Austin, Feb. 05, 2025 (GLOBE NEWSWIRE) -- Sports Technology Market Size & Growth Insights:

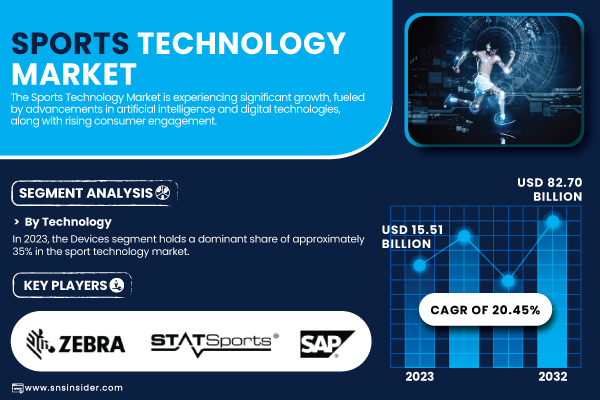

According to the SNS Insider, “The Sports Technology Market Size was valued at USD 15.51 Billion in 2023 and is expected to reach USD 82.70 Billion by 2032 and grow at a CAGR of 20.45% over the forecast period 2024-2032.”

The Impact of AI and Digital Technologies on the Evolution of Sports

The Sports Technology Market is booming, driven by advancements in AI and digital technologies, enhancing fan engagement and athlete performance. AI is transforming the fan experience, improving athlete safety, and streamlining event operations, as seen with the Paris 2024 Olympics using AI for social media monitoring and digital twinning of venues. AI also enhances broadcasting through personalized content and real-time athlete performance analysis. The rise of e-sports, particularly in Asia, is further fueling growth, with platforms securing major funding, such as Virtual Sports Platform Organization raising USD 265 million and Animoca Brands securing USD 120 million. Technologies like AI and machine learning are reshaping talent scouting and training, promising even more immersive experiences for athletes and fans alike. Fantasy sports have also seen rapid growth, with 220 million users in India, 70.5% of whom report increased sports knowledge and viewing time.

Get a Sample Report of Sports Technology Market Forecast @ https://www.snsinsider.com/sample-request/2356

Leading Market Players with their Product Listed in this Report are:

- Catapult Sports (Wearable GPS devices, athlete monitoring systems)

- Zebra Technologies (Motion Works Sports Solution)

- STATSports (Apex Athlete Series)

- Hudl (Video analysis tools, sports performance platforms)

- IBM (Watson AI for sports analytics)

- SAP SE (SAP Sports One)

- Stats Perform (Opta data, AI-driven sports analytics tools)

- Hawk-Eye Innovations (Sony) (Hawk-Eye Vision System)

- Second Spectrum (AI-powered video analytics)

- Genius Sports (Data and technology services for sports leagues)

- SportRadar (Sports data services, analytics platforms)

- Whoop (WHOOP Strap)

- Polar Electro (Heart rate monitors, wearable fitness trackers)

- Fitbit (Google) (Fitness and activity trackers)

- ChyronHego (TRACAB optical tracking system)

- PlaySight Interactive (SmartCourt system)

- ShotTracker (Real-time basketball analytics)

- KINEXON (Wearable sensors, player tracking solutions)

- Garmin (Forerunner GPS watches, fitness wearables)

- Oracle (Oracle Cloud for sports analytics)

Sports Technology Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 15.51 Billion |

| Market Size by 2032 | USD 82.70 Billion |

| CAGR | CAGR of 20.45% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Type (Baseball, Cricket, Tennis, Rugby, Basketball, Ice Hockey, Soccer) • By Technology (Devices, Smart Stadium, E sports, Statistics & Analytics) • By End User ( Sports Clubs, Sports Associations, Sports Leagues, Others) |

| Key Drivers | • Transforming Athlete Performance and Safety Through Wearable Technology in Sportstech. |

Do you Have any Specific Queries or Need any Customize Research on Sports Technology Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/2356

Key Segments Driving Growth in the Sports Technology Market: Devices and Sports Associations at the Forefront

By Technology

In 2023, the Devices segment dominates the sports technology market, accounting for around 35% of the share. This growth is driven by the rising demand for wearable devices like fitness trackers, smartwatches, and biometric sensors, which provide real-time health data, including heart rate, sleep quality, and stress levels. Advancements such as AI integration for personalized insights and injury prevention are further fueling their adoption in both professional sports and recreational fitness. As health and fitness awareness grows, the Devices segment will continue to lead the market.

By End User

In 2023, the Sports Associations segment leads the sports technology market, holding a dominant 42% share. This growth is driven by the widespread adoption of advanced technologies by professional leagues, clubs, and governing bodies to improve performance, safety, and fan engagement. Sports associations are leveraging AI-powered analytics, wearable devices, and performance-monitoring tools to optimize athlete training, prevent injuries, and make data-driven decisions. Additionally, these organizations are enhancing broadcast experiences and fan interactions through virtual platforms and augmented reality. The emphasis on performance optimization and real-time data is strengthening the dominant position of sports associations in the market.

North America Leads the Sports Technology Market with Innovation and Advanced Adoption

In 2023, North America dominates the sports technology market, capturing around 40% of the total revenue. This strong position is fueled by the widespread adoption of advanced technologies in the United States and Canada, where sports organizations and professionals are increasingly integrating AI, wearable devices, and performance analytics into training and competition. The U.S. leads the way with significant investments in sports innovation, with major sports leagues such as the NBA, NFL, and MLB adopting cutting-edge technologies to enhance player performance, improve safety, and engage fans through immersive experiences. In Canada, growth is driven by a focus on wearable technology and AI-powered coaching tools. The region also benefits from the presence of numerous tech companies and startups that are accelerating the growth of sports technology. With its robust infrastructure and commitment to innovation, North America remains a global leader in the sports technology market.

Purchase Single User PDF of Sports Technology Market Report (33% Discount) @ https://www.snsinsider.com/checkout/2356

Recent Development

- On November 25, 2024, New Chyron Virtual Placement 7.7 Introduces Football-Specific Features the latest version of Chyron’s Virtual Placement 7.7 enhances sports broadcasting with new football-specific features, including the Field Goal Target Tool. This tool enables precise, team-specific target lines, improving the accuracy of live game analysis and viewer experience. The update aims to bring more interactive and dynamic visuals to football broadcasts, aligning with modern viewer expectations for enhanced engagement.

- On March 22, 2024, KINEXON and AWS introduced tailored player tracking technology designed specifically for women’s sports. This collaboration focuses on addressing unique physiological differences like menstrual cycles and body measurements, ensuring a personalized approach to performance and injury prevention.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Adoption and Usage Metrics

5.2 Investment and Revenue Metrics

5.3 Event and Team-Specific Metrics

5.4 Sports Technology Workforce

6. Competitive Landscape

7. Sports Technology Market Segmentation, by Type

8. Sports Technology Market Segmentation, by Technology

9. Sports Technology Market Segmentation, by End User

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access More Research Insights of Sports Technology Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/sports-technology-market-2356

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.