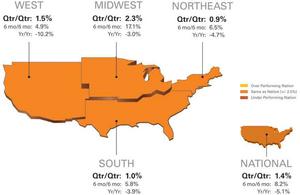

-- National / Four Region Overview: National quarterly price gains are

narrowed to a modest 1.4 percent; with the Midwest (2.3%), West (1.5%),

South (1.0%) and Northeast (0.9%) all posting modest gains.

-- Metropolitan Statistical Area (MSA) drilldown: The highest performing

major markets continued to experience quarterly home price gains, further

minimizing yearly losses. Lake Erie cities of Detroit, Mich. (14.1%), and

Cleveland, Ohio (12.8%), top this month's highest performing major markets.

Softening seasonal home prices have returned most of the lowest performing

major markets to negative quarterly results.

-- Micro Market Analysis: Home price gains of 13.4 percent over the last

two rolling quarters indicate prices in the Atlanta, Ga. MSA may have

bottomed out and are beginning to recover.

The Clear Capital HDI Market Report offers the industry, investors and

lenders a near real-time look at pricing conditions not only at the

national and metropolitan level, but within local markets. Clear Capital

data is built on the most recent data available from recorder/assessor

offices, and then further enhanced by adding the Company's proprietary

market data for the most comprehensive geographic coverage available.

"The modest and improving yearly changes we're seeing at the National and

Regional levels show that many areas have sustained stable price levels for

nearly all of 2009 after the dramatic fall off in prices in the preceding

three years," said Dr. Alex Villacorta, Senior Statistician, Clear Capital.

"Yet, the continued rolling quarter declines experienced over the past two

months have helped confirm that seasonal influences have returned."

"Even with a potential increase in REO saturation rates, many markets are

still showing strong evidence of stabilizing, indicating signs of a price

bottom," added Villacorta. "With the passing of the tax credit helping to

strengthen the momentum through the winter, many buyers may find that this

season is a good time to take advantage of record low prices."

National/Four Region Market Overview (Oct. 29, 2008 - Nov. 27, 2009)

Seasonal softening in the housing market this fall continues, placing the

nation's quarterly gains at a modest 1.4 percent. That's less than half the

3.7 percent returned last month, and nearly five percentage points less

than the 6.3 percent gains reported for September. All four regions

continued to show quarterly gains this month, with the spread in gains

narrowing again, reflecting more consistent price changes among the

regions. Particularly encouraging is the West region which continues to see

moderate price gains among its largest and highly REO-influenced markets.

While the seasonal cycles are still eclipsed by the magnitude of declines

since the market peaked in 2006, the return to seasonality this winter

could expose the dynamics of REO inventories. The traditionally slower

winter season is associated with a reduced number of home sales and an

increase in marketing times. REO properties, on the other hand, are

typically priced to sell in a given timeframe regardless of season.

The net result of combining the two dynamics of seasonal downturn and REO

property liquidations is likely increased REO saturation rates in the

winter months. It's important to note that these increased REO saturation

rates should not necessarily be interpreted as an increase in REO volume.

Declining REO saturation rates during the winter are more difficult to

achieve and any such decrease would be seen as a very good sign that demand

has returned to the marketplace. Even modest increase in REO saturation

rates this winter, more than likely would not signal an end of the recent

recovery.

Illustrating what could be a good sign of things to come this winter,

national REO saturation rates did continue a downward trend this month,

dropping another 1.1 percentage points to 26.9 percent.

Metro Markets (Oct. 29, 2008 - Nov. 27, 2009)

All of the highest performing major markets continue to experience

quarterly home price gains, further eroding yearly losses. Thirteen of the

fifteen markets saw improvements in their yearly gains over last month. The

magnitude of the quarterly gains demonstrates the dire state of the market

a year ago, while the improvements in the yearly returns indicate markets

are stabilizing.

A Lake Erie connection was made atop this month's list of highest

performing major markets. Detroit, which narrowly missed the highest

performing markets list last month, ended Cleveland's five-month reign as

the highest performing major market by posting a 14.1 percent quarterly

gain. Detroit's strong quarterly price gain reduced its yearly price

decline to -4.4 percent. One of the hardest hit areas in the country in

regards to home price declines, Detroit's large percentage home price gains

this rolling quarter are reflective of the low prices still present in the

area. When compared to the current median sale price of $63,000, Detroit's

14.1% quarterly gain translates to an approximately $7,800 increase over

last quarter's median value.

Phoenix, Ariz., a longtime leader of the lowest performing major markets,

moved into the highest performing list this month with solid quarterly

gains (4.4%) offsetting its list-leading 23.8 percent loss for the year.

Northern California's Bay Area is well represented in this month's highest

performing list. Both the San Francisco (6.1%) and San Jose (4.5%) MSAs

turned in solid gains, putting them within striking distance of eliminating

yearly losses.

REO saturation rates decreased from last month in twelve of fifteen markets

by an average 1.8 percent (New Haven, Conn.; Pittsburgh, Pa.; and Cleveland

experienced minor REO saturation increases of 0.8, 0.3 and 0.1 percent,

respectively). The continued general decrease in REO saturation across this

list is a positive sign as we prepare to enter the winter months that, as

stated previously, traditionally experience a rise in REO saturation.

The softening seasonal home prices have returned most of the major markets

on the lowest performing list to negative quarterly results. These declines

remain generally minor, however (less than 3.8%). Las Vegas, Nev. (-0.1%)

was the only MSA on this list to see its quarterly price change improve

from last month (-1.8%), enough to push it to tenth place this month from

its top position on this list last month.

While quarterly price changes continue to show slight dips into negative

territory, annual price changes are improving. Every MSA except for

Rochester, N.Y. saw yearly price improvements in this month's report. This

reflects the seasonal influence on the quarterly numbers, while the yearly

numbers reflect a solid improvement over last year.

Fresno, Calif. has improved since it last appeared on this list three

months ago. While still experiencing high REO activity (42.4%), Fresno's

-15.6 percent yearly price change is a substantial improvement over the

-25.9 percent yearly price change and 48.2 percent REO saturation posted

three months ago.

Houston, Texas; Raleigh, N.C.; and Las Vegas, Nev. saw the largest declines

in REO saturation, 4.7, 3.5 and 3.3 percent, respectively. This late in the

buying season, it's a positive sign to see the lowest performing major

markets continue to see declines in REO saturation, reduced yearly losses

and significantly improved quarterly gains compared to one year ago.

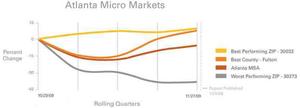

Micro Markets (Oct. 29, 2008 - Nov. 27, 2009)

This section highlights a single market every month with a deeper dive into

how the micro- and macro-markets relate to each other.

Home prices in the Atlanta, Ga. micro markets have returned to levels not

seen in eleven years. Furthermore, if inflation is taken into account,

current home prices would fall even farther below 1998's market, placing

today's prices at a level not seen since 1994. While this picture is grim

if considered by itself, it serves to highlight how discounted much of the

Atlanta MSA has become. It also adds perspective into the 13.4 percent

price gains experienced over the last two rolling quarters -- a substantial

number given the average quarterly gain over the past ten years was 1.7

percent.

While home price changes in Fulton County have generally outpaced DeKalb

County over the past year (7.7% vs. -4.5%), the unincorporated area of

DeKalb County just north of the county seat of Decatur (ZIP 30033) has

demonstrated remarkable home price stability. Decatur, the best performing

ZIP code among Atlanta's micro markets, has experienced an 8.7 percent

price gain this past year, and only a modest -3.5 percent change since home

prices peaked in 2006. Decatur has benefited from low REO volatility, its

proximity to Emory University, and immediate access to downtown Atlanta.

At the other end of the price performance spectrum lies Rex (ZIP 30273), an

unincorporated part of Clayton County southeast of downtown Atlanta. Rex

has an REO saturation rate twice as high as that of the greater Atlanta

area, resulting in price changes of -38.9 percent over the past year. This

annual price drop has added to Rex's decline, which has now returned a

-65.0 percent price change since this market peaked in 2006.

Clear Capital Home Data Index™ Methodology

The Clear Capital Home Data Index (HDI) provides weighted paired sales, and

price-per-square-foot index models that use multiple sale types, including

single-family homes, multi-family homes and condominiums. These models are

combined with an address-level cascade to provide sale-type-specific

analysis for thousands of geographic areas across the country. The indices

include both fair market and institutional (real estate owned)

transactions. They also provide indicators of REO activity such as REO

discount rates, REO days on market and REO saturation. The Clear Capital

HDI generates indices in patent pending rolling quarter intervals that

compare the most recent four months to the previous three months. The

rolling quarters have no fixed start date and can be used to generate

indices as data flows in, or at any arbitrary time period.

About Clear Capital

Clear Capital (www.clearcapital.com) is a premium provider of data and

solutions for real estate asset valuation and risk assessment for large

financial services companies. Our products include appraisals, broker-price

opinions, property condition inspections, value reconciliations, and home

data indices. Clear Capital's combination of progressive technology, high

caliber in-house staff and a well-trained network of more than 40,000 field

experts sets a new standard for accurate, up-to-date and well documented

valuation data and assessments. The Company's customers include 75 percent

of the largest U.S. banks, investment firms and other financial

organizations.

Legend

Address Level Cascade -- Provides the most granular market data available.

From the subject property, progressively steps out from the smallest market

to larger markets until data density and statistical confidence are

sufficient to return a market trend.

Home Data Index (HDI) -- Major intelligence offering that provides

contextual data augmenting other, human-based valuation tools. Clear

Capital's multi-model approach combines address-level accuracy with the

most current proprietary home pricing data available.

Metropolitan Statistical Area (MSA) -- Geographic entities defined by the

U.S. Office of Management and Budget (OMB) for use by Federal statistical

agencies in collecting, tabulating, and publishing Federal statistics.

Paired Sales Model -- Weighted linear model based on repeat sales of same

property over time.

Price Per Square Foot (PPSF) Model -- Median price movement of sale prices

divided by square footage over a period of time -- most commonly a quarter.

Real Estate Owned (REO) Saturation -- Calculates the percentage of REOs

sold as compared to all properties sold in the last rolling quarter.

Rolling Quarters -- Patent pending rolling quarters compare the most recent

four months to the previous three months.

The information contained in this report is based on sources that are

deemed to be reliable; however no representation or warranty is made as to

the accuracy, completeness, or fitness for any particular purpose of any

information contained herein. This report is not intended as investment

advice, and should not be viewed as any guarantee of value, condition, or

other attribute.

Contact Information: Media Contact: Michelle Sabolich Atomic PR for Clear Capital (415) 402-0230