Austin, March 20, 2025 (GLOBE NEWSWIRE) -- Inspection and Maintenance Robots Market Size & Growth Insights:

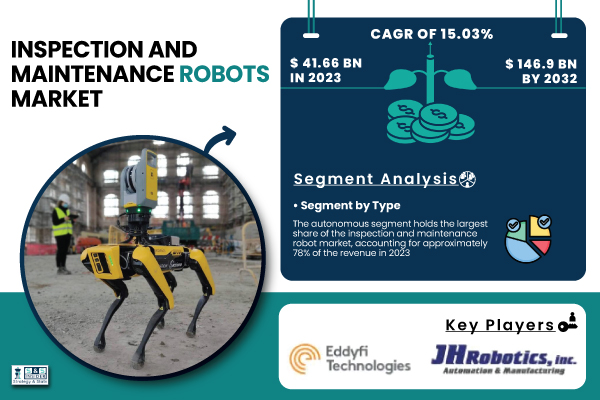

According to the SNS Insider,“The Inspection and Maintenance Robots Market Size was valued at USD 41.66 billion in 2023 and is expected to reach USD 146.9 billion by 2032, and grow at a CAGR of 15.03% over the forecast period 2024-2032.”

Automation and Sustainability Transforming Inspection and Maintenance with Robotics

The rise of automation is revolutionizing inspection and maintenance by enhancing efficiency, safety, and cost-effectiveness. Industries are increasingly adopting robotics to streamline operations, minimize human error, and handle hazardous or complex tasks with minimal human intervention. These robots optimize maintenance routines, maximize uptime, and improve inspection accuracy, reducing labor costs while enhancing safety and equipment reliability. Additionally, automation enables businesses to scale operations efficiently while complying with regulatory standards. Simultaneously, the growing focus on sustainability is driving industries to integrate robotics for environmental monitoring.

Get a Sample Report of Inspection and Maintenance Robots Market Forecast @ https://www.snsinsider.com/sample-request/1364

Leading Market Players with their Product Listed in this Report are:

- ULC Robotics (USA) – Pipeline inspection robots, robotic solutions for infrastructure maintenance

- Eddyfi (Canada) – Eddy current array (ECA) inspection systems, NDT (non-destructive testing) robots

- JH Robotics, Inc. (USA) – Robotic inspection systems, automated robotic devices for pipeline maintenance

- Oceaneering (USA) – Remote-operated vehicles (ROVs), robotic systems for subsea inspection and maintenance

- Robotnik (Spain) – Autonomous mobile robots (AMRs), robotic solutions for industrial environments

- LEO Robotics (USA) – Inspection robots for industrial and hazardous environments

- Superdroid Robots, Inc. (USA) – Custom robotic platforms, inspection robots for various industrial sectors

- FARO Technologies, Inc. (USA) – 3D measurement and inspection equipment, laser scanning robots

- Cognex Group (USA) – Vision sensors, machine vision systems for robotic inspection

- Shell (Netherlands) – Robotic systems for maintenance and inspection of energy and oil assets

- Aetos Group (USA) – UAVs and robotic platforms for inspections and maintenance in high-risk areas

- Ensign Bickford Industries (USA) – Robotics solutions for hazardous material detection and maintenance

- GE Inspection Robotics (USA) – Robotics for industrial inspections, including tank and vessel inspection robots

- Gecko Robotics (USA) – Wall-climbing robots, industrial inspection and maintenance robots

- Genesis Systems Group (USA) – Robotics automation systems for industrial inspection, welding, and maintenance.

Inspection and Maintenance Robots Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 41.66 Billion |

| Market Size by 2032 | USD 146.9 Billion |

| CAGR | CAGR of 15.09% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type (Autonomous, Remotely Operated) • By Application (Oil & Gas, Food & Beverage, Utility, Others) • By Component (Hardware, Software) |

| Key Drivers | • Automation Revolution Enhancing Efficiency and Safety in Inspection and Maintenance Processes. • Advancing Sustainability Through Robotics in Environmental Monitoring. |

Do you Have any Specific Queries or Need any Customize Research on Inspection and Maintenance Robots Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/1364

Inspection and maintenance robots play a crucial role in tracking pollution, gas emissions, and energy efficiency in real-time, helping industries meet environmental regulations. By automating air, water, and soil quality assessments, these robots not only reduce human exposure to hazardous conditions but also contribute to sustainability by optimizing resource use, minimizing waste, and lowering carbon emissions. This shift towards automated environmental monitoring presents new opportunities for robotic solutions across industries, reinforcing the synergy between automation and sustainability in modern industrial operations.

Evolving Landscape of Inspection and Maintenance Robots by Type, Application, and Component

By Type

In 2023, the autonomous segment dominated the inspection and maintenance robot market with a 78% revenue share. This growth was driven by increasing demand for AI-powered robots that operate in hazardous environments with minimal human intervention, enhancing efficiency, safety, and reliability across industries like oil & gas, utilities, and manufacturing.

The remotely operated segment is expected to grow the fastest from 2024 to 2032, driven by increasing demand for real-time data collection and precision in hard-to-reach areas. Industries such as oil & gas, aerospace, and utilities rely on these robots for safe, efficient inspections and maintenance, reducing risks and improving operational efficiency in hazardous environments.

By Application

In 2023, the oil & gas sector led the market with a 50% revenue share, driven by the growing adoption of inspection and maintenance robots. These robots enhance operational efficiency by conducting real-time infrastructure monitoring and preventative maintenance, reducing downtime and improving safety in hazardous environments where human access is limited. Their role is crucial in ensuring system reliability.

The utility segment is expected to experience the fastest growth over the forecast period 2024-2032 , driven by the rising demand for efficient inspection solutions in power grids, water treatment plants, and renewable energy systems. Inspection and maintenance robots enhance safety, reduce downtime, and optimize performance, making them essential for maintaining critical infrastructure in increasingly complex and hazardous environments.

By Component

In 2023, the hardware segment accounted for 69% of the market, fueled by advancements in sensors, actuators, cameras, and robotic arms. These innovations enhance durability, precision, and performance, enabling robots to operate effectively in challenging environments. The growing need for reliable and high-performance robotic systems continues to drive demand for advanced hardware components.

The software segment is set for the fastest growth over the forecast period 2024-2032 , as AI, machine learning, cloud computing, and remote monitoring enhance robotic capabilities for autonomous decision-making and operational optimization. The ongoing integration of automation and intelligence into inspection and maintenance robots continues to reshape industrial efficiency, safety, and sustainability.

Purchase Single User PDF of Inspection and Maintenance Robots Market Report (33% Discount) @ https://www.snsinsider.com/checkout/1364

North America's Dominance and Asia-Pacific’s Rapid Growth in Inspection and Maintenance Robots

North America led the Inspection and Maintenance Robot Market in 2023, capturing 40% of total revenue. This dominance is fueled by strong technological capabilities, widespread automation adoption, and significant investments in industries like oil & gas, manufacturing, utilities, and aerospace. Robust regulatory frameworks emphasizing safety, efficiency, and sustainability further drive demand for robotic solutions. Additionally, the presence of key robotics innovators accelerates advancements in autonomous and remotely operated systems, enhancing operational reliability and minimizing downtime.

Asia-Pacific is set to be the fastest-growing region from 2024 to 2032, driven by increasing industrial automation, infrastructure expansion, and demand from critical sectors. Countries like China, Japan, and India are investing heavily in robotic technologies to improve safety and efficiency while reducing costs in hazardous environments. The rise of smart cities, renewable energy projects, and Industry 4.0 integration is further fueling demand for next-generation inspection and maintenance robots. With its expanding industrial base and technological progress, Asia-Pacific is emerging as a global leader in automation, reshaping the market landscape.

Recent Development

- February 13, 2024 – Con Edison and ULC Technologies successfully tested a Cable Splicing Machine designed to automate medium-voltage cable termination, enhancing worker safety and grid reliability. The machine improves splice consistency, reduces high-voltage exposure, and minimizes outage durations, strengthening overall network resilience.

- January 27, 2025 – FARO Technologies launched the Leap ST handheld 3D scanner, expanding its metrology-grade product line with five advanced scanning modes. Alongside this, FARO updated its CAM2 software, introducing tailored versions for enhanced scanning and probing capabilities in manufacturing.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates

5.2 Robot Deployment and Utilization

5.3 Cost Reductions and Efficiency Gains

5.4 Failure Rates and Downtime Data

6. Competitive Landscape

7. Inspection and Maintenance Robots Market Segmentation, by Type

8. Inspection and Maintenance Robots Market Segmentation, by Application

9. Inspection and Maintenance Robots Market Segmentation, by Component

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access More Research Insights of Inspection and Maintenance Robots Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/inspection-and-maintenance-robot-market-1364

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.