NEWARK, Del:, Feb. 11, 2025 (GLOBE NEWSWIRE) -- The global high barrier packaging films market is poised for significant growth, with its market size projected to expand from USD 19.3 billion in 2025 to USD 28.3 billion by 2035. This marks a steady CAGR of 3.9% over the forecast period. In 2024, the revenue generated by high barrier packaging films stood at USD 18.8 billion, highlighting the increasing demand for advanced packaging solutions.

High barrier packaging films are widely utilized in the food industry to protect products from moisture, oxygen, and light, ensuring extended shelf life, freshness, and the preservation of nutritional value and flavor. The rising consumption of packaged food products further accelerates market growth.

A major factor driving this expansion is the surge in e-commerce sales, fueled by a shift in consumer preference toward online shopping. As digital purchasing becomes more ingrained in modern lifestyles, the demand for high-performance packaging that guarantees product safety and quality during transit is skyrocketing. Consumers, particularly working professionals, are increasingly relying on the flexibility and convenience offered by online shopping, making robust packaging solutions more essential than ever.

Discover Market Opportunities – Get Your Sample of Our Industry Overview Today!

https://www.futuremarketinsights.com/report-sample#5245502d47422d32313338

High Barrier Packaging Films Market Soars as Hygiene and Product Protection Take Center Stage

The demand for high barrier packaging films is witnessing a significant surge, particularly among cosmetics and medical device companies. As consumers increasingly prioritize hygiene and cleanliness in the post-pandemic era, the global market for high barrier packaging films is poised for substantial growth.

High barrier packaging films play a crucial role in the medical device industry, offering protection against moisture and potential damage during transportation. These films ensure the integrity of medical products, safeguarding them from external contaminants and maintaining sterility. Their transparent, tear-resistant, and flexible properties also enhance visibility, allowing for improved product presentation and secure handling.

The cosmetics industry is also emerging as a key driver of demand for high barrier packaging films. Beyond their aesthetic appeal, these films provide an added layer of protection against atmospheric elements, extending the shelf life of cosmetic products. The ability to incorporate reusable and innovative packaging solutions further amplifies their appeal to environmentally conscious brands and consumers.

"The high barrier packaging films market is growing fast, driven by demand for extended shelf life & sustainability. Innovations in materials & tech are shaping the future." Says a Lead Consultant Ismail Sutaria in Packaging at Future Market Insights (FMI).

Key Takeaways From the High Barrier Packaging Films Market

- The global high barrier packaging films market recorded a CAGR of 2.7% from 2020 to 2024.

- Market value reached USD 18.8 billion in 2024.

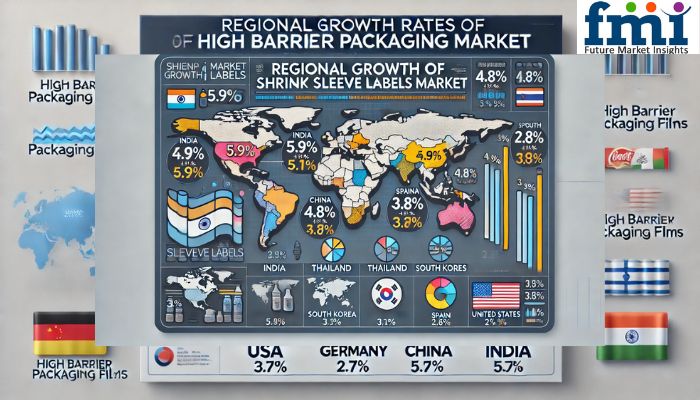

- The USA is expected to lead North America with a projected CAGR of 3.2% through 2035.

- Germany is anticipated to see a CAGR of 2.7% in Europe by 2035.

- Metallized films are estimated to account for over 39% of the market share by 2035.

- Pouches are expected to dominate packaging types, holding a 34.2% share by 2035.

Overcoming Obstacles: Key Challenges in the High Barrier Packaging Films Market

- High Production Costs: The manufacturing of high barrier packaging films involves advanced materials and technologies, leading to higher production costs. This can affect pricing and limit market accessibility for some consumers.

- Environmental Concerns: The growing demand for eco-friendly packaging solutions has placed pressure on the high barrier packaging films market to develop more sustainable options. Traditional barrier films are often made from plastics that are difficult to recycle, raising environmental concerns.

- Raw Material Supply and Price Fluctuations: The availability and cost of raw materials such as resins and coatings used in high barrier films can fluctuate, leading to supply chain disruptions and increased costs for manufacturers.

- Competition from Alternative Packaging Solutions: The rise of alternative packaging options like biodegradable films, edible coatings, and reusable containers is posing competition to the traditional high barrier films, especially in industries looking to reduce plastic usage.

- Regulatory Compliance: As governments around the world tighten regulations on packaging materials, particularly concerning food safety and environmental impact, high barrier film manufacturers must constantly adapt to comply with new rules, which can incur additional costs and operational challenges.

Discover the Future of Packaging – Gain exclusive insights and stay ahead in the Plastic Packaging Industry with our in-depth analysis reports.

High Barrier Packaging Films Market Dynamics: A Regional Breakdown

The United States, being North America's largest market, plays an important role in the high barrier packaging film business. The United States market is expanding rapidly due to its developed industry and consumer sectors. The country's strong food and beverage sector, combined with its major pharmaceutical business, produces high demand for these films. Innovation and consumer preferences for convenience and sustainability are significant drivers of industry growth.

Europe is a mature market for high barrier packaging films, distinguished by a strong focus on sustainability and severe regulatory requirements. The region's established food and beverage industry, as well as its rising pharmaceutical sector, are the key drivers of market expansion. Germany, France, and the United Kingdom are leaders in the adoption of innovative packaging technologies.

Competitive Landscape

Key players in the high barrier packaging films business are offering new products in the market. They are combining with various organizations and expanding their geographical reach. A few of them also collaborate and work with local brands and start-up enterprises to produce new products.

Key Developments in High Barrier Packaging Films Market

- Dunmore plans to introduce a new tamper-evident film for brand protection and anti-counterfeiting applications in July 2024.

- Toray Plastics America will offer a new Torayfan® polypropylene film created with certified-circular polymers in May 2024, with the goal of assisting the packaging industry in transitioning to a circular plastic economy.

- Cosmo Films introduced Metalised Electrical grade BOPP films for capacitor applications in December 2023, with thicknesses ranging from 2.5 micron to 12 micron.

Key Players in High Barrier Packaging Films Market

- Amcor plc

- Sealed Air Corp

- Glenroy, Inc.

- Mondi plc

- Winpak LTD.

- Bischof & Klein SE & Co. KG

- Berry Global Group, Inc.

- Schur Flexibles GmbH

- Huhtamaki Oyj

- UFLEX Limited

- Toray Plastics (America), Inc.

- Jindal Poly Films Ltd

- Cosmo Films Ltd

Explore In-Depth Analysis—Click Here to Access the Report!

https://www.futuremarketinsights.com/reports/high-barrier-film-packaging-market

High Barrier Packaging Films Industry Segmentation

By Film Type:

In terms of film type, the market for high barrier packaging films is divided into metallized films, clean films, organic coating films and inorganic oxide coating films.

By Material Type:

In terms of material type, the market for high barrier packaging films is segmented into plastic, aluminum, oxides and other. Plastic is further sub-segmented into polyethylene (PE), polypropylene (PP), ethylene vinyl alcohol (EVOH), polyethylene terephthalate (PET), polyvinylidene chloride (PVDC), polyamide (Nylon), polyethylene naphthalate (PEN), and others. Oxides include aluminum oxide and silicon oxide.

By Packaging Type:

Various packaging types in the market for high barrier packaging films include pouches, bags, lids, shrink films, laminated tubes and others.

By End Use:

End users of high barrier packaging films include food, beverages, pharmaceuticals, electronic devices, medical devices, agriculture, chemicals and others.

By Region:

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa are covered.

Have a Look at Related Research Reports on the Packaging Domain:

The global high barrier packaging films for pharmaceuticals market size is projected to exceed USD 812.5 million by 2033. Throughout the projection period, the market is estimated to register a CAGR of 5.3%.

The barrier packaging market size in USA is estimated to be worth USD 3,964.7 million in 2024 and is anticipated to reach a value of USD 5,503.9 million by 2034. Sales are projected to rise at a CAGR of 3.3% over the forecast period between 2024 and 2034.

The demand for hemp-based packaging is rising due to its eco-friendly nature, offering a sustainable alternative to traditional materials as consumers and industries prioritize environmental responsibility and waste reduction.

The barrier packaging market size is projected to reach a value of USD 18.32 billion in 2024, at a CAGR of 2.8% from 2024 to 2034. Sales are predicted to reach USD 24.14 billion by 2034.

Metalized barrier film packaging refers to a type of packaging material that combines plastic films with a thin layer of metal, typically aluminum, to create a barrier against light, moisture, oxygen, and other external factors.

The growing demand for barrier tube packaging is driven by its ability to preserve product integrity, extend shelf life, and offer enhanced protection against contamination and environmental factors in various industries.

The Packaging Barrier Film market is expected to be valued at USD 18.8 billion in 2024. The pace of progress for the market from 2024 to 2034 is expected to be consistent, with a CAGR of 2.7%.

The growth of sterile barrier packaging is driven by increasing demand in the healthcare sector for contamination-free medical devices and pharmaceuticals, ensuring safety and compliance with stringent regulatory standards.

Global demand for barrier coatings for packaging is expected to reach a market valuation of USD 11.1 billion by the end of the year 2023, accelerating at a CAGR of 10% over the forecast period (2023 to 2033).

The demand for electron high barrier packaging film is rising due to its superior protective qualities, ensuring extended product shelf life and maintaining freshness in food and pharmaceutical packaging.

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube