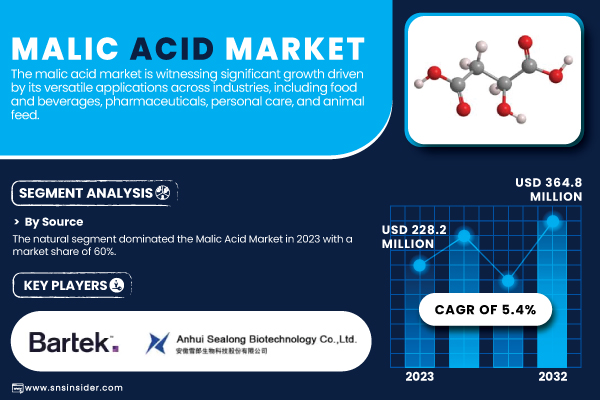

Austin, Jan. 27, 2025 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Malic Acid Market is projected to reach a valuation of USD 364.8 million by 2032, growing at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2032.”

Trends Shaping the Malic Acid Market

A key driver for the growth of the malic acid market is the rising demand for natural food additives and preservatives, especially in the food and beverage sector. As consumers become more conscious of their health and the ingredients used in the products they consume, the demand for clean-label ingredients is increasing. Malic acid, a naturally occurring organic acid found in fruits like apples, cherries, and grapes, is increasingly sought after for its versatility and eco-friendly profile.

The food and beverage industry has seen a surge in the use of malic acid as a flavoring agent, acidulant, and preservative. In addition to enhancing the tartness and sour taste in foods, malic acid also acts as a natural preservative, extending the shelf life of products without the use of artificial chemicals. Its use in carbonated beverages, fruit-based products, confectionery, and bakery goods is expanding due to the increasing demand for natural ingredients.

Another sector where malic acid is witnessing notable growth is in the pharmaceutical industry. It is utilized in drug formulation, specifically in effervescent tablets and oral care products, due to its ability to enhance the dissolution of certain compounds. Additionally, malic acid’s role in various topical cosmetics and skincare products, where it serves as a pH regulator, exfoliant, and moisturization agent, is driving its demand in the cosmetic sector.

Download PDF Sample of Malic Acid Market @ https://www.snsinsider.com/sample-request/2702

Key Players:

- Anhui Sealong Biotechnology Co., Ltd. (L-Malic Acid, DL-Malic Acid)

- Bartek Ingredients Inc. (Food-Grade Malic Acid, Beverage-Grade Malic Acid)

- Changmao Biochemical Engineering Co., Ltd. (L-Malic Acid, Fumaric Acid)

- Fuso Chemical Co., Ltd. (High-Purity L-Malic Acid, DL-Malic Acid)

- Guangzhou ZIO Chemical Co., Ltd. (Food-Grade Malic Acid, Industrial-Grade Malic Acid)

- Isegen South Africa (Pty.), Ltd. (L-Malic Acid, DL-Malic Acid)

- Jinhu Lile Biotechnology Co., Ltd. (L-Malic Acid, Fumaric Acid)

- Lonza (Pharmaceutical-Grade Malic Acid, Food-Grade Malic Acid)

- Nacalai Tesque, Inc. (L-Malic Acid, Research-Grade Malic Acid)

- Polynt (Technical-Grade Malic Acid, Food-Grade Malic Acid)

- Prinova Group LLC (Beverage-Grade Malic Acid, Food-Grade Malic Acid)

- Shandong Ensign Industry Co., Ltd. (L-Malic Acid, DL-Malic Acid)

- Thirumalai Chemicals Ltd. (L-Malic Acid, Fumaric Acid)

- U.S. Chemicals, LLC (L-Malic Acid, DL-Malic Acid)

- Weifang Ensign Industry Co., Ltd. (Food-Grade Malic Acid, Industrial-Grade Malic Acid)

- Yongsan Chemicals (Food-Grade Malic Acid, Technical-Grade Malic Acid)

- Yunnan Fuyan Biological Technology Co., Ltd. (L-Malic Acid, DL-Malic Acid)

- Zhejiang Huadee Food Ingredients Co., Ltd. (L-Malic Acid, Food-Grade Malic Acid)

- Zhejiang Sanhe Food Science and Technology Co., Ltd. (Food-Grade Malic Acid, Beverage-Grade Malic Acid)

- Zhengzhou Ruipu Biological Engineering Co., Ltd. (L-Malic Acid, Industrial-Grade Malic Acid)

Malic Acid Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 228.2 Million |

| Market Size by 2032 | USD 364.8 Million |

| CAGR | CAGR of 5.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Natural, Synthetic) •By Type (L-Malic Acid, D-Malic Acid, DL-Malic Acid) •By Form (Powder, Liquid) •By Application (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Animal Feed, Others) |

| Key Drivers | •Rising Demand for Personal Care Products Leveraging Malic Acid’s Exfoliating and Skin-Brightening Properties •Growing Adoption of Malic Acid in Animal Feed to Enhance Livestock Health and Digestive Efficiency |

If You Need Any Customization on Malic Acid Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/2702

Regional Insights: Asia Pacific Led the Market

The malic acid market was led by the Asia Pacific region in 2023 accounting for 45% of the market. Asia Pacific represented the largest malic acid market share on account of high production capacity, substantial demand in all pertaining industries, and growing inclination towards natural ingredients among consumers. Having occupancy in the region, China being the largest producer and consumer of malic acid proves to be instrumental for the growth of the market. The growing use of malic acid in flavoring agents, acidulants, and preservatives from the food beverage industry and rapid industrialization across China, are the major contributors to Asia Pacific malic acid market growth. There are big malic acid manufacturers in the country that can provide malic acid products for use in both the national and foreign markets. The dominance of the Asia Pacific region can also be attributed to growing opportunities in the food processing industry in India coupled with the demand for malic acid from beverages and confectionery products. Furthermore, the transition to clean-label products across nations such as Japan and South Korea has triggered demand for naturally derived malic acid. All of these will collectively cement Asia Pacific's dominance in this space.

Market Segmentation

By Source

The natural segment held the largest market share around 60% in 2023. Consumer awareness towards health and wellness has been rising and natural ingredients are no exception. For example, consumers are gravitating towards clean-label food and beverages containing natural ingredients, which makes this trend so pronounced among food companies. This is likely figured into the increased move towards natural malic acid coming from plants or other fruits, such as apples. This also aligns with trends from consumers looking for more transparency and sustainable goods. In addition, the cosmetic and pharmaceutical industry is also driving the growth of natural malic acid, with manufacturers targeting products for health-conscious consumers.

By Type

In 2023, L-Malic Acid covered 45% of shares of Malic Acid Market. L-malic acid holds a dominant share of the malic acid market, due to its preferred usage in end-use industries, especially in food and beverages. Being obtained from nature, normally fruits give it an organic trait, which is an attraction for consumers who like cleaner and organic products. For this reason, L-malic acid is widely utilized in soft drink beverages, candy, and various food commodities as a flavoring substance and acidulant. Its flavor enhancement properties and its nice balanced acidity make it very appealing to food manufacturers. In addition, the pharmaceutical industry applies L-malic acid due to its health-promoting agents, such as being involved in energy metabolism and possible antioxidant activity.

By Application

Food & Beverages accounted for a market share of 50% in 2023. The largest application of malic acid market continues to be food and beverages, as it is utilized extensively in use as a flavor enhancer and acidulant. As consumers share an increasing taste for taste-forward, nutrient-sparse food products, malic acid is marketed as a preferable alternative that allows the taste to shine without overshadowing other ingredients. Found in everything from sodas to candy, its ubiquity in this industry illustrates its importance. The rising demand for malic acid is further propelled by its functional properties to provide texture and shelf life to food products. At the same time, with the growing consumption of natural ingredients and nutritional food products, the preference for naturally derived malic acid in food items is also escalating.

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/2702

Recent Developments

- In 2023, Corbion, a leading player in the malic acid market, expanded its product portfolio with a new range of bio-based malic acid, catering to the growing demand for natural additives. The company’s commitment to sustainability and clean-label solutions in the food industry is driving its innovations in malic acid production.

- In 2023, Lactic Acid Bacteria (LAB) produced malic acid through microbial fermentation, offering a more sustainable and cost-effective alternative to traditional production methods. This breakthrough is expected to reduce the carbon footprint of malic acid production while making it more accessible to manufacturers in the food and beverage sector.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Malic Acid Market Segmentation, by Source

8. Malic Acid Market Segmentation, by Type

9. Malic Acid Market Segmentation, by Form

10. Malic Acid Market Segmentation, by Application

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Buy Full Research Report on Malic Acid Market 2024-2032 @ https://www.snsinsider.com/checkout/2702

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.