Austin, March 17, 2025 (GLOBE NEWSWIRE) -- Blood Collection Market Size & Growth Analysis:

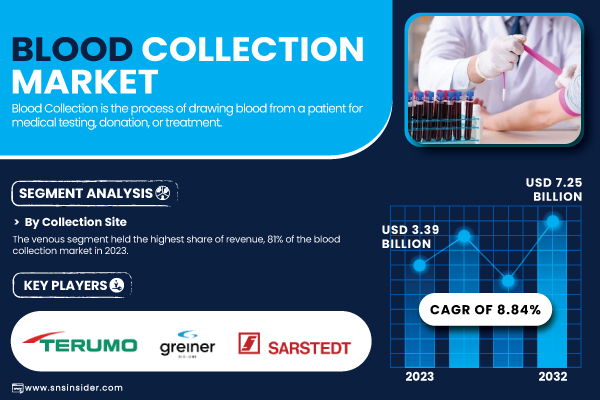

“According to SNS Insider, the global Blood Collection Market valued at USD 3.39 billion in 2023, is projected to Hit USD 7.25 billion by 2032, growing at a CAGR of 8.84% from 2024 to 2032.”

The blood collection market is growing at a considerable rate due to advances in technology and a rise in the need for diagnostic testing. The developments in blood collection devices, like the innovation of safety-engineered devices and minimally invasive procedures, are improving patient experience and process efficiency. Moreover, the growth in chronic diseases like diabetes, cardiovascular disease, and cancer is rapidly driving the need for routine blood testing, further accelerating the growth of the market.

Get a Sample Report of Blood Collection Market@ https://www.snsinsider.com/sample-request/5862

Governments across the globe are investing in healthcare infrastructure, especially in developing economies, which is also driving the market further. The rising use of automated blood collection techniques, to enhance precision and minimize contamination risk, is also driving the market. In addition, the rising demand for home-based and point-of-care testing solutions is driving the demand for effective and easy blood collection techniques, which is going to define the future of the industry.

Major Players Analysis Listed in this Report are:

- Becton, Dickinson and Company (BD) (Vacutainer Blood Collection Tubes, BD Vacutainer Safety-Lok Blood Collection Set)

- Terumo Corporation (VENOJECT Blood Collection Tube, Surshield Safety Winged Blood Collection Set)

- Greiner Bio-One International GmbH (VACUETTE Blood Collection Tubes, VACUETTE Safety Blood Collection Set)

- Sarstedt AG & Co. KG (S-Monovette Blood Collection System, Safety-Multifly Winged Needle Set)

- Nipro Medical Corporation (VACUETTE Blood Collection Tubes, Nipro SafeTouch Blood Collection Needle)

- F.L. Medical S.r.l. (Blood Collection Tubes, Blood Collection Needles)

- Improve Medical Instruments Co., Ltd. (Vacuum Blood Collection Tubes, Safety Blood Collection Needles)

- Sekisui Medical Co., Ltd. (Venous Blood Collection Tubes, Blood Collection Needles)

- Medtronic plc (Minimed 770G Insulin Pump System, Guardian Sensor 3)

- Haemonetics Corporation (NexSys PCS Plasma Collection System, MCS+ 9000 Blood Collection System)

- Fresenius Kabi AG (CompoGuard Blood Component Separator, CompoMat G5 Automated Blood Component Separator)

- Macopharma SA (Blood Collection Bags, Leucolab LCG2 Leukocyte Reduction Filters)

- B. Braun Melsungen AG (Vasofix Safety IV Catheters, Introcan Safety IV Catheters)

- Smiths Medical (Jelco Safety IV Catheters, ViaValve Safety IV Catheters)

- Retractable Technologies, Inc. (VanishPoint Blood Collection Set, VanishPoint Blood Collection Tube Holder)

- Cardinal Health (Monoject Blood Collection Tubes, Monoject Blood Collection Needles)

- Thermo Fisher Scientific Inc. (Nunc Serum Vials, Samco Blood Collection Tubes)

- Abbott Laboratories (Cell-Dyn Hematology Analyzers, i-STAT Handheld Blood Analyzer)

- Roche Diagnostics (Accu-Chek Blood Glucose Monitoring Systems, Cobas Blood Gas Analyzers)

- Masimo Corporation (Rad-97 Pulse CO-Oximeter, Pronto Noninvasive Hemoglobin Monitor)

Blood Collection Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.39 billion |

| Market Size by 2032 | US$ 7.25 billion |

| CAGR | CAGR of 8.84% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Collection Site

The venous blood collection segment led the market in 2023 and accounted for 81% of overall revenue. This technique is still the gold standard because it can harvest greater blood volumes required for several diagnostic tests. Hospitals, diagnostic laboratories, and blood banks mostly depend on venous blood collection because of its efficiency and accuracy.

The capillary blood collection segment would be the fastest-growing one with the rising need for point-of-care testing and minimally invasive procedures. Capillary blood collection is especially helpful in pediatric and geriatric populations, where access through veins becomes difficult. Growing usage of home-based glucose meters and rapid diagnosis kits is also fueling the growth of this segment.

By Application

Diagnostics held 67% of the market share in 2023, and it was the largest segment. The rise in the incidence of chronic conditions and the upsurge in the need for regular blood tests to track health conditions have also boosted the diagnostics segment considerably. The growth in preventive healthcare programs has further consolidated the leadership role of this segment.

The treatment segment is expected to have the highest growth, fueled by the growing application of blood components in therapeutic procedures. As there is an increase in surgeries, trauma cases, and sophisticated medical treatments involving blood transfusion, the demand for treatment purposes for blood collection is on the rise. Growth in blood banks and growing awareness regarding blood donation are also fueling the growth of this segment.

By Method

The manual blood collection technique dominated the market in 2023, accounting for 74% of the overall market share. The reason behind its dominance is its affordability and ubiquitous availability, primarily in developing countries. Healthcare institutions worldwide still use manual blood collection because of its versatility and lower infrastructure demands.

Automated blood collection technology is predicted to increase at the highest rate, owing to increasing demand for accuracy and efficiency in high-volume test environments. Automated systems minimize contamination risks and maximize sample consistency, which explains why they are gaining popularity in large diagnostic laboratories and blood banks. Enhanced adoption of robotic technologies and AI-driven collection systems further consolidates the growth opportunity for this segment.

By End Use

Hospitals dominated the largest end-user segment in 2023 with a 37% market share. The large patient flow and the extensive list of diagnostic and treatment procedures that need blood samples are reasons for this leadership. Blood sampling for surgical procedures, emergency departments, and specialized treatments keeps hospitals leading this segment.

Diagnostic centers are expected to see the most rapid growth as demand for specialized testing services continues to rise. With hospitals outsourcing laboratory services to specialized diagnostic facilities more and more, these centers are increasing their infrastructure to meet the rising workload. The growth of independent labs and mobile diagnostic services is also driving this segment's growth.

Need Any Customization Research on Blood Collection Market, Enquire Now@ https://www.snsinsider.com/enquiry/5862

Blood Collection Market Segmentation

By Collection Site

- Venous

- Needles and Syringes

- Double-Ended Needles

- Winged Blood Collection Sets

- Standard Hypodermic Needles

- Other Blood Collection Needles

- Blood Collection Tubes

- Serum-separating

- EDTA

- Heparin

- Plasma-separating

- Blood Bags

- Others

- Needles and Syringes

- Capillary

- Lancets

- Micro-Container Tubes

- Micro-Hematocrit Tubes

- Warming Devices

- Others

By Method

- Manual Blood Collection

- Automated Blood Collection

By Application

- Diagnostics

- Treatment

By End Use

- Hospitals

- Emergency Departments

- Diagnostics Centers

- Blood Banks

- Others

Regional Analysis

North America led the blood collection market in 2023, with 39% of the overall market share. The region's established healthcare infrastructure, high healthcare expenditure, and dominant presence of top diagnostic firms are the reasons behind its leadership. Moreover, the increasing incidence of lifestyle diseases, including diabetes and cardiovascular diseases, necessitates regular blood testing.

The Asia-Pacific is expected to be the fastest-growing market because of rising investments in healthcare, a growing population, and improving awareness regarding regular screening of health. China and India are among the leading countries in the growth, with preventive healthcare being encouraged through government policy and the increase in diagnostic services access. Advanced blood collection technologies and rapid urbanization further drive the expansion of the market in the region.

Recent Developments

- January 2025 – Becton, Dickinson, and Company (BD) introduced a new line of blood collection tubes intended to enhance sample quality and decrease redraws. The new tube provides a 15% gain in sample stability over earlier models.

- April 2024 – Streck launched Protein Plus BCT, a whole blood collection tube for stabilizing plasma proteins across a concentration range under room temperature. It is to be used only for research.

- June 2024 – Tasso partnered with Lindus Health to launch an innovative remote system of blood collection for clinical trials that increases accessibility to patients while lessening procedure discomfort.

- May 2024 – QIAGEN introduced the QIAseq Multimodal DNA/RNA Library Kit, which simplifies the preparation of DNA and RNA libraries from one blood sample, and enhances efficiency in genetic and biomarker research.

Statistical Insights and Trends

- The global prevalence of diabetes reached 9.3%, driving demand for frequent blood glucose monitoring and diagnostic testing.

- Approximately 70% of medical decisions are based on laboratory test results, reinforcing the crucial role of blood collection in modern healthcare.

- The adoption of automated blood collection systems is expected to increase significantly, with over 60% of diagnostic labs projected to integrate automation by 2032.

- Government and private healthcare expenditures on blood collection devices and services exceeded USD 1.2 billion, reflecting the growing importance of efficient diagnostic systems.

- Over 118 million blood donations were recorded globally, with an increasing shift towards voluntary and non-remunerated donations to ensure a stable blood supply.

Buy a Single-User PDF of Blood Collection Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/5862

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Blood-Related Disorders (2023)

5.2 Blood Collection Device Volume and Growth (2020-2032)

5.3 Healthcare Spending on Blood Collection Procedures (2023)

5.4 Blood Donation and Collection Trends (2023)

5.5 Technological Advancements in Blood Collection (2023)

5.6 Regulatory Compliance and Standardization (2023)

6. Competitive Landscape

7. Blood Collection Market by Collection Site

8. Blood Collection Market by Method

9. Blood Collection Market by Application

10. Blood Collection Market by End Use

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Blood Collection Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/blood-collection-market-5862

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.