-- Age and other determining factors remained roughly consistent, while

home values continue to drop by 6.9% on a national average and as much as

31% in California

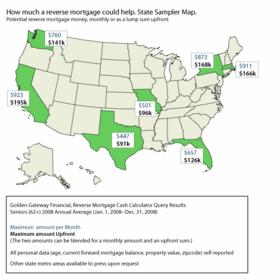

-- On average, borrowers could have earned approximately $134,000 in up-

front proceeds in 2008 from a reverse mortgage, with California borrowers

potentially earning the most at more than $195,000 (see attached map of

U.S.)

-- The national average for percent of loan to home value (LTV) for those

who held a forward mortgage was slightly more than a third at 36%

Reverse Mortgage Calculator National Averages

Q1 ‘08 Q2 ‘08 Q3 ‘08 Q4 ‘08

---------- ---------- ---------- ----------

Average age 68.6 69.5 69.7 69.2

---------- ---------- ---------- ----------

Average home value $ 449,200 $ 438,461 $ 428,786 $ 412, 627

---------- ---------- ---------- ----------

Percent with existing

mortgage 51.4% 53.4% 53.8% 46.1%

---------- ---------- ---------- ----------

Average existing mortgage

Debt $ 157,575 $ 159,700 $ 146,217 $ 149,683

---------- ---------- ---------- ----------

* For state specific data, please contact Golden Gateway Financial

Home Prices Hurting Oldest of Americans the Most

In addition to its own calculator data, Golden Gateway Financial measured

the impact of home price changes over the course of the calendar year 2008

as provided in the most recent S&P/Case-Shiller Home Prices Indices on

older Americans. Tracking home price changes from the beginning of the

first quarter 2008 to the end of the fourth quarter 2008 shows a steep

drop-off in value for many of the top real estate markets. For example,

once vibrant markets like Phoenix, Las Vegas, and San Francisco are down

more than thirty percent from the first quarter of 2008.

For older Americans considering tapping their home equity to help fund

their retirement, a drop in home value corresponds to a similar loss in

cash available through a reverse mortgage. Those potential borrowers

already hurt by investment or job loss should consider locking in their

home value now in order to avoid future declines in available equity.

"For these borrowers it makes sense to avoid selling stocks or other assets

at or close to the bottom when a reverse mortgage allows them to

participate in the potential upside of a rebound in property values,"

continued Mr. Bachman.

The table below shows how the drop in average home value as determined by

the S&P/Case-Shiller Indices impacts the amount of money available through

a reverse mortgage in sample markets. All numbers are based on an initial

home value of $200,000, and calculations were analyzed on March 10, 2009.

One Year

Change in Q1 2008 Q4 2008

Home Upfront Upfront Reduction

Price Cash Cash in Cash

Index(1) Age Available Available Available

--------- ---------- ---------- ---------- ---------

National Average -18.2% 78-79 $ 136,777 $ 110,642 ($ 26,135)

--------- ---------- ---------- ---------- ---------

Atlanta -12.1% 78-79 $ 136,777 $ 121,084 ($ 15,693)

--------- ---------- ---------- ---------- ---------

Detroit -21.7% 78-79 $ 136,777 $ 107,126 ($ 29,651)

--------- ---------- ---------- ---------- ---------

Las Vegas -33.0% 78-79 $ 136,777 $ 90,695 ($ 46,082)

--------- ---------- ---------- ---------- ---------

New York -9.2% 78-79 $ 136,777 $ 125,301 ($ 11,476)

--------- ---------- ---------- ---------- ---------

Phoenix -34.0% 78-79 $ 136,777 $ 89,241 ($ 47,536)

--------- ---------- ---------- ---------- ---------

San Francisco -31.2% 78-79 $ 136,777 $ 93,313 ($ 43,464)

--------- ---------- ---------- ---------- ---------

* For additional markets and age brackets, please contact Golden Gateway

Financial

Golden Gateway Financial's award winning online reverse mortgage calculator

has been recognized as an important resource for seniors by the Wall Street

Journal. It allows users to enter basic information to configure reverse

mortgage loan parameters and then compare lenders based on those fields.

Golden Gateway Financial makes anonymous and aggregated data from these

basic entry fields publicly available on a quarterly basis.

Golden Gateway Financial recently launched a new Reverse Mortgage for Purchase Calculator to offer borrowers

assistance in understanding how changes in federal reverse mortgage

guidelines could help them.

For more information about reverse mortgages or to access Golden Gateway

Financial's industry-leading suite of online retirement assessment tools

and resources, please visit http://www.goldengateway.com.

About Golden Gateway Financial

Golden Gateway Financial (www.goldengateway.com), located in Oakland,

California, is a comprehensive resource for senior citizens, baby boomers

and soon-to-be retirees to assess their financial health at retirement.

Through a unique set of online tools and clear and unbiased communication,

the company helps individuals address "The Great American Retirement

Dilemma." The tools enable users to better assess the security of their

nest egg and to make intelligent choices to fully enjoy what should be the

best years of their lives. The company also operates the industry's

premiere reverse mortgage and life settlement services with proprietary

calculators and products for each, and a team of trained counselors to help

seniors better understand the products, evaluate whether they are right for

them.

(1) Nationally, Home Price Declines Closed Out 2008 with Record Lows

According to the S&P/Case-Shiller Home Prices Indices (Press Release),

Standard & Poor’s, February 24, 2009

Contact Information: Press Contact: Michael Azzano Cosmo PR 415.596.1978