (PIPs)) • By Type (Bioinsecticides [Bacillus thuringiensis, Beauveria bassiana, Metarhizium anisopliae, Verticillium lecanii, Nucleopolyhedroviruses (NPV) & Granuloviruses (GV), Others], Biofungicides [Trichoderma spp., Bacillus spp., Pseudomonasspp., Streptomyces spp., Others], Bionematicides [Paecilomyces lilacinus, Bacillus firmus, Pasteuria spp., Others], Bioherbicides [Phytophthora palmivora, Alternaria cassia, Others]) • By Formulation (Liquid, Dry) • By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Plantation Crops, Turf & Ornamentals, Others) • By Mode of Application (Seed Treatment, Soil Treatment, Foliar Spray, Post-Harvest Treatment, Others) |

| Key Drivers | • Rising Consumer Preference for Organic and Chemical-Free Agricultural Practices Fuels the Growth of the Biopesticides Market. |

If You Need Any Customization on Biopesticides Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/5789

Research & Development Investments by Companies

- Leading market players have ramped up R&D investments to develop next-generation biopesticides.

- Companies like BASF and Corteva Agriscience have allocated over USD 250 million in 2023 to develop new microbial-based solutions.

- In 2023, UPL Ltd. partnered with international biotech firms to expand its biopesticide product range.

- Advances in RNA interference (RNAi) and CRISPR-based biopesticides are set to revolutionize pest control.

- Emerging companies such as Biotalys and Vestaron are introducing peptide-based biopesticides to enhance crop protection efficiency.

By Source, Microbial Biopesticides Dominated the Biopesticides Market in 2023 with a 65.2% Market Share

These biopesticides, derived from naturally occurring bacteria, fungi, and viruses, offer targeted pest control while ensuring minimal environmental impact. Bacillus thuringiensis (Bt) is one of the most widely used microbial biopesticides, employed extensively in organic and conventional farming. Regulatory approvals and strong support from government programs promoting integrated pest management (IPM) have bolstered adoption. For instance, in 2023, the EPA granted expanded registration for microbial-based products, encouraging their wider application. Furthermore, microbial biopesticides improve soil health, making them a preferred choice among sustainable agriculture practitioners. Companies such as Marrone Bio Innovations and Certis Biologicals are continuously developing new microbial strains to tackle emerging pest threats.

By Type, Bioinsecticides Segment Dominated the Biopesticides Market in 2023 with a 42.5% Market Share

The dominance is primarily due to their effectiveness in controlling insect pests while maintaining ecological balance. They are widely used in agriculture, horticulture, and forestry to combat pests such as aphids, caterpillars, and beetles. The increased awareness of insecticide resistance in conventional pesticides has accelerated the shift toward bio-based alternatives. Notably, the introduction of Spinosad-based bioinsecticides has significantly impacted the market. In 2023, Syngenta launched a new bioinsecticide targeting Lepidopteran pests, further boosting the segment’s growth. The rising popularity of organic farming and stringent bans on chemical pesticides in regions like the EU and North America are also driving demand for bioinsecticides.

By Mode of Application, Foliar Spray Dominated the Biopesticides Market in 2023 with a 38.6% Market Share

The widespread adoption of foliar sprays can be attributed to their ease of application and quick pest control action. This method ensures direct contact with plant surfaces, making it highly effective in controlling foliar pests and diseases. Additionally, foliar sprays require lower dosages, minimizing environmental impact. Companies like Bayer and FMC Corporation have been launching innovative biopesticide spray solutions to enhance efficacy. The rising adoption of precision agriculture techniques and drone-based spraying methods is further boosting market growth.

North America Region Dominated the Biopesticides Market In 2023, Holding A 39.7% Market Share.

The region’s strong regulatory framework, coupled with rising consumer preference for organic produce, has fueled demand. The U.S. has been a pioneer in biopesticide adoption, with the EPA supporting rapid product approvals. In 2023, Marrone Bio Innovations expanded its distribution network across North America, reinforcing the market’s growth. Furthermore, government incentives for organic farming, including subsidies under the USDA Organic Certification Cost Share Program, have encouraged farmers to transition to biopesticides. The growing concerns over chemical pesticide residues in food products have also played a crucial role in market expansion.

Recent Developments

- April 2024: Syngenta partnered with Lavie Bio to accelerate biopesticide R&D using AI-driven microbial selection, aiming to cut development time and enhance bioinsecticide solutions for global crop protection.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Biopesticides Market Segmentation, By Source

8. Biopesticides Market Segmentation, By Type

9. Biopesticides Market Segmentation, By Formulation

10. Biopesticides Market Segmentation, By Crop Type

11. Biopesticides Market Segmentation, By Mode of Application

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practice

15. Conclusion

Buy Full Research Report on Biopesticides Market 2024-2032 @ https://www.snsinsider.com/checkout/5789

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.