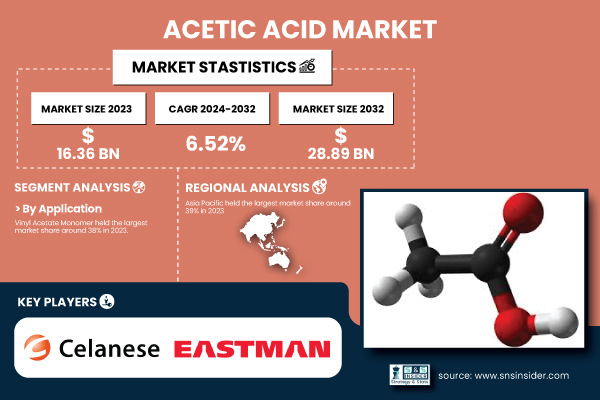

Austin, March 17, 2025 (GLOBE NEWSWIRE) -- The acetic acid market is projected to reach a valuation of USD 28.89 billion by 2032, expanding at a compound annual growth rate (CAGR) of 6.52% from 2024 to 2032. Acetic acid serves as an important feedstock in the manufacturing of chemicals such as vinyl acetate monomer (VAM), acetic anhydride, and acetate esters that go into adhesives, coatings, and textiles. Also, the increasing use of acetic acid in the food industry as a preservative and flavoring agent is driving the growth of the market.

This market growth is propelled by stringent government regulations supporting bio-based chemicals and sustainable production methods. New technologies like the production of bio-based acetic acid and carbon-efficient processing technologies are making acetic acid a greener and more economical product. Another major factor driving market growth is the growing use of acetic acid to produce purified terephthalic acid (PTA) for the polyester industry. In addition, the increasing trend of consumers towards organic food products is driving its demand, due to vinegar production containing acetic acid which is further boosting its market growth.

Download PDF Sample of Acetic Acid Market @ https://www.snsinsider.com/sample-request/5975

Key Companies:

- Celanese Corporation (Acetic Acid, Vinyl Acetate Monomer)

- Eastman Chemical Company (Acetic Anhydride, Cellulose Esters)

- LyondellBasell Industries Holdings B.V. (Polypropylene, Advanced Polyolefins)

- SABIC (Chemicals, Polymers)

- HELM AG (Chemical Feedstocks, Crop Protection Products)

- Indian Oil Corporation Ltd. (Petroleum Products, Petrochemicals)

- Gujarat Narmada Valley Fertilizers & Chemicals Limited (Fertilizers, Chemicals)

- DAICEL CORPORATION (Cellulose Acetate, Organic Chemicals)

- Dow (Chemicals, Plastics)

- INEOS (Petrochemicals, Specialty Chemicals)

- Jiangsu Sopo (Group) Co., Ltd. (Glacial Acetic Acid, Vinyl Acetate)

- Mitsubishi Chemical Corporation (Chemicals, Performance Products)

- Wacker Chemie AG (Silicones, Polymers)

- Chang Chun Group (Petrochemicals, Electronic Chemicals)

- Kingboard Holdings Limited (Laminates, Chemicals)

- Shandong Hualu-Hengsheng Chemical Co., Ltd. (Methanol, Urea)

- Yankuang Group (Coal Chemicals, Methanol)

- Shanghai Huayi (Group) Company (Chemicals, Plastics)

- BP (Energy Products, Chemicals)

- PetroChina (Petroleum Products, Petrochemicals)

Acetic Acid Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 16.36 Billion |

| Market Size by 2032 | USD 28.89 Billion |

| CAGR | CAGR of 6.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Vinyl Acetate Monomer, Acetic Anhydride, Acetate Esters, Purified Terephthalic Acid, Ethanol, Others) •By End User Industry (Food and beverages, Paints and coating, Plastics & Polymers, Pharmaceutical, Chemicals, Others) |

| Key Drivers | • Rising demand for vinyl acetate monomer (VAM) which drives market growth. |

If You Need Any Customization on Acetic Acid Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/5975

Which Region Leads the Acetic Acid Market Growth?

In 2023, the Asia Pacific region accounted for the largest market share, approximately 39%. The region's dominance is attributed to its strong industrial base, rapid urbanization, and high demand for acetic acid across industries. Countries such as China, India, Japan, and South Korea are major contributors, owing to their expanding chemical and textile industries. China, the world’s largest producer and consumer of acetic acid, has witnessed substantial investments in production capacity expansion and technological advancements. Government initiatives supporting sustainable chemical production and the increasing demand for PTA and VAM in the region are bolstering market growth. Furthermore, the availability of raw materials, cost-effective production, and a well-established supply chain network enhance the region's market position.

Market Segmentation

By Application

In 2023, Vinyl Acetate Monomer (VAM) contributed to the largest market share of 38%. This dominance is due to its extensive application in adhesives, paints, coatings, and textiles. VAM is a crucial intermediate in the production of polyvinyl acetate (PVA) and polyvinyl alcohol (PVOH), which are widely used in the construction and packaging industries. Additionally, increasing investments in infrastructure projects and the rising demand for high-performance adhesives are further driving the demand for VAM.

Other key product segments include acetic anhydride, acetate esters, and purified terephthalic acid (PTA), each playing a vital role in diverse industrial applications such as pharmaceuticals, food preservation, and plastics manufacturing.

By End Use Industry

Plastics & Polymers are the biggest share of the market around 38% in 2023. With the prevalence of derivatives of acetic acid, in the acetic acid market. VAM serves as an important intermediate in the production of polyvinyl acetate (PVA) and ethylene-vinyl acetate (EVA) copolymers with diverse end-use industries such as adhesives, coatings, and flexible packaging. In contrast, another derivative PT is a required feedstock for the petrochemical polyethylene terephthalate (PET), used in common, widespread applications in packaging, textiles, and beverage bottles. Increasing global demand for sustainable and lightweight plastic packaging, especially from the food &beverage and e-commerce industry is further fuelling the adoption of such polymers. Growing adoption of EVA across solar panel encapsulations, foot, and medical end-use sectors has also been driving sales within the Plastics & Polymers segment. It is expected to dominate the acetic acid market throughout the forecast period, driven primarily by the growing demand for bio-based polymers and recyclable plastics.

Recent Developments

- In 2023, Celanese Corporation announced the expansion of its acetic acid production capacity in China to meet the growing regional demand for VAM and specialty chemicals.

- In 2023, BP and Lotte Chemical entered into a strategic partnership to enhance bio-based acetic acid production, aligning with sustainability goals and reducing carbon emissions.

- In 2023, Eastman Chemical Company launched a new acetic acid technology aimed at improving production efficiency and reducing environmental impact.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Acetic Acid Market Segmentation, By Application

8. Acetic Acid Market Segmentation, by End-Use Industry

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practice

12. Conclusion

Buy Full Research Report on Acetic Acid Market 2024-2032 @ https://www.snsinsider.com/checkout/5975

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.