Pune, Feb. 28, 2025 (GLOBE NEWSWIRE) -- Proteinase K Market Size & Growth Analysis:

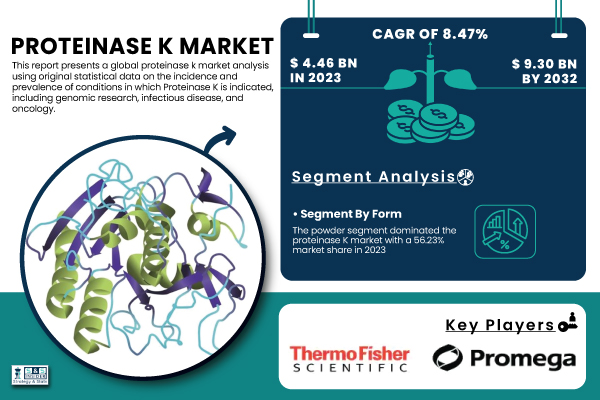

According to SNS Insider, The Proteinase K Market size was valued at USD 4.46 billion in 2023 and is projected to reach USD 9.30 billion by 2032, growing at a CAGR of 8.47% during the forecast period of 2024 to 2032.

The Proteinase K Market is driven by the growing use of next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies in research-based and diagnostic applications, leading to a significant rise in the consumption of Proteinase K.

Get a Sample Report of Proteinase K Market@ https://www.snsinsider.com/sample-request/5722

The increase in genomic research, as well as personalized medicine for various diseases, is one of the prominent factors driving the demand for Proteinase K. One of the most significant market drivers is the increasing utilization of next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies for research and diagnostics, which substantially increases the demand for Proteinase K. In addition, the rising prevalence of infectious diseases like HIV, hepatitis, and others is expected to boost market growth over the coming years. Proteinase K is widely utilized in diagnostic kits for pathogen detection, leading to its wide accessibility in clinical laboratories.

The expansion of the market can also be attributed to advances in biotechnology as well as new recombinant Proteinase K. Recombinant Proteinase K achieves superior purity, stability and activity over conventional sources, and thus is the material of choice for demanding applications. Additionally, the market is substantially driven by government support and funding for genomic research and infectious disease management. In the US, the National Institutes of Health (NIH) has invested heavily in genomic studies and diagnostics for infectious diseases, which is fueling demand for Proteinase K.

Major Players Analysis Listed in this Report are:

- Abcam plc (Abcam Proteinase K, Abcam Recombinant Proteinase K)

- Amano Enzyme Inc. (Amano Proteinase K, Microbial Proteinase K)

- Bio-Rad Laboratories, Inc. (Bio-Rad Proteinase K, PureProteome Proteinase K)

- Biorbyt Ltd. (Biorbyt Proteinase K, Biorbyt Enzyme Grade Proteinase K)

- Biovision Inc. (Biovision Proteinase K, Biovision Ultrapure Proteinase K)

- Creative Enzymes (Creative Enzymes Proteinase K, Recombinant Proteinase K)

- Enzo Life Sciences, Inc. (Enzo Proteinase K, Enzo Diagnostic Proteinase K)

- Eurofins Scientific (Eurofins Proteinase K, Genomics Proteinase K)

- F. Hoffmann-La Roche Ltd. (Roche Proteinase K, High Purity Proteinase K)

- GenScript Biotech Corporation (GenScript Proteinase K, Molecular Biology Grade Proteinase K)

- MedGenome Labs Ltd. (MedGenome Proteinase K, Clinical Grade Proteinase K)

- Merck KGaA (Proteinase K Solution, Proteinase K Lyophilized)

- New England Biolabs (NEB) (NEB Proteinase K, Monarch Proteinase K)

- Promega Corporation (Proteinase K, DNA IQ Proteinase K)

- Qiagen N.V. (QIAgen Proteinase K, QIAzol Lysis Reagent)

- Sekisui Diagnostics, LLC (Sekisui Proteinase K, Diagnostic Grade Proteinase K)

- Takara Bio Inc. (Takara Proteinase K, Nuclease-Free Proteinase K)

- Thermo Fisher Scientific, Inc. (Invitrogen Proteinase K, Pierce Proteinase K)

- Worthington Biochemical Corporation (Worthington Proteinase K, Research Grade Proteinase K)

- Zymo Research Corporation (Zymo Proteinase K, ZR Proteinase K)

Proteinase K Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.46 billion |

| Market Size by 2032 | US$ 9.30 billion |

| CAGR | CAGR of 8.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

For A Detailed Briefing Session with Our Team of Analysts, Connect with Us Now@ https://www.snsinsider.com/request-analyst/5722

Segment Analysis

By Form

The powder segment held the largest share of the Proteinase K market, at 56.23% in 2023. Powdered Proteinase K, however, is preferred as it is easy to store, has longer shelf life and is versatile in terms of applications. With its easy reconstitution to the concentration needed for a variety of research and diagnostic applications. Though liquid segment is a smaller segment, it is expected to steadily grow as it is convenient and ready to use, especially in high-throughput laboratories.

By Therapeutic Area

In 2023, the infectious diseases segment accounted for the largest share of the Proteinase K market at 31.15%. The proteinase K is widely used in the diagnosis of infectious diseases including viral, bacterial, and fungal infection. COVID-19 pandemic has tremendously raised the market demand for Proteinase K in the diagnostic kits for detection of SARS-CoV-2. This is mainly used in cancer research and genetic testing, contributing to market growth in other therapeutic areas including oncology and genetic disorders.

By Application

The isolation and purification of genomic DNA and RNA segment dominated the Proteinase K market with a 60.23% market share in 2023. The specifics of the application of proteinase K lay under nucleic acid extraction protocols to eliminate proteins and nucleases that antipodean with downstream applications. This has made it indispensable in research and diagnostics, particularly for its use in such techniques as PCR, NGS, and more. Other applications such as protein digestion or cell lysis are also important, especially in proteomics and cell biology studies.

By End-Use

In 2023, the Proteinase K market was dominated by the biotechnology companies segment with a market share of 37.45% Most of the users of Proteinase K include biotechnology companies, which use it in multiple research and development activities like drug discovery, genetic engineering, and diagnostic kit production. The academic and research institutions, encouraged by the rise in the global focus on genomic research, and molecular biology. Other major end-users include clinical laboratories and pharmaceutical companies, which utilize Proteinase K for various diagnostic and therapeutic purposes.

Proteinase K Market Segmentation

By Form

- Powder

- Liquid

By Therapeutic Area

- Infectious diseases

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune diseases

- Neurology

- Others

By Application

- Isolation and Purification of Genomic DNA & RNA

- In Situ Hybridization

- Mitochondria isolation

By End-use

- Contract Research Organization

- Academic Institutes

- Biotechnology Companies

- Diagnostic Laboratories

Regional Insights

North America is the largest market, with a share of about 44.26%. The region is led by high infectious disease prevalence, well-developed biotechnology and pharmaceuticals sectors, and substantial government support of genomic research. In particular, the United States has ramped up its investment both in research and diagnostics for understanding this viral outbreak, led by the NIH and CDC. Major market players, including Thermo Fisher Scientific and Merck KGaA, will also drive the market in the region.

Asia-Pacific is expected to be the fastest-growing market for Proteinase K due to rapid advancements in biotechnology infrastructure, growing healthcare budgets, and increasing prevalence of infectious diseases. The government of China, India, and Japan have also played a major role in contributing to this market, and are trying to improve their healthcare infrastructure and promote their genomic research capabilities. The National Health Mission (NHM) of the Indian government and China's 14th Five-Year Plan for Biotechnology Development are likely to drive the market growth in the region.

Recent Developments

- In 2023, Thermo Fisher Scientific launched a new recombinant Proteinase K product, offering higher purity and stability for critical applications in genomic research and diagnostics.

- In January 2024, Merck KGaA received regulatory approval for its advanced Proteinase K formulation, designed for use in high-throughput diagnostic kits for infectious diseases.

Buy a Single-User PDF of Proteinase K Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/5722

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Research Trends (2023), by Region

5.3 Application Volume by Region (2020-2032)

5.4 Healthcare Spending, by Region (2023)

5.5 Innovation and R&D

6. Competitive Landscape

7. Proteinase K Market by Form

8. Proteinase K Market by Therapeutic Area

9. Proteinase K Market by Application

10. Proteinase K Market by End-use

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Proteinase K Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/proteinase-k-market-5722

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.