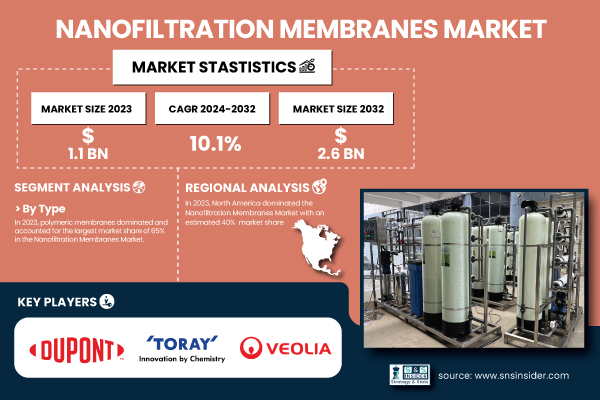

Austin, March 11, 2025 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Nanofiltration Membranes Market Size was valued at 1.1 Billion in 2023 and is expected to reach USD 2.6 Billion by 2032, growing at a CAGR of 10.1% over the forecast period of 2024-2032.”

The Nanofiltration Membranes market is projected to witness substantial growth in the coming years, driven by rising investments in water treatment infrastructure, advancements in membrane technology, and growing demand across various end-use sectors. Governments and organizations around the world are implementing strict regulations for industrial wastewater discharge, further boosting the adoption of nanofiltration membranes. Based on data analysis by the U.S. Environmental Protection Agency (EPA), approximately 80% of industrial wastewater needs to be treated before being released, which bolsters the need for advanced filtration solutions. Moreover, demand for the water reuse project in Europe further enhances the market since the European Environment Agency (EEA) estimates have the presence of up to 2700 water reuse project in continent. Global firms like DuPont have also reported R&D investments in membrane improvements. In 2023, Toray Industries had launched a new high-rejection nanofiltration membrane. Nanofiltration is gaining traction in food and beverage processing, and, as a result, is an important contributor to the emergence of the food & beverage industry as a key user. In Asia-Pacific, a surge in regional market growth has been widened, following China’s Ministry of Ecology and Environment imposing stringent water purification standards. The growing need for desalination in water-stricken areas, along with these advancements is boosting the growth of the nanofiltration membranes industry.

Download PDF Sample of Nanofiltration Membranes Market @ https://www.snsinsider.com/sample-request/5637

Key Players:

- DuPont Water Solutions (FilmTec NF membranes, FilmTec NF Plus membranes)

- Toray Industries, Inc. (Toray NF membranes, Toray NF-90 membranes)

- Veolia Environnement S.A. (Hydranautics ESPA NF membranes, Hydranautics LFC1 membranes)

- Alfa Laval AB (Alfa Laval NF membranes, Alfa Laval RO/NF membranes)

- GEA Group AG (GEA NF membranes, GEA Reverse Osmosis membranes)

- Hydranautics (ESPA NF membranes, LFC3 membranes)

- NX Filtration (NX Filtration NF membranes, NX Filtration NF100)

- Pall Corporation (Pall Nanofiltration membranes, Pall Aria NF membranes)

- Pentair (Pentair X-Flow NF membranes, Pentair RO/NF membranes)

- Koch Separation Solutions (Koch TFC NF membranes, Koch Sepro NF membranes)

- Pure Aqua Inc. (Pure Aqua NF membranes, Pure Aqua NF-4040 membranes)

- Synder Filtration Inc. (Synder NF membranes, Synder 8040 NF membranes)

- Applied Membranes Inc. (Applied NF membranes, Applied Membranes NF-400)

- Nitto Denko Corporation (Nitto NF membranes, Nitto NF-90 membranes)

- Osmotech Membranes Pvt. Ltd. (Osmotech NF membranes, Osmotech NF-4040)

- SPX FLOW Inc. (SPX FLOW membrane filters, SPX FLOW NF membranes)

- Vontron Technology Co., Ltd. (Vontron NF membranes, Vontron NF-4040)

- Argonide Corporation (Argonide NF membranes, Argonide NF-90)

- Danaher (Danaher NF membranes, Danaher reverse osmosis membranes)

- Merck & Co. (Merck NF membranes, Merck Millipore NF membranes)

Nanofiltration Membranes Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 1.1 Billion |

| Market Size by 2032 | USD 2.6 Billion |

| CAGR | CAGR of 10.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Polymeric, Ceramic, Hybrid) •By Membrane Module (Spiral wound, Tubular, Hollow fiber, Flat sheet, Others) •By Application (Water & Wastewater Treatment, Food & Beverage, Pharmaceutical & Biomedical, Chemical & Petrochemical, Others) •By End-Use (Municipal, Industrial, Commercial) |

| Key Drivers | • Rising Demand for High-Quality Filtration in the Food and Beverage Industry Accelerates the Nanofiltration Membranes Market |

If You Need Any Customization on Nanofiltration Membranes Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/5637

By Type, Polymeric Membranes Dominated the Nanofiltration Membranes Market in 2023 with a 65% Market Share

Polymeric membranes held the largest share of the overall market due to their low cost, ease in fabrication, and versatility of deployment in multiple types of applications. These membranes have found applications in water treatment, food & beverage, and pharmaceutical industries. Their higher selectivity and durability make them more favorable for desalination and wastewater recycling. Major builders, mentioning Hydranautics and DuPont, have developed high-performance polymeric membranes that achieve heightened rejection rates. The ongoing rise in water pollution, and thus the demand for both drinking water and industrial wastewater treatment is anticipated to increase polymeric membrane implementation even more.

By Application, Water & Wastewater Treatment Dominated the Nanofiltration Membranes Market in 2023 with a 55% Market Share

The Water & Wastewater Treatment segment led the market due to increasing concerns regarding water scarcity, along with strict waste water regulations. Nanofiltration Membranes are widely utilized in municipal and industrial wastewater treatment plants for the removal of contaminants and to comply with environmental laws. The expanding use of decentralized water treatment systems in developing regions, as well as increased investment in desalination plants in the Middle East are driving demand. For example, Saudi Arabia’s National Water Company this month announced a $2.5 billion investment in advanced water treatment projects by 2025.

By End-Use, Municipal Dominated the Nanofiltration Membranes Market in 2023 with a 50% Market Share

The Municipal segment dominated the market owing to rapid urbanization and large-scale water supply networks. Municipal nanofiltration membrane adoption has advanced significantly through various government-launched programs to improve water quality, like India’s Jal Jeevan Mission and the EU’s Water Framework Directive. Water-stressed cities like Los Angeles and Cape Town are exploring advanced filtration technologies to ensure sustainable water access. Moreover, the growing adoption of intelligent water treatment solutions, embedded with IoT-based monitoring are further facilitating growth in the market.

North America dominated the Nanofiltration Membranes market in 2023, holding a 40% market share.

The Nanofiltration Membranes market in North America was dominated by the stringent regulations and advanced developments of membrane technology in North America. The U.S. Environmental Protection Agency (EPA) has set stringent wastewater discharge limits, forcing industries to implement high-performance filtration solutions. Koch Membrane Systems and DuPont, both major companies, are also working on membrane innovation. Recent increased awareness about PFAS (per- and polyfluoroalkyl substances) in drinking waters, and hence rising demand to remove PFAS from waters, has further enhanced the growth of the market.

Asia Pacific Emerged as The Fastest-Growing Market with A Significant Growth Rate in The Forecast Period

Asia Pacific is the fastest-growing market due to rapid industrialization and increasing demand for water purification. Wastewater treatment infrastructure projects in China, India, and Southeast Asian countries are also attracting more investments. Nanofiltration membranes are being adopted more widely because China's Five-Year Plan requires better water quality. Additionally, increasing requirements from food & beverage industry especially in terms of dairy and beverages processing, will continue to promote the market expansion in the region.

Recent Highlights

- February 2025: Memsift and Singapore Institute of Technology presented nanofiltration membranes to achieve chemical recovery of 90% in microelectronics wastewater

- September 2024: DuPont’s FilmTec Nanofiltration membranes received a sustainability award for innovations in water purification and industrial reuse.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Nanofiltration Membranes Market Segmentation, by Type

8. Nanofiltration Membranes Market Segmentation, by Membrane Module

9. Nanofiltration Membranes Market Segmentation, by Application

10. Nanofiltration Membranes Market Segmentation, by End-Use

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practice

14. Conclusion

Buy Full Research Report on Nanofiltration Membranes Market 2024-2032 @ https://www.snsinsider.com/checkout/5637

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.