Pune, Feb. 25, 2025 (GLOBE NEWSWIRE) -- HbA1c Testing Devices Market Size & Growth Analysis:

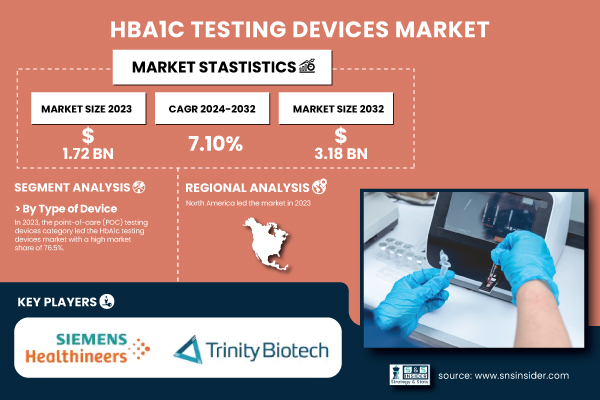

“According to SNS Insider, The Global HbA1c Testing Devices Market Size was valued at USD 1.72 billion in 2023, is anticipated to reach USD 3.18 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.10% from 2024 to 2032.”

The market's expansion is driven by

- Increasing Diabetes Cases: With diabetes becoming a global health concern, the need for accurate and efficient testing solutions is on the rise, fueling demand for HbA1c testing devices.

- Advancements in Diagnostic Technologies: The introduction of automated and portable testing devices enhances accuracy and efficiency in diabetes monitoring, further propelling market growth.

- Increased Government Support and Awareness: Government backing towards early diabetes detection and care and awareness campaigns are going a long way towards the utilization of HbA1c analysis machines.

- Growing Adoption of Point-of-Care Testing: Shift towards POC diagnostic products in clinics, hospitals, and homecare settings enhances convenience and accessibility, thereby driving market growth.

Get a Sample Report of HbA1c Testing Devices Market@ https://www.snsinsider.com/sample-request/5747

Major Players Analysis Listed in this Report are:

- Bio-Rad Laboratories, Inc. – D-10 System, VARIANT II TURBO, VARIANTnxt

- Abbott – Afinion 2 Analyzer, Architect c8000

- F. Hoffmann-La Roche Ltd – Cobas b 101, Cobas Integra 800

- Siemens Healthineers AG – DCA Vantage Analyzer, Atellica CH Analyzer

- HUMAN – HumaNex A1c

- Trinity Biotech – Premier Hb9210, PDQ Analyzer

- Menarini Diagnostics s.r.l – HA-8180V, HA-8180T

- SAKAE CO. LTD. – HbA1c Analyzer GA09

- Ceragem Medisys Inc. – CM HbA1c Analyzer

- SEKISUI MEDICAL CO., LTD. – SK HbA1c Analyzer

- GC Medical Science Corp. – GCHbA1c Analyzer

- Osang Healthcare Co., Ltd. – OHC HbA1c Analyzer

- EKF Diagnostics Holdings – Quo-Lab HbA1c, Quo-Test HbA1c

- Boditech Med Inc. – iChroma HbA1c

- Eurolyser Diagnostica GmbH – CUBE-S HbA1c

- Bayer AG – A1CNow+ System

HbA1c Testing Devices Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.72 billion |

| Market Size by 2032 | US$ 3.18 billion |

| CAGR | CAGR of 7.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segmentation Analysis

By Type of Device

In 2023, point-of-care (POC) testing devices led the HbA1c testing devices market with the largest market share because they can give rapid and effective results. These devices enable clinicians to make timely clinical decisions without laboratory-based testing and cut down on patient waiting times. The growing demand for decentralized diagnostic products, especially for outpatient care and remote healthcare delivery, has led to the prominence of the POC segment. The need for easy-to-use and transportable testing solutions also continues to increase, further contributing to adoption. In the future, the POC segment is expected to see the fastest growth over the forecast period, underpinned by improvements in device precision, price, and integration with digital health platforms. The rising incidence of diabetes globally, combined with the greater emphasis on early detection and individualized treatment, will also propel the growth of the POC HbA1c testing market.

By Technology

The immunoassays segment dominated the market in the HbA1c testing devices market in 2023 due to its established use in diabetes diagnosis. Immunoassays are highly sensitive and specific, thus a good choice for the measurement of HbA1c levels. The extensive use of immunoassay-based testing solutions in hospitals, diagnostic labs, and clinics has helped them dominate the market. Moreover, these tests are low in cost and have low operational complexity, thereby promoting their uptake in ongoing diabetes management. Nonetheless, HPLC is expected to have the highest growth rate throughout the forecast period. HPLC is superior in precision and can perform detailed molecular analysis, and it is thus very much in demand for sophisticated diagnostic use. Growth in demand for highly precise and standardized HbA1c testing technologies is anticipated to propel the growth of HPLC-based devices, especially among research centers, specialized diabetes clinics, and high-end diagnostic labs across the globe.

By End-Use

Hospitals and clinics dominated the HbA1c testing devices market in 2023 due to their position as first-line facilities for diabetes screening and long-term care. They possess advanced laboratory facilities, skilled personnel, and access to large patient populations in need of regular HbA1c testing. Government programs for promoting diabetes screening programs in hospitals and clinics have also helped them gain maximum market share. However, the homecare settings market is expected to experience the highest growth rate over the forecast period. The growing trend towards patient-focused care and self-management of diabetes is driving the need for home-based HbA1c testing solutions. The creation of small, simple-to-use, and low-cost testing devices allows patients to control their diabetes more effectively without having to visit hospitals repeatedly. Moreover, the implementation of digital health technologies, such as remote patient monitoring and telemedicine, is also speeding up the uptake of home-based HbA1c testing, especially in established and emerging health markets.

Need any customization research on HbA1c Testing Devices Market, Enquire Now@ https://www.snsinsider.com/enquiry/5747

HbA1c Testing Devices Market Segmentation

By Type of Device

- Laboratory-based Testing Devices

- Point-of-care (POC) Testing Devices

By Technology

- Immunoassays

- Chromatography

- Enzymatic Assays

- Boronate Affinity Chromatography

- High-Performance Liquid Chromatography

- Others

By End-use

- Hospitals & Clinics

- Diagnostic Laboratories

- Homecare Settings

Regional Insights

In 2023, North America was the most prominent region in the HbA1c testing devices market, largely because of the prevalence of diabetes and the well-established healthcare system. Major industry presence, ongoing innovations in diagnostic equipment, and good government support for diabetes care further established North America as the strongest market force. The area has the added advantage of a very sensitive population that engages actively in regular diabetes screening programs. At the same time, the Asia Pacific is anticipated to experience the highest growth over the forecast period. The market here is being driven by factors like an increasing number of diabetics, growing healthcare spending, and enhanced access to diagnostic services. Moreover, increased awareness regarding the need for early detection of diabetes, along with government efforts in favor of low-cost testing kits, is fueling market growth. China and India are specifically experiencing heightened demand for HbA1c testing devices because of their huge patient base and enhanced healthcare infrastructure.

Recent Developments

- April 2023: FIND collaborated with Abbott, i-SENS Inc., and Siemens Healthineers to enhance access to affordable point-of-care HbA1c testing in low- and middle-income countries. This initiative aims to align test kit prices with target affordability benchmarks, improving diabetes diagnosis and management in resource-limited settings.

- August 2024: Dexcom launched its over-the-counter continuous glucose monitor, Stelo, in the United States. Designed for adults aged 18 and older who do not use insulin, Stelo offers continuous glucose monitoring without the need for a prescription, expanding accessibility for diabetes management.

Statistical Insights and Trends

- The global prevalence of diabetes has been on a steady rise, with an estimated 537 million adults affected in 2021, projected to reach 643 million by 2030. This escalating incidence underscores the critical need for effective HbA1c testing solutions to manage and monitor diabetes.

- North America exhibited the highest prescription rates for HbA1c testing devices, attributed to advanced healthcare systems and proactive diabetes management programs. Europe followed suit, with a significant number of prescriptions driven by increasing awareness and routine screening initiatives.

- Point-of-care HbA1c testing devices witnessed an adoption rate of 76.5% in 2023, indicating a strong preference for immediate and accessible testing options among healthcare providers and patients alike.

Buy a Single-User PDF of HbA1c Testing Devices Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/5747

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. HbA1c Testing Devices Market by Type of Device

8. HbA1c Testing Devices Market by Technology

9. HbA1c Testing Devices Market by End-use

10. Regional Analysis

11. Company Profiles

132. Use Cases and Best Practices

For A Detailed Briefing Session with Our Team of Analysts, Connect with Us Now@ https://www.snsinsider.com/request-analyst/5747

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.