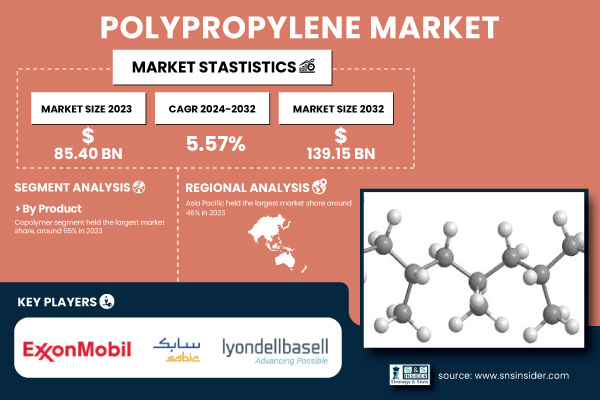

Austin, Feb. 21, 2025 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Polypropylene Market Size was valued at 85.40 Billion in 2023 and is expected to reach USD 139.15 Billion by 2032, growing at a CAGR of 5.57% over the forecast period of 2024-2032.”

Polypropylene (PP) is in high demand in various end-use sectors such as packaging, automotive, and construction, due to its lightweight, durability, and recyclability. According to the U.S. Department of Energy, polymer recycling rates rose 12% in 2023, with polypropylene leading the charge. In yet another sustainability-oriented development, in April 2023, LyondellBasell revealed further expansion of its PP recycling capabilities. The automotive sector is also driving growth with the European Automobile Manufacturers Association (ACEA) stating that lightweight materials like PP are progressively replacing metal components, thereby enhancing fuel efficiency. The application of the food-grade PP resins was also broadened in 2022, when the Food and Drug Administration (FDA) approved new ones for use. The industry is shifting and is ready to grow due to innovations in bio-based PP and rising investments in sustainable plastic solutions. In 2023, the Chinese Ministry of Industry and Information Technology reported that PP production in China grew 15% year on year, elevating the country to a pivotal position. Also, ExxonMobil's 2024 update to our advanced PP catalyst technology will improve production efficiency and ensure the growth of the market.

Download PDF Sample of Polypropylene Market @ https://www.snsinsider.com/sample-request/5646

Key Players:

- LyondellBasell Industries Holdings B.V. (Purell, Moplen)

- SABIC (Eltex, Vestolen)

- ExxonMobil Corporation (Achieve, Exxtral)

- Borealis AG (Borclear, Bormed)

- Braskem (I’m Green, Inspire)

- TotalEnergies (Lumicene, TotalE)

- Reliance Industries Limited (Repol, Relene)

- INEOS Group (Eltex, Repsol)

- Formosa Plastics Corporation (Formolene, Homopolymer PP)

- Sinopec (Yansab PP, SECCO)

- LG Chem (LUPOY, Lupolen)

- Mitsui Chemicals, Inc. (Beaulon, TPX)

- Sumitomo Chemical (Tafmer, TPV)

- Indian Oil Corporation Limited (Proppylene, Marlex)

- China National Petroleum Corporation (CNPC PP, PetroChina PP)

- Haldia Petrochemicals Limited (Haldia PP, Raffia)

- Hyosung Corporation (Hyosung PP, Topilene)

- Braskem Idesa (Green PE, Polipropileno)

- Chevron Phillips Chemical (Marlex, K-Resin)

- Repsol (Repol, Impact PP)

Polypropylene Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 85.40 Billion |

| Market Size by 2032 | USD 139.15 Billion |

| CAGR | CAGR of 5.57% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Homopolymer, Copolymer) • By End Use (Automotive, Building & Construction, Packaging, Medical, Electrical & Electronics, Others) |

| Key Drivers | • Growing demand from the packaging industry fuels market growth, which drives the market growth. |

If You Need Any Customization on Polypropylene Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/5646

By Product, Copolymer dominated the Polypropylene market in 2023, accounting for approximately 65%.

Copolymer polypropylene offers greater impact resistance and flexibility than homopolymers, and its dominance is because of its suitability in applications that demand better toughness properties. By way of example, in the automobile sector, copolymer PP is most commonly used to fabricate parts like bumpers and interior trims that provide high impact strength. In the packaging sector likewise, its strength makes it the best material for the manufacture of containers and packaging films that would be resistant to rough handling and stresses during transportation.

By End-Use, Packaging segment dominated the Polypropylene in 2023, holding a 32% market share.

The properties of lightweight, moisture resistance and versatility of polypropylene make it an essential material in the field of packaging. Polypropylene is widely used in the food and beverage industry for packaging owing to its capability of maintaining product freshness and increasing shelf life. In addition, the increasing preference toward online shopping has driven the market requirement for robust packaging raw materials such as polypropylene for protective packaging solutions. Leading companies such as Amcor have developed new polypropylene packaging to meet demand, which indicates the importance of this material within the industry.

Asia Pacific dominated the global Polypropylene market in 2023, holding a 46 % market share.

The region’s growth is fueled by China and India’s growing manufacturing base, rising urbanization and rapid industrialization. China's polypropylene output increased by 15% in 2023, according to the China Petroleum and Chemical Industry Federation. Moreover, the packaging industry in India is growing at an unprecedented rate, with demand for PP-based materials up by 10%, according to the Packaging Industry Association of India. Also, increase adoption of electric vehicles (EVs) in the region majorly fuelled the growth of the automotive lightweight PP components market.

North America emerged as the fastest-growing market region, with a significant CAGR in the forecast period.

The region’s dominance is driven by growing adoption of polypropylene in sustainable packaging and medical applications. In 2023, several polypropylene-based medical devices were approved by U.S. Food and Drug Administration (FDA) which in turn is fueling the material in the healthcare sector. Moreover, more recent investments in recycling have focused on securing the circular economy for polypropylene in North America, and a good example of this is the new polypropylene purification process from PureCycle Technologies, which started operation in 2024.

Recent Highlights

February 2025: Genpak unveils the 'Grab-A-Bowl,' a new line of microwave-safe, recyclable polypropylene bowls in response to growing consumer interest in convenient, sustainable packaging.

August 2024: Lummus Technology was awarded a contract from Petronet LNG to provide its Novolen polyurethane technology to a new 500 KTA plant in Dahej, India. This megaproject is expected to ramp up domestic polypropylene production to support India's packaging and consumer goods industries.

November 2024: W. R. Grace & Co. reported the successful startup of Nayara Energy's 450 KTA polypropylene plant located in Vadinar, Gujarat, India. The facility is designed to manufacture a number of polypropylene grades for use in the pharmaceutical, health and hygiene fields using Grace's UNIPOL PP process technology.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Polypropylene Market Segmentation, by Type

8. Polypropylene Market Segmentation, by End-Use Industry

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Buy Full Research Report on Polypropylene Market 2024-2032 @ https://www.snsinsider.com/checkout/5646

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.