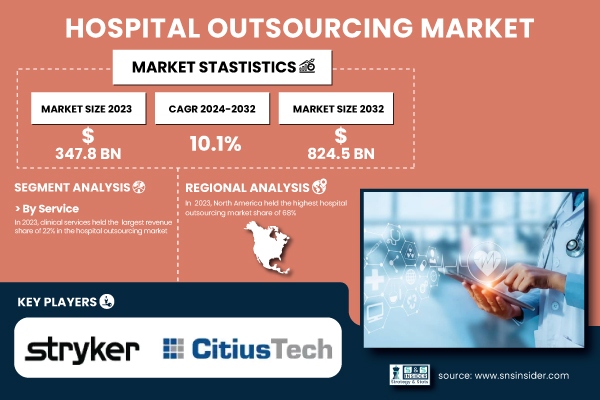

Pune, March 04, 2025 (GLOBE NEWSWIRE) -- “According to SNS Insider, The Hospital Outsourcing Market size was valued at USD 347.8 billion in 2023 and is projected to reach USD 824.5 billion by 2032, expanding at a CAGR of 10.1% during the forecast period of 2024 to 2032.”

The Hospital Outsourcing Market growth is driven by rising complexity of healthcare services, coupled with the need to reduce operational burdens, has led hospitals to outsource non-core functions, enabling them to focus on patient care and clinical outcomes.

Market Analysis

The increasing cost of healthcare delivery is the major driver of the hospital outsourcing market. To reduce overhead costs and improve efficiency, hospitals are increasingly outsourcing services, from clinical care to administrative and facility management. In addition, increasing demand for specialized services, including diagnostic imaging, laboratory testing, and IT services has also contributed to the market expansion. The adoption of outsourcing is accelerated by hospitals faced unprecedented challenges in managing resources and maintaining service quality. Another growth driver includes government initiatives and policies to improve healthcare infrastructure and reduce costs. For example, the U.S. government has implemented numerous initiatives to help healthcare providers adopt cost-effective solutions, such as outsourcing. In Europe government is calling for public private partnership to improve health care delivery and decrease load on public hospital.

Get a Sample Report of Hospital Outsourcing Market@ https://www.snsinsider.com/sample-request/5834

Key Hospital Outsourcing Companies Profiled

- Baxter International (Intravenous therapy solutions, Artificial kidney devices)

- Stryker Corporation (Orthopedic implants, Surgical navigation systems)

- CitiusTech (Healthcare data analytics, Health information technology solutions)

- Hill-Rom Holdings, Inc. (Hospital smart beds, Patient monitoring systems)

- Greenway Health (Electronic health records (EHR) systems, Practice management solutions)

- Medtronic (Cardiac devices, Minimally invasive surgical instruments)

- Philips Healthcare (Medical imaging systems, Patient monitoring equipment)

- GE Healthcare (Diagnostic imaging equipment, Healthcare IT services)

- Siemens Healthineers (Laboratory diagnostics, Advanced therapy solutions)

- Cerner Corporation (Health information technologies, Electronic health record systems)

- Allscripts Healthcare Solutions (Practice management software, Revenue cycle management)

- McKesson Corporation (Pharmaceutical distribution services, Healthcare management software)

- Cardinal Health (Medical supply distribution, Inventory management solutions)

- Fresenius Medical Care (Dialysis equipment, Renal care services)

- DaVita Inc. (Kidney care services, Dialysis center management)

- HCA Healthcare (Hospital management services, Outpatient care facilities)

- Tenet Healthcare (Ambulatory surgery centers, Diagnostic imaging services)

- Aramark Healthcare (Clinical support services, Facilities management)

- Sodexo Healthcare (Patient nutrition services, Environmental services)

Hospital Outsourcing Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 347.8 billion |

| Market Size by 2032 | US$ 824.5 billion |

| CAGR | CAGR of 10.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segmentation Insights

By Service

The clinical segment held the largest revenue share of 22% in 2023, dominated the hospital outsourcing market. This segment comprises everything from diagnostic imaging and laboratory testing to specialized care (dialysis, oncology, cardiology, etc.) and nursing services. Clinical services come to the forefront due to the evolving landscape of healthcare delivery, the integration of cutting-edge medical technologies, and the rising need for specialized skillsets. Predictably, hospitals are outsourcing clinical services, as outsourcing enables them to mitigate future operational responsibilities, enhance patient outcomes, and provide access to the latest technologies without incurring significant capital expenditures. Diagnostic imaging services (MRI, CT scan, and X-rays) are frequently outsourced to specialized providers that have advanced equipment in addition to experienced and expert radiologists. This facilitates timely and accurate diagnoses, which are essential for effective patient care.

By Hospital Type

In 2023, the private hospitals segment dominated the market and accounted for 71% of its share. Private hospitals operate in a highly competitive environment, where efficiency, cost-effectiveness, and patient satisfaction are critical to maintaining profitability. By outsourcing non-core functions, private hospitals can reduce operational costs, improve the quality of services, and focus on the quality of patient care delivery. Private hospitals tend to outsource a variety of services ranging from clinical and administrative services to facility management. Many private hospitals, for instance, outsource their revenue cycle management (RCM) processes to dedicated providers to help them optimize billing, minimize errors, and boost their financial health. Hospital Facility Management Services Facility management services, including cleaning up, security and maintenance are always outsourced to ensure the hospital environment is safe and seamless.

Need any customization research on Hospital Outsourcing Market, Enquire Now@ https://www.snsinsider.com/enquiry/5834

Hospital Outsourcing Market Segmentation

By Service

- Healthcare IT

- Transportation Services

- Clinical Services

- Business Services

- Others

By Hospital Type

- Public

- Private

Regional Analysis

The North America region accounted for the largest share of the hospital outsourcing market, at 68%, in 2023. This dominance can be due to the region's robust healthcare infrastructure, high healthcare spending, and the presence of major market players. Driven by rapidly increasing adoption of outsourcing to reduce costs and enhance efficiency, the U.S. represents the region's largest market. According to the Centers for Medicare & Medicaid Services (CMS), U.S. healthcare spending reached USD 4.3 trillion in 2023, accounting for 18.3% of the GDP. The rising costs have prompted hospitals to consider cost-effective solutions like outsourcing e.g. outsourcing to reduce expenses in exchange for better utilization of human resources in the hospital.

The Asia-Pacific region is expected to witness the fastest growth in the hospital outsourcing market, Rapid improvements in healthcare infrastructure and a rise in healthcare investments will further drive the growth of the hospital outsourcing market in the region. Market growth is led by China, India, and Japan countries with governments taking steps to improve healthcare access and reduce costs. The Government of India, through its National Health Mission (NHM), has launched various reform initiatives with the intent to reorient health care services delivery, including outsourcing non-core services to private providers. Similarly, China's healthcare reforms have led to increased adoption of outsourcing to improve efficiency and reduce costs.

Recent Developments

- In 2023, leading facility management services company Sodexo further enhanced its healthcare outsourcing portfolio by acquiring one of the foremost hospital outsourcing companies in the U.S. It has enhanced Sodexo's defensive positioning in the hospital outsourcing segment.

- In January 2024, Cerner Corporation (now part of Oracle Health) launched a new outsourcing solution for revenue cycle management, specifically designed for hospitals. This solution integrates advanced analytics and automation to improve financial performance and reduce administrative burdens.

Buy a Single-User PDF of Hospital Outsourcing Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/5834

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Cost Savings & Efficiency Gains

5.2 Service Utilization Trends (2023)

5.3 Regional Spending & Investment

5.4 Regulatory Compliance & Vendor Accreditation

5.5 Technology Adoption in Outsourced Services

6. Competitive Landscape

7. Hospital Outsourcing Market by Service

8. Hospital Outsourcing Market by Hospital Type

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access Complete Report Details of Hospital Outsourcing Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/hospital-outsourcing-market-5834

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.