Austin, United States, Feb. 10, 2025 (GLOBE NEWSWIRE) -- Diabetes Drug Market Size & Growth Analysis:

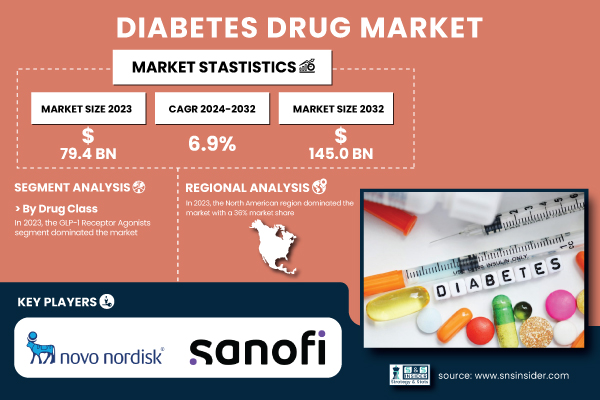

According to the new market research report "Diabetes Drug Market Size, Share & Segmentation By Drug class, By Route of Administration (Oral, Intravenous, Subcutaneous), By Diabetes Type (Type 1, Type 2), By Distribution Channel, By Region, and Global Forecast 2024-2032”, published by SNS Insider, the Diabetes Drug Market size was USD 79.4 billion in 2023 projected to reach USD 145 billion by 2032, grow at a CAGR of 6.9% from 2024 to 2032. The rising global burden of diabetes, innovations in drug therapies, and rising healthcare expenditures are major factors driving this growth.

Get a Sample Report of Diabetes Drug Market@ https://www.snsinsider.com/sample-request/4177

Major Players Analysis Listed in this Report are:

- Novo Nordisk A/S (Ozempic, Rybelsus)

- Eli Lilly and Company (Mounjaro, Trulicity)

- Sanofi (Lantus, Toujeo)

- Merck & Co., Inc. (Januvia, Janumet)

- AstraZeneca (Farxiga, Bydureon)

- Boehringer Ingelheim (Jardiance, Trajenta)

- Bayer AG (Glucobay, Acarbose)

- Takeda Pharmaceutical Company Limited (Actos, Nesina)

- Pfizer Inc. (Exubera, Ertugliflozin)

- MannKind Corporation (Afrezza, Technosphere Insulin)

Diabetes Drug Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 79.4 billion |

| Market Size by 2032 | US$ 145 billion |

| CAGR | CAGR of 6.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | The rapid rise in diabetes cases worldwide, advancements in drug development, and increased accessibility of treatment options. |

Segment analysis

Based on Drug Class, the GLP-1 Receptor Agonists segment held the largest revenue share of the market in 2023. Medications such as Ozempic and Rybelsus are growing is use because of their use for dual purpose such as blood sugar benefits, and also for weight loss benefits. Recent FDA approvals, including Synjardy and Jardiance for pediatric use, further driving this segment’s dominance.

Based on Diabetes Type, Type 2 diabetes held the highest revenue share 62.9% in 2023, because of its high prevalence worldwide, over 537 million adults were suffering with the disease in 2021, and is expected to increase 783 million by 2045. This persistent rise can be largely attributed to sedentary lifestyles, obesity, and aged populations among regions like Asia-Pacific and North America.

By Route of Administration, Subcutaneous route held the highest share of the market due to its high preference for insulin administration alongside controlling blood glucose rapidly. Innovations like needle-free injectors and wearable insulin pumps are enhancing patient compliance.

In 2023, Retail pharmacies represented the highest revenue share due to their high accessibility, affordability, and availability of a variety of therapies, among other aspects. Post-pandemic digital adoption is enabling online pharmacies to emerge as a growth segment.

For A Detailed Briefing Session with Our Team of Analysts, Connect with Us Now@ https://www.snsinsider.com/request-analyst/4177

Diabetes Drug Market Segmentation

By Drug Class

- Insulin

- SGLT2 Inhibitors

- DPP-4 Inhibitors

- GLP-1 Receptor Agonists

- Others

By Route of Administration

- Oral

- Intravenous

- Subcutaneous

By Diabetes Type

- Type 1

- Type 2

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

In 2023, North America accounted for the largest share of revenue, at 36%.

This is due to the high incidence of obesity, an advanced healthcare infrastructure, and strong R&D investments. According to CDC reporting, the U.S. only with 38.2 million T2DM physician-prescribed patients annually. Major pharmaceutical companies such as Eli Lilly, Novo Nordisk, and Pfizer are putting their money where the action is and investing billions in diabetes drugs, especially in next-generation GLP-1 receptor agonists and SGLT-2 inhibitors.

The Asia-Pacific region is growing with the fastest compound annual growth rate from 2024-2032.

China boasts 140 million diabetics and is accelerating drug affordable by initiatives like the Healthy China 2030 plan. For example, In India, Glenmark’s launch of the biosimilar Lirafit (70% cheaper than branded alternatives) exemplifies efforts to expand treatment access.

Recent Developments

- In May 2024, Sanofi launched Soliqua in India for type 2 diabetes and obesity, while Novo Nordisk’s experimental oral obesity drug demonstrated 13.1% weight loss in trials, outperforming Wegovy.

- Governments are making diabetes care a priority with legislation such as the U.S. Inflation Reduction Act, which included Jardiance within the Medicare Drug Price Negotiation Program.

- During a January 2025 settlement with Minnesota, Novo Nordisk agreed to limit insulin prices to a maximum of $35 per monthly prescription in an effort to help make insulin more affordable.

Buy a Single-User PDF of Diabetes Drug Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/4177

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Diabetes Drug Market by Drug Class

8. Diabetes Drug Market by Route of Administration

9. Diabetes Drug Market by Diabetes Type

10. Diabetes Drug Market by Distribution Channel

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Diabetes Drug Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/diabetes-drug-market-4177

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.